Silver Price Analysis: XAG/USD stages sharp rebound after testing $23

- XAG/USD reversed its direction after dropping to a monthly low on Thursday.

- A daily close above 100-day SMA could open the door for additional gains.

- $23 aligns as critical technical support for silver.

After suffering heavy losses on Wednesday, the XAG/USD pair extended its slide on Thursday and touched its lowest level in a month at $22.56. However, the pair managed to close the day above the critical $23 level and staged a decisive rebound on Friday. As of writing, XAG/USD was up 1.67% on the day at $23.65.

Silver technical outlook

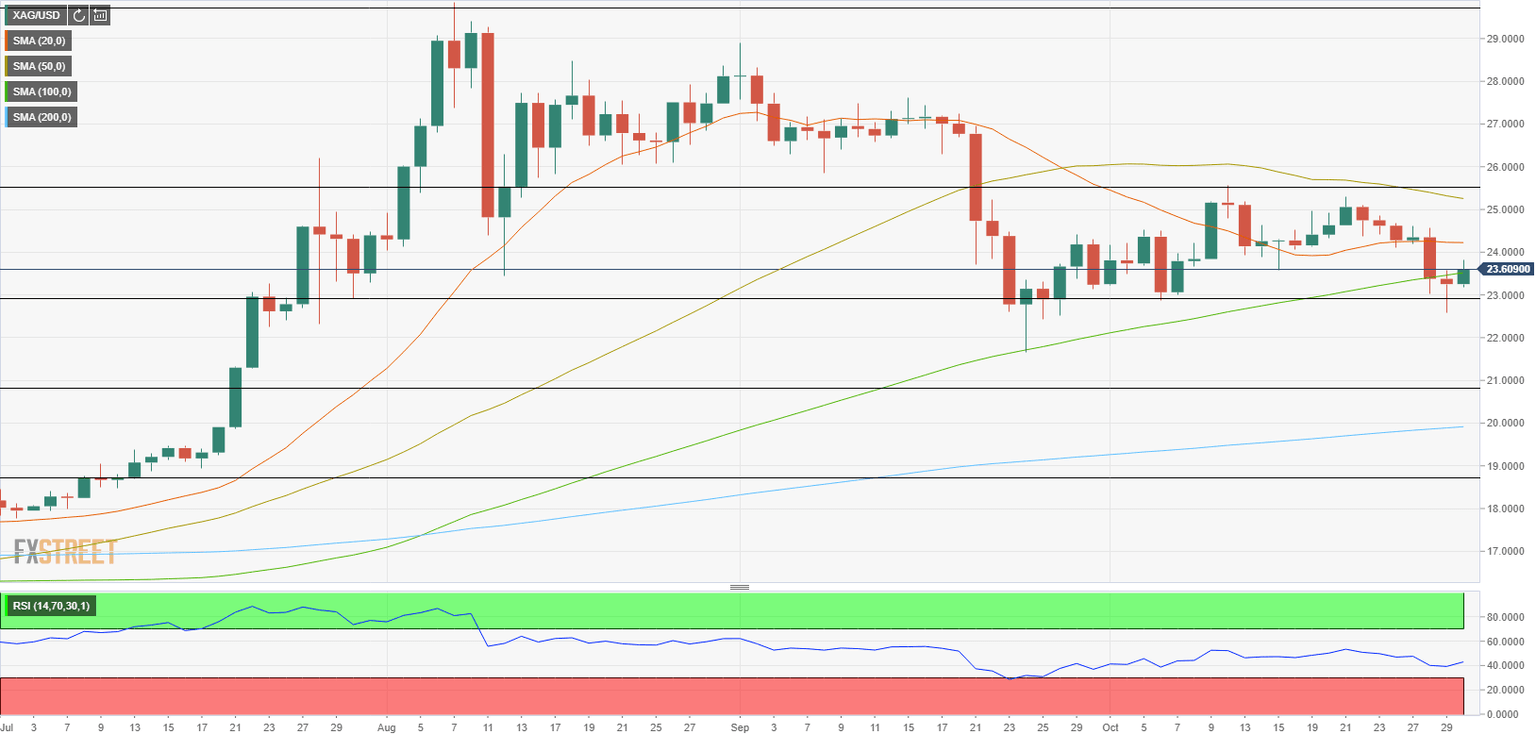

On the daily chart, the Relative Strength Index (RSI) indicator seems to have turned north after dropping to 40. However, the fact that the RSI remains below 50 suggests that Friday's climb is a technical correction of the latest decline.

However, XAG/USD is currently sitting above the 100-day SMA, which is currently located at $23.50, and a daily close above that key moving average could attract more buyers. On the upside, the initial resistance aligns at $24.25 (20-day SMA) ahead of $25 (psychological level) and $25.25 (50-day SMA).

Supports, on the other hand, are located at $23.50 (100-day SMA) and $23 (psychological level/Fibonacci 38.2% retracement of March-August uptrend). With a daily close below $23, the outlook could turn bearish.

XAG/USD chart (daily)

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.