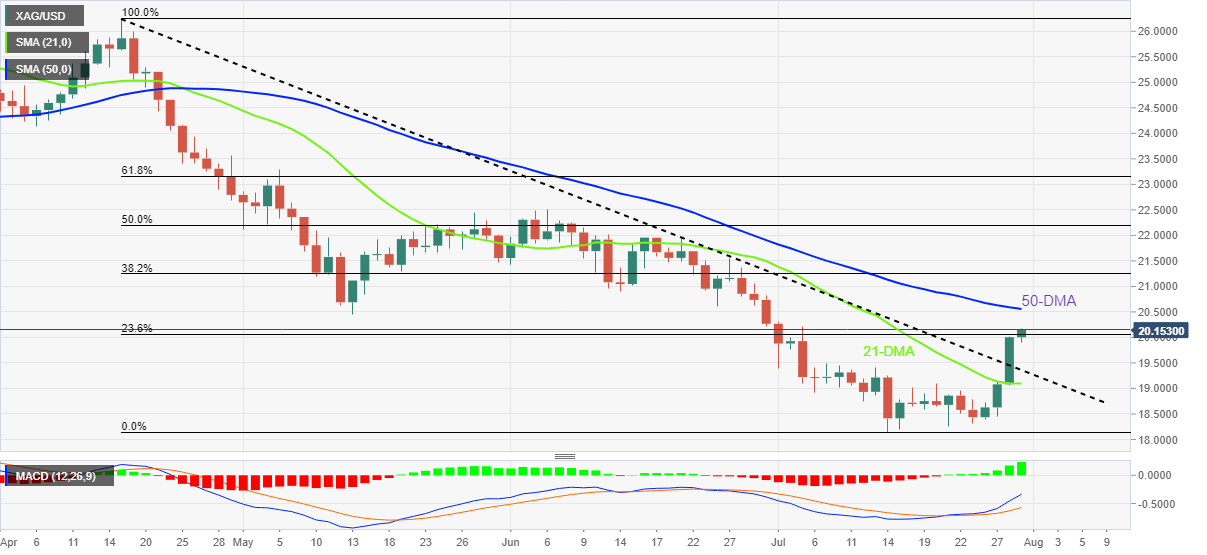

Silver Price Analysis: XAG/USD marches beyond $20.00 to renew three-week high

- Silver price pokes the monthly top marked on July 01.

- Successful break of descending trend line from April 18 joins bullish MACD signals to keep buyers hopeful.

- May’s low, 50-DMA could challenge short-term upside moves.

- Sellers need validation from 20-DMA to retake control.

Silver price (XAG/USD) marches above $20.00 during the four-day uptrend heading into Friday’s European session. In doing so, the bright metal extends the previous day’s upside break of a three-month-old resistance towards refreshing the three-week top.

In addition to the trend line breakout, the bullish MACD signals and successful trading above the 21-DMA also favor XAG/USD buyers.

However, May’s low and the 50-DMA, respectively around $20.45 and $20.55, could challenge the metal’s further upside. Also acting as the upside hurdle is the mid-June swing low near $20.90 and the $21.00 threshold.

Should the quote remain firmer past $21.00, the odds of witnessing a run-up towards June’s high near $22.50 can’t be ruled out.

Meanwhile, pullback moves may aim for the $20.00 round figure before revisiting the previous resistance line, at $19.35 by the press time.

Even so, the silver bears should remain cautious until the quote stays beyond the 21-DMA support level near $19.00.

Following that, a south-run to renew the yearly low of $18.14, marked earlier in July, can be anticipated.

Silver: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.