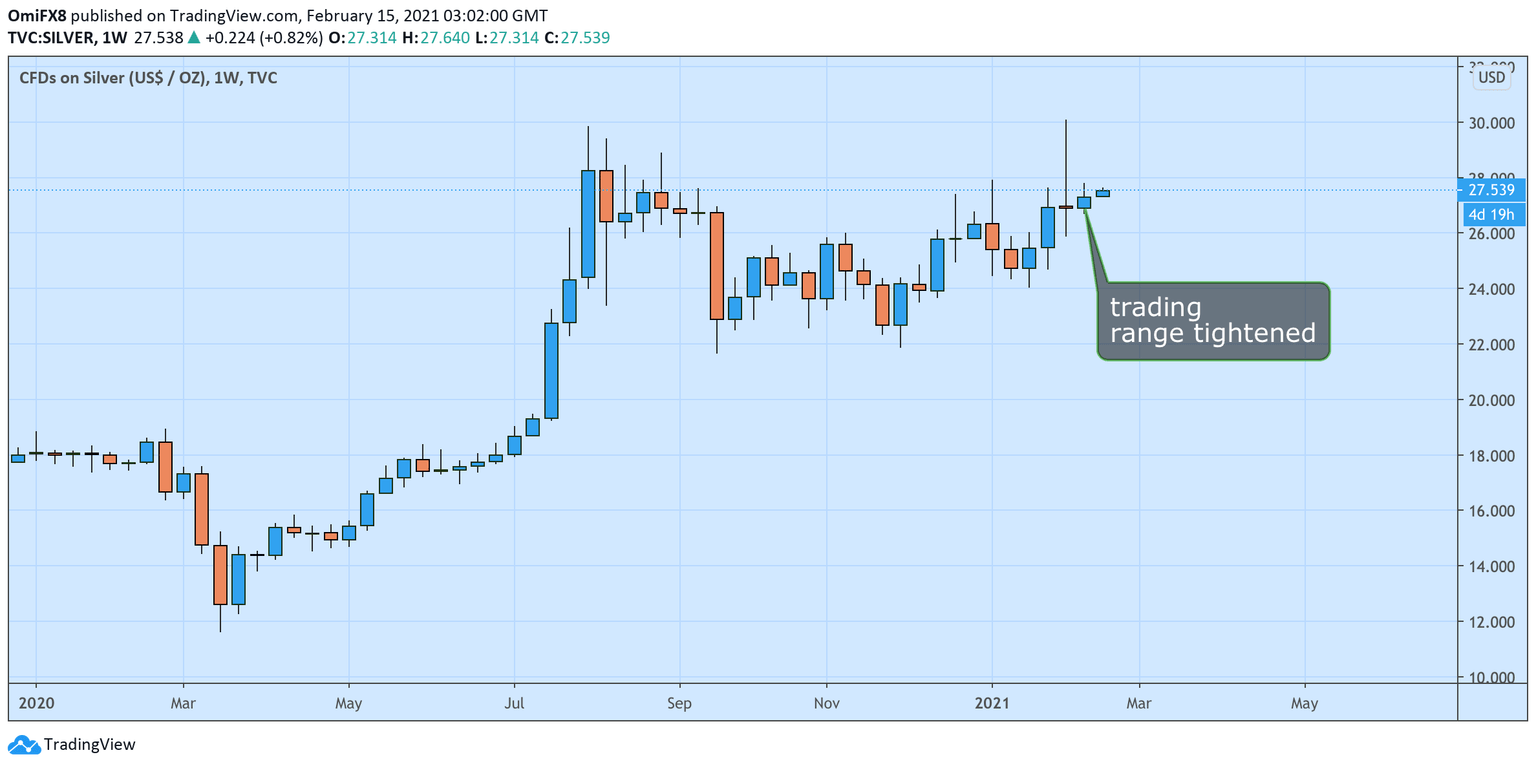

Silver Price Analysis: XAG/USD on the rise, $27.80 is a crucial resistance

- While silver trades higher, resistance at $27.80 is still intact.

- A move above that would confirm a range breakout.

Silver trades near $27.55 at press time, representing a 0.87% gain on the day.

While the metal is flashing green, it is yet to take out resistance at $27.80 (the previous week's high).

A move above that level would imply a bullish breakout from the narrowing price range signaled by the previous week's candle, whose high and low falls well within the preceding week's price range.

Above $27.80, the focus would shift to $30.09, the high seen earlier this week. On the other hand, acceptance under the previous week's low of $27.31 would put the bears in a commanding position, exposing support at $24.06, the higher low created on Jan. 6.

Daily chart

Trend: Bullish above $27.80

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.