Silver Price Forecast: Bulls extend control as Silver trades at multi-year highs

- Silver extends its rally for the fourth straight session, hitting the highest level since 6 September 2011.

- Weaker US Dollar and falling Treasury yields underpin bullish momentum ahead of the Fed decision.

- Technical outlook remains strong, though RSI is near 75, signaling overbought conditions.

Silver (XAG/USD) continues its rally on Monday, building on last week’s strong momentum to notch a fourth consecutive daily gain. The white metal is supported by a broadly weak US Dollar (USD) and retreating US Treasury yields as traders brace for a pivotal Federal Reserve (Fed) interest rate decision on Wednesday, where a 25-basis-point (bps) rate cut is fully priced in, but the real focus lies on how dovish the forward outlook will be.

At the time of writing, XAG/USD is trading around $42.65, up nearly 1% on the day and marking its strongest level since 6 September 2011. The weaker Greenback makes precious metals more attractive for non-USD holders, while falling real yields reduce the opportunity cost of holding non-interest-bearing assets like silver. Broader safe-haven demand and firm industrial consumption trends add to the supportive backdrop.

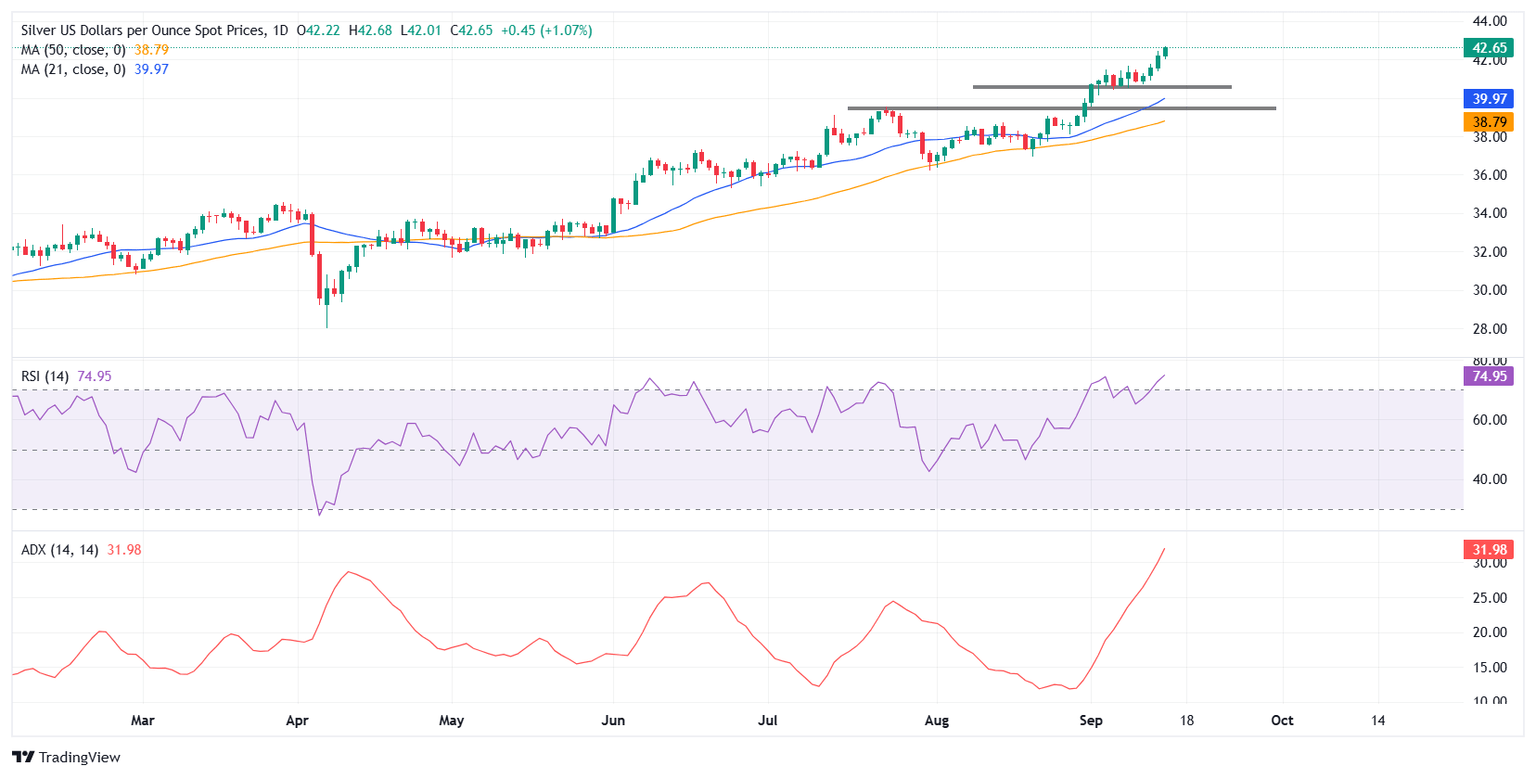

From a technical perspective, Silver remains firmly bullish, with price action holding well above key moving averages. The metal trades comfortably above its 21-day Simple Moving Average (SMA) at $39.96 and the 50-day SMA at $38.79, underscoring strong upside momentum.

The Relative Strength Index (RSI) is around 75, deep in overbought territory but reflecting persistent demand, while the Average Directional Index (ADX) has risen to 31.98, confirming the strength of the prevailing uptrend.

On the upside, immediate resistance comes at the $43.00 psychological level, followed by $43.40, the peak from 5 September 2011. A sustained break above these barriers would open the door for a move toward $44.24, the high from 24 August 2011. On the downside, first support is seen at $41.50, followed by $40.50 and the $40.00 round figure.

Speculative positioning adds weight to the bullish tone but also raises caution. The latest CFTC Commitments of Traders (CoT) report shows non-commercial speculators holding 72,450 long contracts against just 18,513 shorts. Commercial participants, by contrast, remain heavily net short at 113,565 contracts.

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.