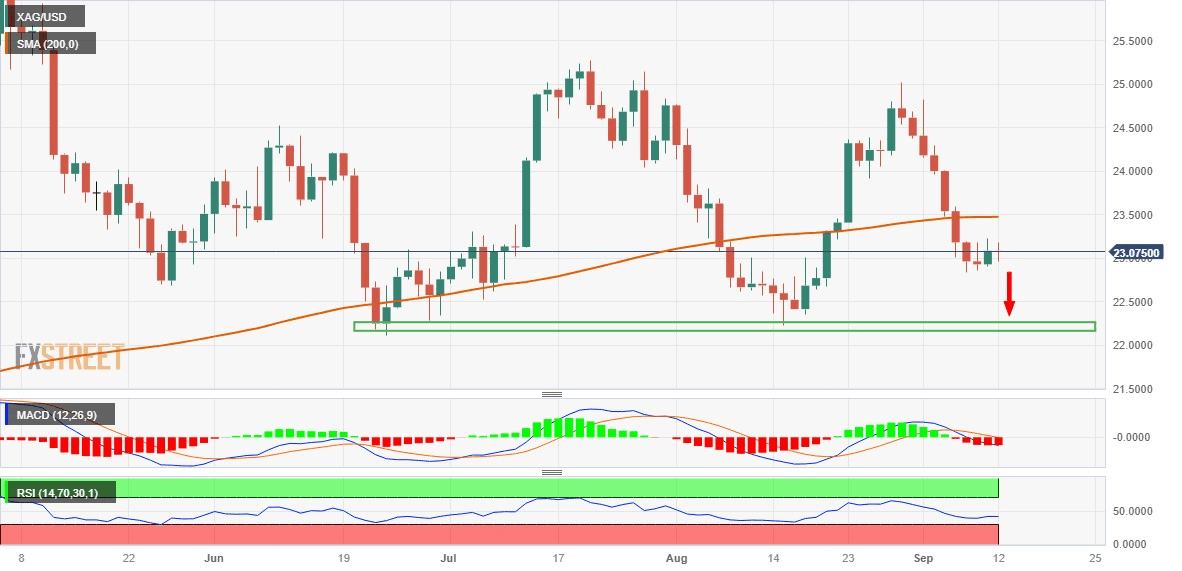

Silver Price Analysis: XAG/USD remains confined in a range around $23.00, seems vulnerable

- Silver attracts some intraday selling on Tuesday, albeit lacks follow-through.

- The technical setup suggests that the path of least resistance remains down.

- Attempted recoveries could be seen as a selling opportunity and remain capped.

Silver struggles to capitalize on the previous day's modest recovery gains and attracts fresh sellers in the vicinity of the $23.20 area on Tuesday. The white metal extends its steady descent through the early part of the European session and hits a fresh daily low in the last hour, though shows some resilience below the $23.00 round-figure mark.

Looking at the broader picture, Silver has been oscillating in a familiar trading back since last Thursday. Against the backdrop of the recent sharp downfall from the $25.00 psychological mark, this range-bound price action might be categorized as a bearish consolidation phase. Moreover, oscillators on the daily chart are holding in the negative territory and are still far from being in the oversold zone. This, in turn, suggests that the path of least resistance for the XAG/USD is to the downside.

Bearish traders, however, might wait for some follow-through selling below the $22.85-$22.80 area or a multi-week low touched last Thursday, before placing fresh bets. The XAG/USD might then accelerate the fall towards challenging a strong horizontal support near the $22.20-$22.10 zone. This is followed by the $22.00 round-figure mark, which if broken decisively will be seen as a fresh trigger for bearish traders and pave the way for an extension of a multi-week-old descending trend.

On the flip side, the $23.20 region now seems to have emerged as an immediate strong resistance. Any subsequent move up might be seen as a selling opportunity and remain capped near the very important 200-day Simple Moving Average (SMA), currently pegged near the $23.45-$23.50 area. This is followed by the 100-day SMA barrier, around the $23.80 region, and the $24.00 mark, which if cleared should negate the near-term negative outlook for the XAG/USD.

The subsequent short-covering move has the potential to lift the white metal beyond the $24.30-$24.35 supply zone, towards reclaiming the $25.00 psychological mark. The latter represents the August monthly swing high and should act as a pivotal point. A sustained strength beyond will be seen as a fresh trigger for bullish traders and pave the way for some meaningful appreciating move for the XAG/USD.

Silver daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.