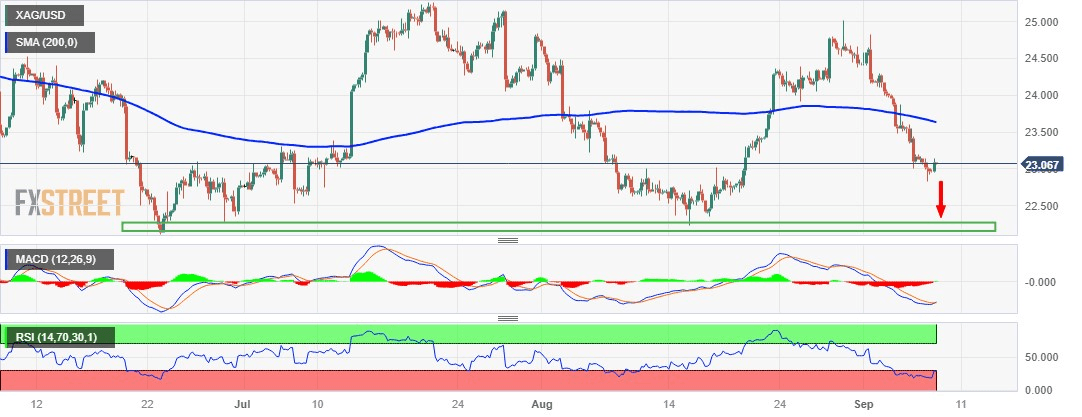

Silver Price Analysis: XAG/USD retakes $23.00 mark, not out of the woods yet

- Silver gains some positive traction and snaps a seven-day losing streak to over a two-week low.

- The technical setup still favours bears and warrants caution before positioning for further gains.

- A sustained move beyond the 100-period SMA on the 4-hour chart will negate the bearish bias.

Silver attracts some buying during the Asian session on Friday and for now, seems to have snapped a seven-day losing streak to a two-and-half-week low, around the $22.85 region touched the previous day. The white metal currently trades just above the $23.00 mark, up over 0.40% for the day, though lacks bullish conviction and seems vulnerable to weaken further.

The outlook is reinforced by the fact that technical indicators on the daily chart have just started gaining negative traction, which supports prospects for the emergence of fresh selling at higher levels. Moreover, the Relative Strength Index (RSI) on the 4-hour chart has also recovered from the oversold territory. This, in turn, suggests that the path of least resistance for the XAG/USD is to the downside and any subsequent move up might still be seen as a selling opportunity.

Bearish traders, however, need to wait for some follow-through selling below the overnight swing low, around the $22.85 area, before placing fresh bets. The XAG/USD might then accelerate the downward trajectory below the $22.65-$22.60 support, towards challenging a strong horizontal support near the $22.20-$22.10 zone. This is followed by the $22.00 mark, which if broken will confirm a fresh breakdown and set the stage for an extension of the well-established downtrend.

On the flip side, the $23.35-$23.40 region is likely to act as an immediate hurdle ahead of the $23.65 area, representing the 100-period Simple Moving Average (SMA) on the 4-hour chart, which should act as a pivotal point. A sustained strength beyond will suggests that the recent downfall has run its course and shift the bias in favour of bullish traders. The subsequent short-covering move might then lift the XAG/USD to the $24.00 mark en route to the $24.30-$24.35 supply zone.

Silver 4-hour chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.