Silver Price Analysis: XAG/USD retakes $27.00 mark, upside potential seems limited

- Silver gains some positive traction on Wednesday, albeit it lacks follow-through.

- The setup supports prospects for the emergence of fresh selling at higher levels.

- A sustained strength beyond mid-$27.00 could pave the way for additional gains.

Silver (XAG/USD) attracts some dip-buyers near the $26.75 region during the Asian session on Wednesday, albeit lacks bullish conviction and remains confined in the previous day's broader trading range. The white metal is currently placed just above the $27.00 mark, up around 0.35% for the day.

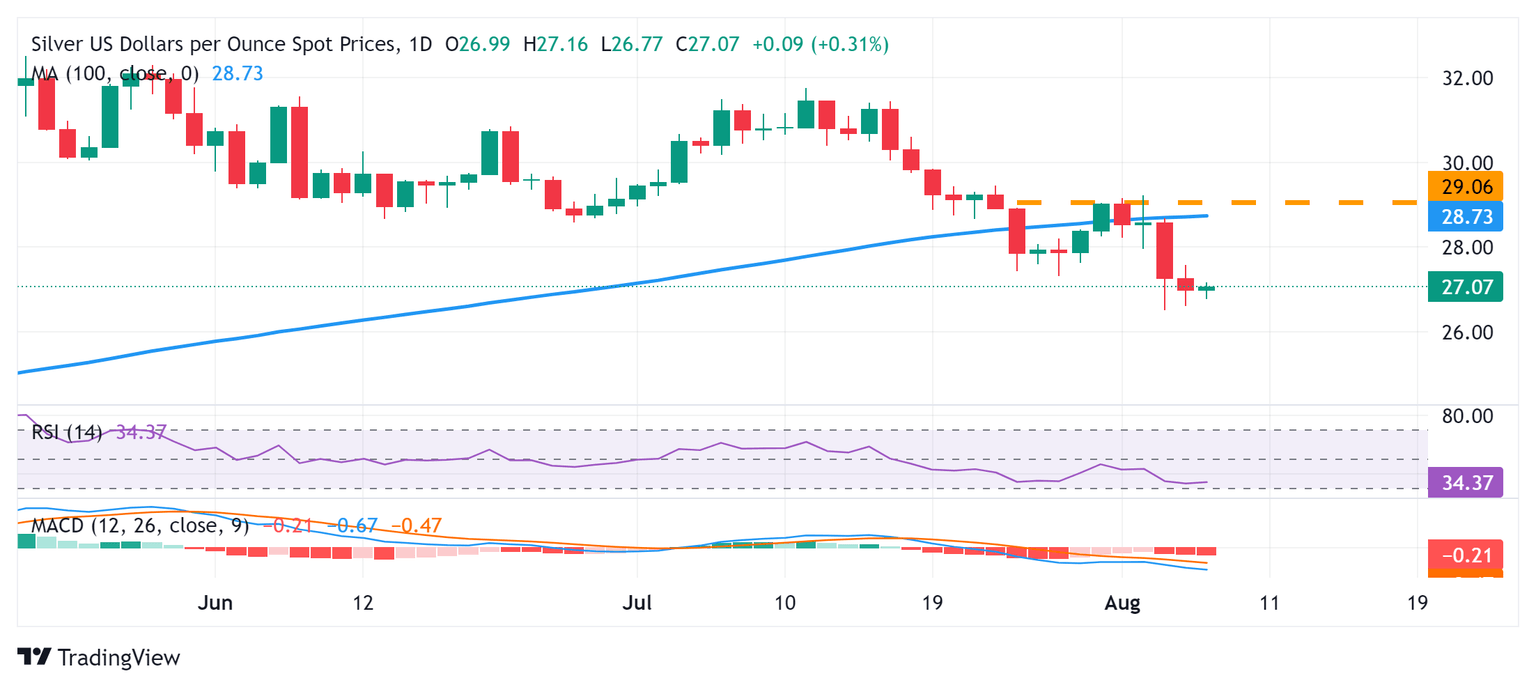

From a technical perspective, the recent breakdown through the 100-day Simple Moving Average (SMA) and last week's failure to find acceptance above the $29.00 mark favors bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone. This, along with the lack of strong follow-through buying, warrants some caution before positioning for any meaningful recovery from a three-month low reached on Monday.

In the meantime, any subsequent move up is likely to confront some resistance near the $27.50 horizontal zone, above which a bout of a short-covering move could lift the XAG/USD beyond the $28.00 mark, to the $28.20 hurdle. The momentum could extend further, though is likely to remain capped near the 100-day SMA support breakpoint, near the $28.70 region. This is followed by the $29.00 round figure, which if cleared will shift the near-term bias back in favor of bullish traders.

On the flip side, the $26.60-$26.50 region now seems to have emerged as an immediate support. A convincing break below will reaffirm the negative bias and make the XAG/USD vulnerable to test the May monthly swing low, around the $26.00 mark. The next relevant support is pegged near the $25.60 horizontal zone, below which the white metal could accelerate the fall towards the $25.00 psychological mark before eventually dropping to the $24.40-$24.30 support zone.

Silver daily chart

Silver FAQs

Silver is a precious metal highly traded among investors. It has been historically used as a store of value and a medium of exchange. Although less popular than Gold, traders may turn to Silver to diversify their investment portfolio, for its intrinsic value or as a potential hedge during high-inflation periods. Investors can buy physical Silver, in coins or in bars, or trade it through vehicles such as Exchange Traded Funds, which track its price on international markets.

Silver prices can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can make Silver price escalate due to its safe-haven status, although to a lesser extent than Gold's. As a yieldless asset, Silver tends to rise with lower interest rates. Its moves also depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAG/USD). A strong Dollar tends to keep the price of Silver at bay, whereas a weaker Dollar is likely to propel prices up. Other factors such as investment demand, mining supply – Silver is much more abundant than Gold – and recycling rates can also affect prices.

Silver is widely used in industry, particularly in sectors such as electronics or solar energy, as it has one of the highest electric conductivity of all metals – more than Copper and Gold. A surge in demand can increase prices, while a decline tends to lower them. Dynamics in the US, Chinese and Indian economies can also contribute to price swings: for the US and particularly China, their big industrial sectors use Silver in various processes; in India, consumers’ demand for the precious metal for jewellery also plays a key role in setting prices.

Silver prices tend to follow Gold's moves. When Gold prices rise, Silver typically follows suit, as their status as safe-haven assets is similar. The Gold/Silver ratio, which shows the number of ounces of Silver needed to equal the value of one ounce of Gold, may help to determine the relative valuation between both metals. Some investors may consider a high ratio as an indicator that Silver is undervalued, or Gold is overvalued. On the contrary, a low ratio might suggest that Gold is undervalued relative to Silver.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.