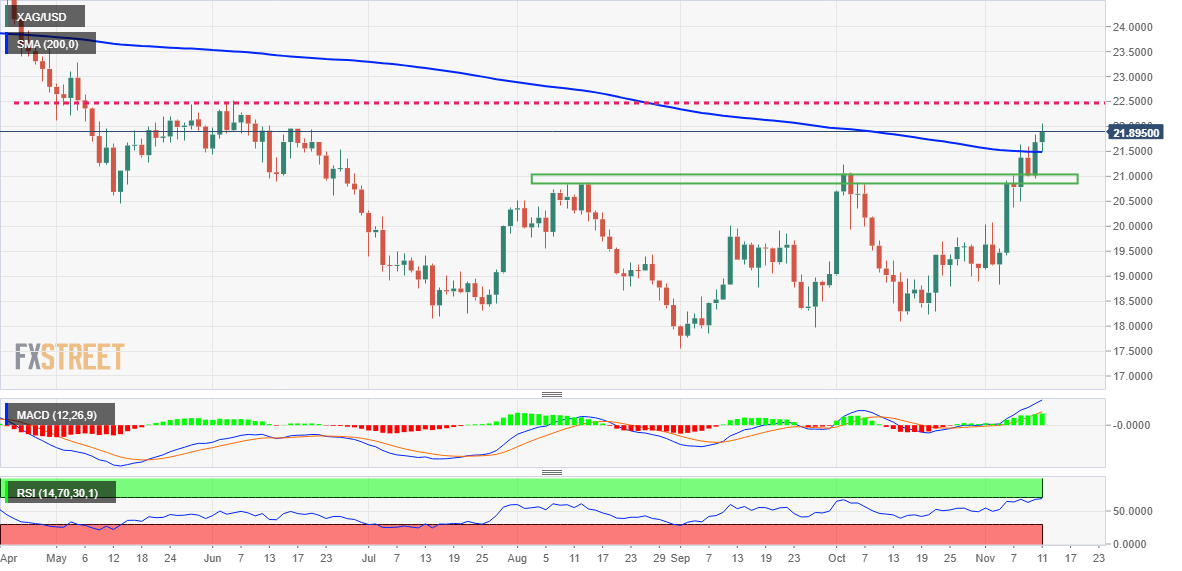

Silver Price Analysis: XAGUSD bulls retain control, could aim to test $22.50 supply zone

- Silver gains traction for the second straight day and climbs to over a five-month peak.

- The technical set-up favours bullish traders and supports prospects for further gains.

- A convincing break below the $21.00 mark is needed to negate the positive outlook.

Silver builds on the previous day's breakout momentum through the very important 200-day SMA and scales higher for the second successive day on Friday. The white metal jumps to over a five-month high during the early European session, though struggles to find acceptance above the $22.00 round-figure mark. The XAGUSD, however, sticks to its intraday gains and is currently placed near the $21.85-$21.90 region, still up nearly 0.90% for the day.

The overnight rally from sub-$21.00 levels and a subsequent strength beyond a technically significant moving average supports prospects for a further near-term appreciating move. That said, RSI (14) on the daily chart is on the verge of breaking into overbought territory and warrants caution for aggressive bullish traders. This makes it prudent to wait for some near-term consolidation or a modest pullback before positioning for additional gains.

Nevertheless, the XAGUSD seems poised to climb beyond the $22.00 mark and could aim to test the next relevant hurdle near the $22.45-$22.50 region. The mentioned area marks a heavy supply zone and could act as a tough nut to crack for bulls. Some follow-through buying, however, will mark a fresh breakout and pave the way for a move towards reclaiming the $23.00 round figure. The momentum could eventually lift spot prices to May swing high, around the $23.25-$23.30 area.

On the flip side, the daily low, around the $21.45 region, which coincides with the 200 DMA breakout point should protect the immediate downside. Any further pullback could be seen as a buying opportunity and remain limited near the $21.00 mark. A convincing break below might trigger some technical selling and drag the XAGUSD to the $20.40 support zone. Failure to defend the aforementioned support levels could shift the near-term bias in favour of bearish traders.

Silver daily chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.