Silver Price Analysis: XAG/USD strengthens and rallies past $19.00

- Silver prices extend recovery to reach levels beyond $19.00.

- The US dollar dives on Fed easing speculation.

- XAG/USD is now at a key resistance area of $19.30.

Silver prices have extended Thursday’s rebound from $18.30 lows on Friday, breaking beyond $19.00 and reaching one-week highs at $19.30 so far. The precious metal appreciates more than 3% on the day, retracing half of the ground lost on the previous week’s sell-off.

Precious metals appreciate against a softer USD

A news report by the Wall Street Journal has suggested Federal Reserve officials are open to debate on how to signal a smaller rate hike in December. This has offset the positive impact of the bank’s representative’s hawkish rhetoric and sent the US dollar tumbling across the board.

Furthermore, an alleged intervention by the Bank of Japan and the Japanese Finance Ministry has sent the yen surging across the board. The USD/JPY plunged more than 2.5%, as a consequence, and weighed the US dollar across the board.

XAG/USD pushing against key resistance at $19.30

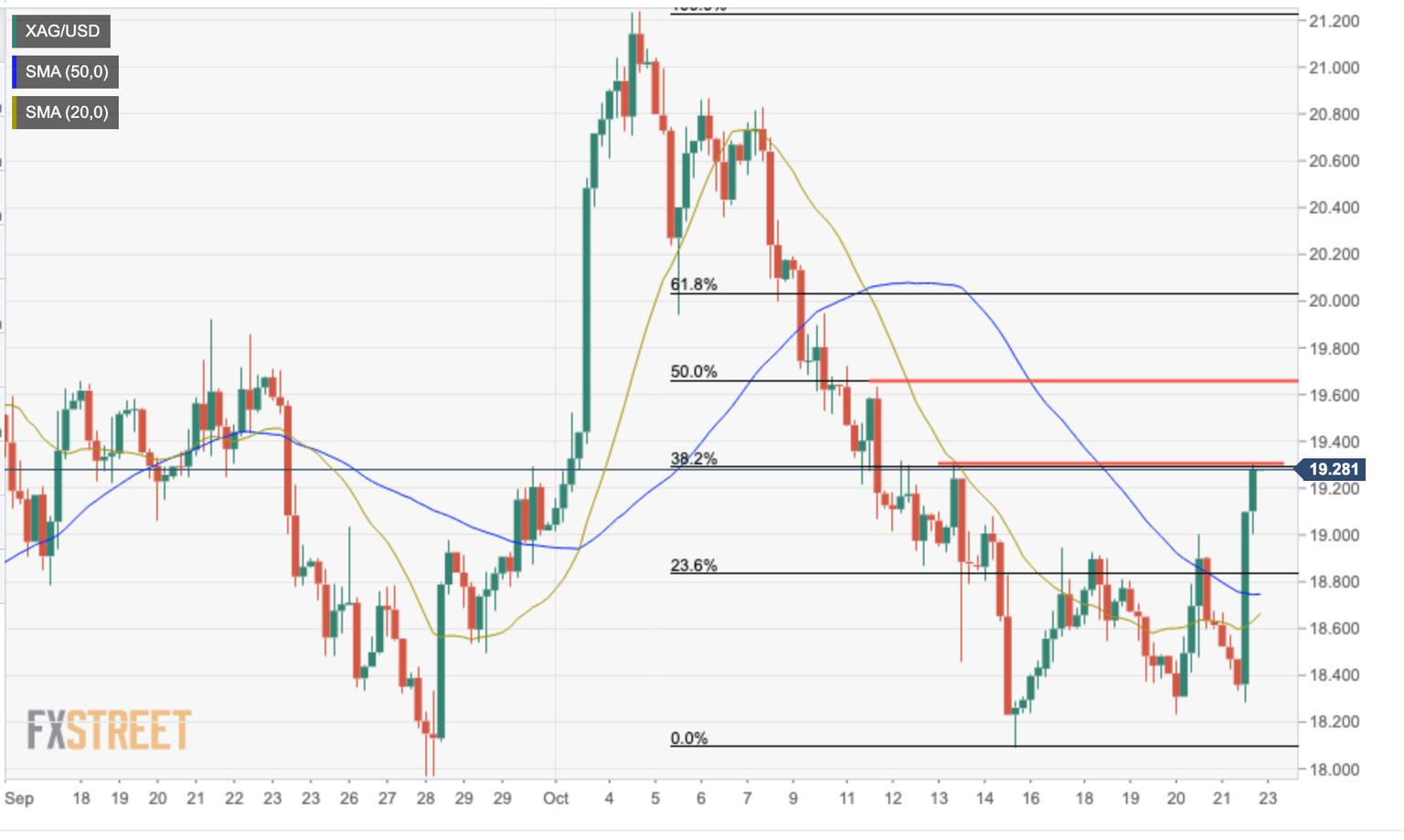

From a technical perspective, the pair is now testing the resistance area at $19.30 (Oct. 13 high and the 38.7% Fib. Retracement of the October 4-10 decline). Above here, the next potential targets are $19.65 (50% retracement and Oct. 11 high) and the $20.00 level.

On the downside, below the $19.00 previous resistance area, the next potential targets could be the 20-period SMA in the 4-hour chart, now at $18.60, and October 14 low at $18.08.

XAG/USD 4-hour chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.