Silver Price Analysis: XAG/USD stays bid above $26.00 inside weekly rising channel

- Silver remains on the front foot around intraday high.

- Sustained trading above 200-HMA, strong RSI back further upside.

- Sellers need to defy the channel formation for fresh entries.

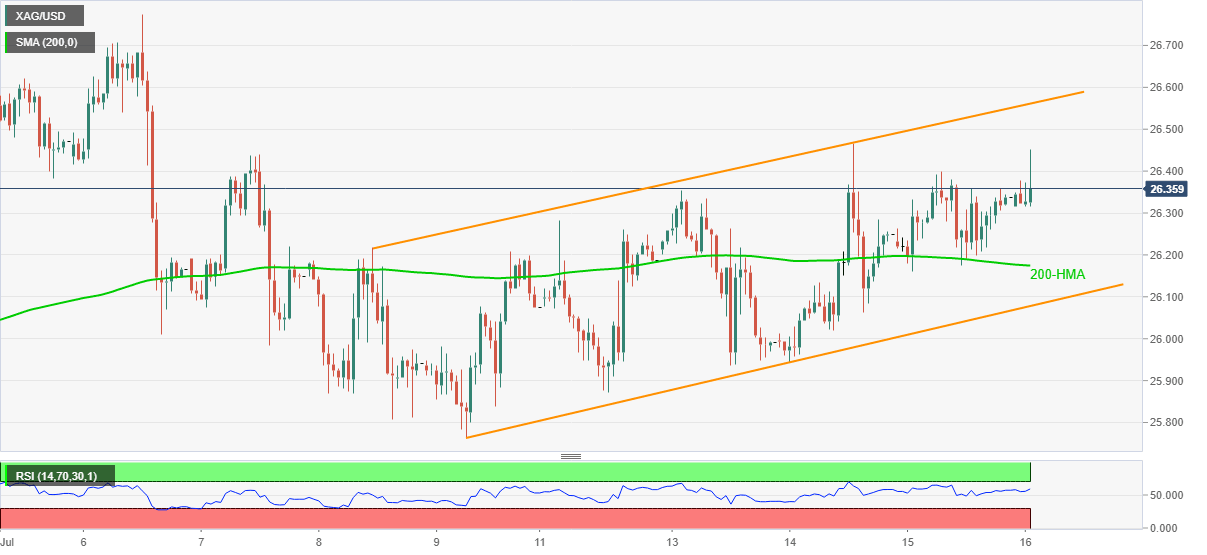

Silver (XAG/USD) rises 0.20% on a day, around the intraday high of $26.45, amid Friday’s Asian session. In doing so, the white metal stays bid inside a one-week-old ascending trend channel formation.

Also favoring the commodity buyers is the solid RSI line, not overbought, as well as the successful trading above 200-HMA.

Hence, the quote’s further upside towards the channel’s resistance of $26.60 can’t be ruled out. However, the RSI might have turned overbought by then and triggered the quote’s pullback, if not then the monthly high of $26.77 will be in focus.

If at all the silver buyers dominate past $26.77, early June’s low near the $27.00 round figure should be watched closely for extra bullish catalysts.

On the flip side, 200-HMA and the stated channel’s support, respectively near $26.15 and $26.05, quickly followed by the $26.00 round figure, could test the short-term declines.

Though, a clear downside below $26.00 won’t hesitate to drag the silver prices towards June’s low near $25.55.

Silver: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.