Silver Price Analysis: XAG/USD seems vulnerable below $26.75-80 confluence breakpoint

- Silver seemed struggling to capitalize on the overnight bounce from over one-month lows.

- The set-up seems tilted in favour of bearish traders and supports prospects for a further slide.

- A sustained move beyond the $27.00 mark is needed to negate the near-term bearish outlook.

Silver reversed a modest intraday dip and climbed to the top end of its daily trading range, around the $26.75-80 area during the early European session, albeit lacked follow-through.

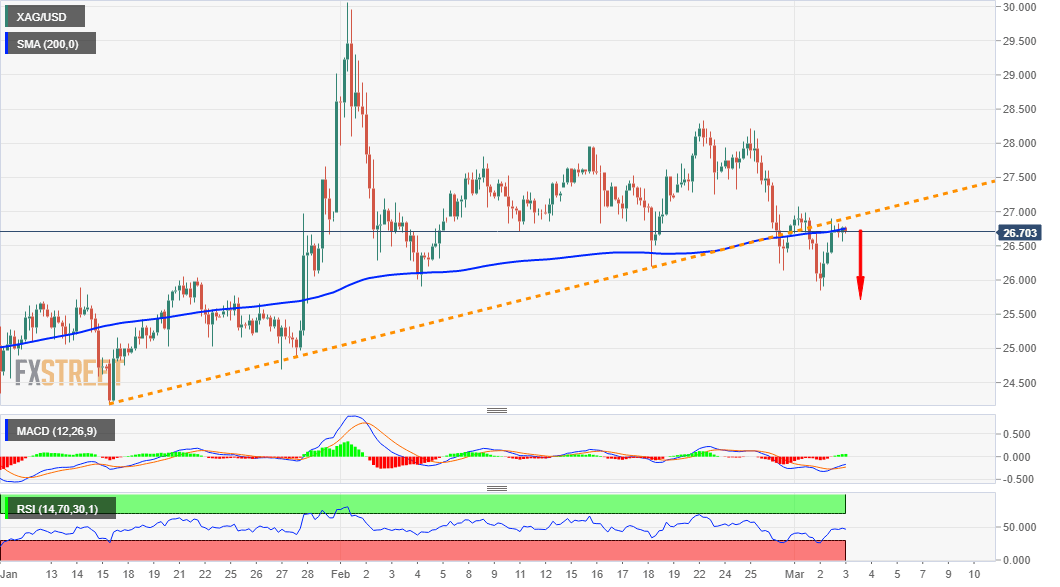

The mentioned region coincides with a confluence support breakpoint that comprised of 200-period SMA on the 4-hourly chart and a short-term ascending trend-line extending from mid-January. This, in turn, should now act as a key pivotal point for short-term traders.

Meanwhile, technical indicators on the 1-hourly chart have been gaining traction but are yet to confirm a bullish bias on 4-hourly/daily charts. This makes it prudent to wait for some follow-through buying beyond the support-turned-resistance before placing bullish bets.

Any subsequent move beyond might confront a strong barrier near the $27.00 area. That said, a convincing breakthrough will negate the near-term bearish bias and push the XAG/USD back towards the $28.00 mark with some intermediate resistance near the $27.60-65 region.

On the flip side, immediate support is pegged near mid-$26.00s. Sustained weakness below will be seen as a fresh trigger for bearish traders and set the stage for an extension of the white metal's recent sharp pullback from the key $30.00 psychological mark.

The XAG/USD might then accelerate the fall towards the $26.00 mark before eventually dropping to the $25.45-35 congestion zone. The downfall could further get extended towards the $25.00 level en-route the $24.75-70 area and YTD lows, around the $24.00 mark.

XAG/USD 4-hourly chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.