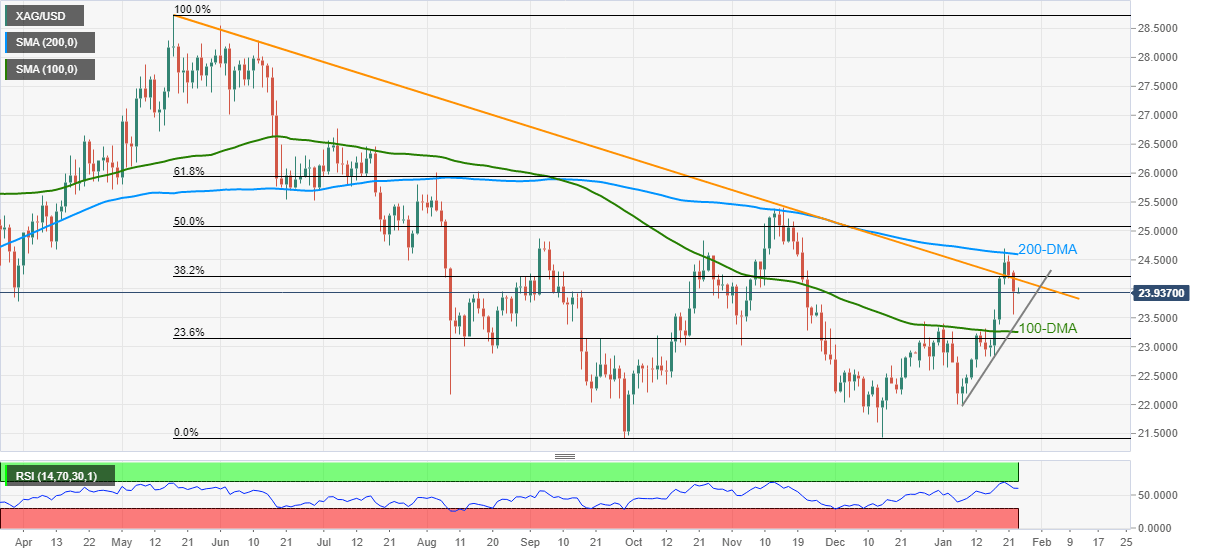

Silver Price Analysis: XAG/USD sellers eye 100-DMA retest

- Silver prices stay pressured after two-day declines, 12-day-old support line in focus.

- RSI pullback from overbought territory joins failures to cross 200-DMA to favor sellers.

- 100-DMA defends corrective pullback from December’s low, November’s high adds to the upside filters.

Silver (XAG/USD) fades bounce off weekly low under $24.00 during Tuesday’s Asian session.

The bright metal’s failures to keep the late Monday’s recovery could be linked to the failures to cross the 200-DMA and RSI pullback from the overbought region, which in turn signals extension of the latest weakness.

That said, an upward sloping trend line from January 07, near $23.45 by the press time, challenges the metal’s short-term declines ahead of the key 100-DMA support level surrounding $23.25.

Should XAG/USD remains bearish past $23.25, the monthly low near $21.95 and the previous month’s low around $21.40 will be in focus.

On the flip side, a downward sloping trend line from May, at $24.15 by the press time, restricts the metal’s immediate recoveries ahead of the 200-DMA level of $24.60.

If the XAG/USD prices rise past $24.60, November’s high of $25.40 and 61.8% Fibonacci retracement of May-December 2021 downside near $25.95, should lure the bulls.

Silver: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.