Silver Price Analysis: XAG/USD soars to three-week high, pushed by US employment report

- Silver breaks through ley technical levels, eyes resistance at $24.49.

- Buyers dominate XAG/USD market as RSI crosses 50-midline.

- Falling below the EMA confluence at $23.88-$23.76 could challenge $23.25 weekly lows.

Silver price skyrockets following a worse-than-expected employment report in the United States (US), which sent US bond yields plunging, a headwind for the US Dollar (USD). Therefore, XAG/USD is advancing sharply to new three-week highs, exchanging hands at around $24.18.

XAG/USD Price Analysis: Technical outlook

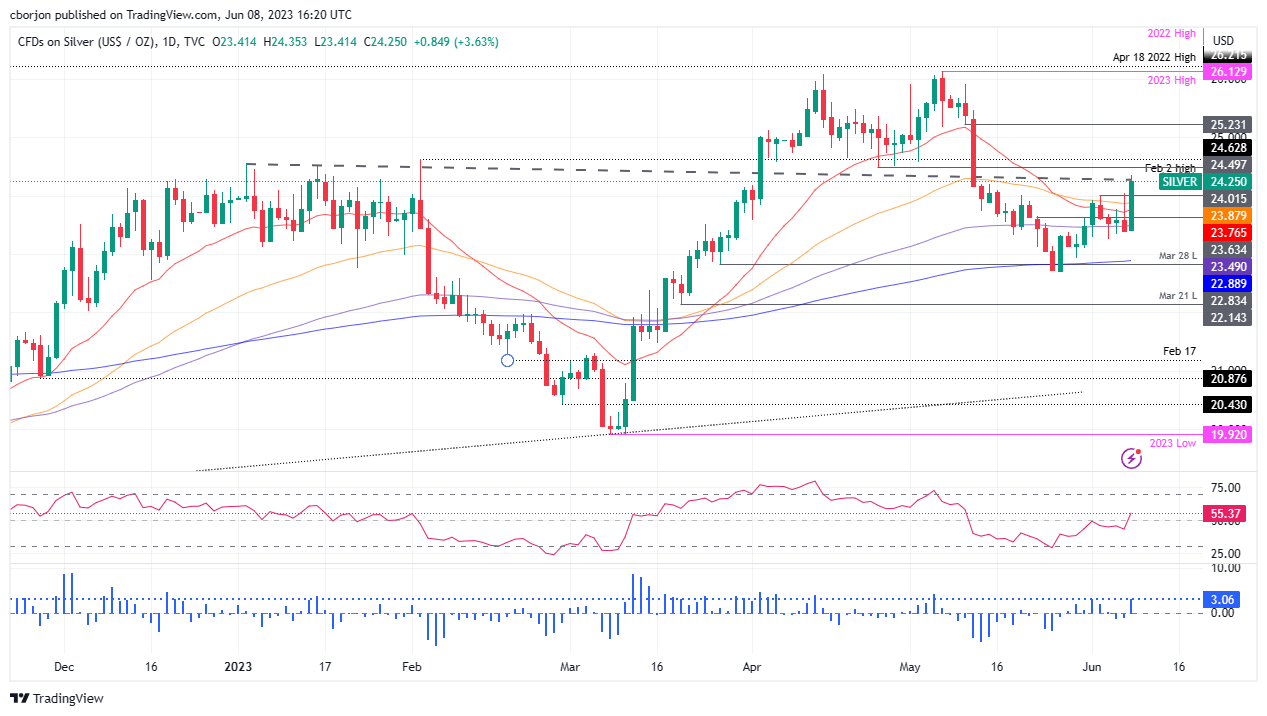

XAG/USD shifted from neutral biased to upwards, claiming essential technical levels on its way north but capped by resistance at April 25 daily low at $24.49. XAG/USD’s jump in price action spurred a reaction in oscillators, with the Relative Strength Index (RSI) indicator crossing above the 50-midline, while the three-day Rate of Change (RoC) depicts buyers in charge.

Therefore, the XAG/USD path of least resistance is upwards. That said, the XAG/USD first resistance would be $24.49, followed by the $25.00 figure. Once cleared, Silver could rally toward the May 11 high at $25.47, followed by the May 10 swing high at $25.91.

Conversely, if XAG/USD drops below the confluence of the 50 and 20-day Exponential Moving Averages (EMAs) at $23.88-$23.76, that could open the door to challenging weekly lows of $23.25.

XAG/USD Price Action – Daily chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.