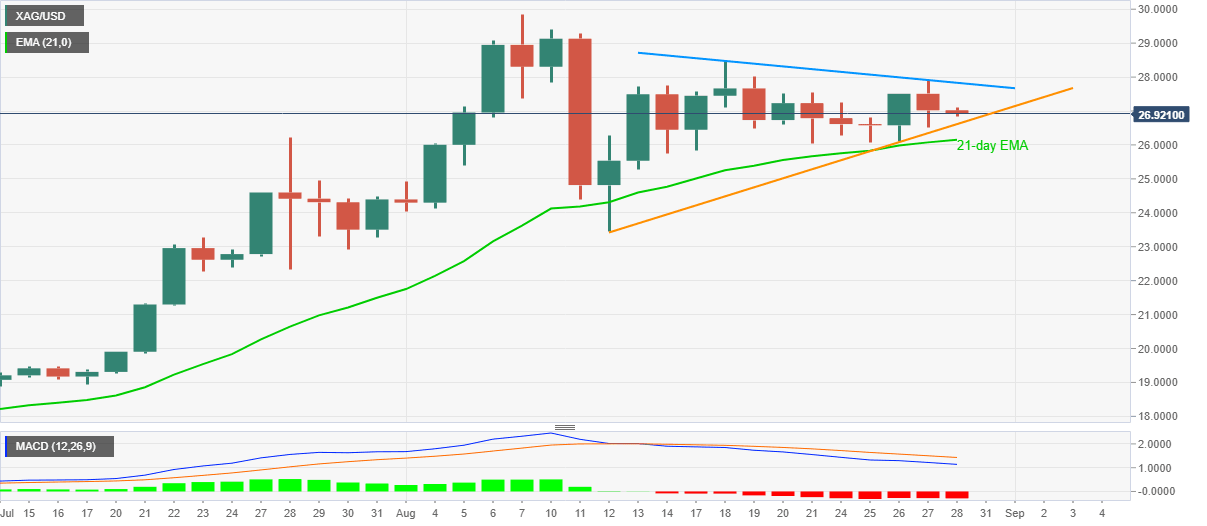

Silver Price Analysis: XAG/USD sellers eye two-week-old support line below $27.00

- Silver fails to respect the bounce off $26.51, drops for the second day.

- Bearish MACD favors the sellers amid risk-on sentiment.

- An eight-day-old resistance line guards immediate upside.

Silver prices remain on the back foot around $26.88, down 0.56% on a day, as markets in Tokyo open for Friday’s trading. The white metal’s failures to keep the one-week high, followed by notable downside, joins bearish MACD to suggest further downside.

As a result, an upward sloping trend line from August 12, near $26.60, gains the intraday sellers’ attention, a break of which will again shift market focus to 21-day EMA level, currently around $26.10.

In a case where the bullion keeps declining past-$26.10, the $26.00 threshold will hold the key to the monthly low near $23.45/40.

Alternatively, buyers will keep hesitating unless the quote stays below a descending trend line from August 18, at $27.83 now.

If at all the bullion crosses the short-term resistance line, the August 18 top near $28.50 and the monthly peak surrounding $29.85 will be important to watch.

Silver daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.