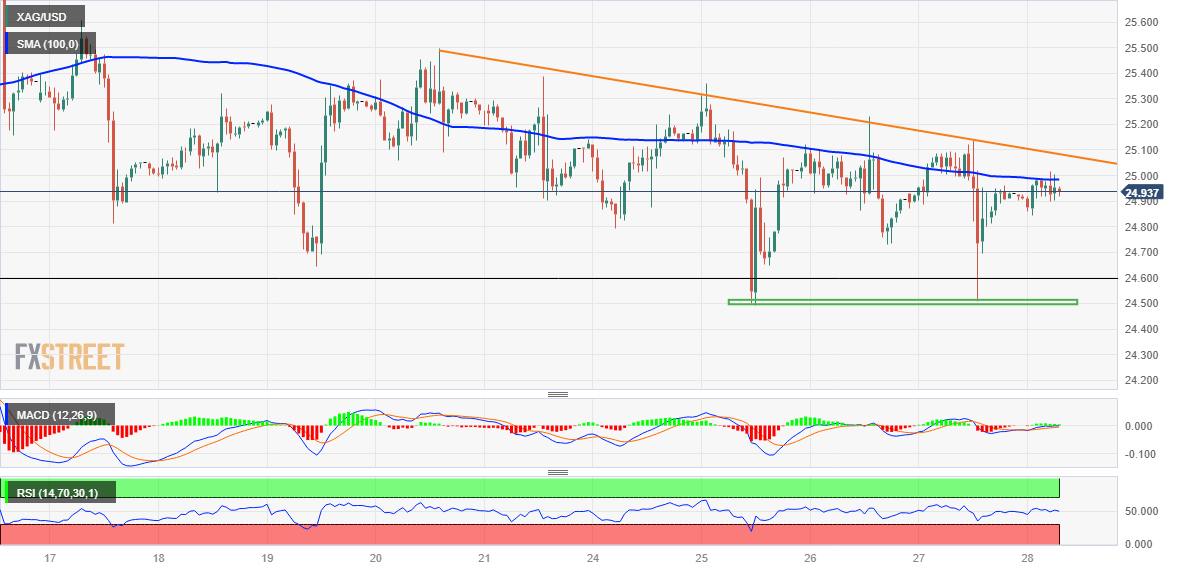

Silver Price Analysis: XAG/USD oscillates in a range below 100-hour SMA, $25.00 mark

- Silver struggles to capitalize on the overnight goodish rebound from the $24.50 support zone.

- The technical setup seems tilted in favour of bulls and supports prospects for additional gains.

- A convincing break below the $24.40-30 resistance-turned-support will negate the positive bias.

Silver edges higher on Friday, albeit struggles to capitalize on the move beyond 100-hour Simple Moving Average (SMA) and remains capped near the $25.00 psychological mark through the early European session.

From a technical perspective, the XAG/USD has been showing some resilience below the 23.6% Fibonacci retracement level of the March-April rally and finding support ahead of the $24.40-$24.30 strong horizontal resistance breakpoint. The subsequent bounce, along with positive oscillators on the daily chart, favour bullish traders and support prospects for additional gains. That said, it will still be prudent to wait for some follow-through buying beyond the $25.00 mark before placing fresh bullish bets.

The XAG/USD might then accelerate the momentum towards the $25.50-$25.60 supply zone. A sustained strength beyond will negate any near-term negative bias and allow the white metal to make a fresh attempt to conquer the $26.00 round-figure mark and retest a one-year high touched earlier this month. Some follow-through buying should pave the way for an extension of the positive momentum towards the next relevant hurdle near the $26.25-$26.30 region en route to the $27.00 round-figure mark.

On the flip side, the $24.50-$24.40 region might continue to act as immediate strong support, which if broken decisively might prompt some technical selling. The XAG/USD might then weaken further below the $24.00 mark and test the 38.2% Fibo. level, around the $23.70 area. The corrective decline could get extended further towards the $23.35-$23.30 horizontal support before the metal eventually drops to the $23.00 round-figure mark, representing the 50% Fibo. level.

Silver 1-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.