Silver Price Analysis: XAG/USD hangs near weekly lows, below $28.00 mark

- Silver witnessed some fresh selling on Thursday and erased the previous day’s modest gains.

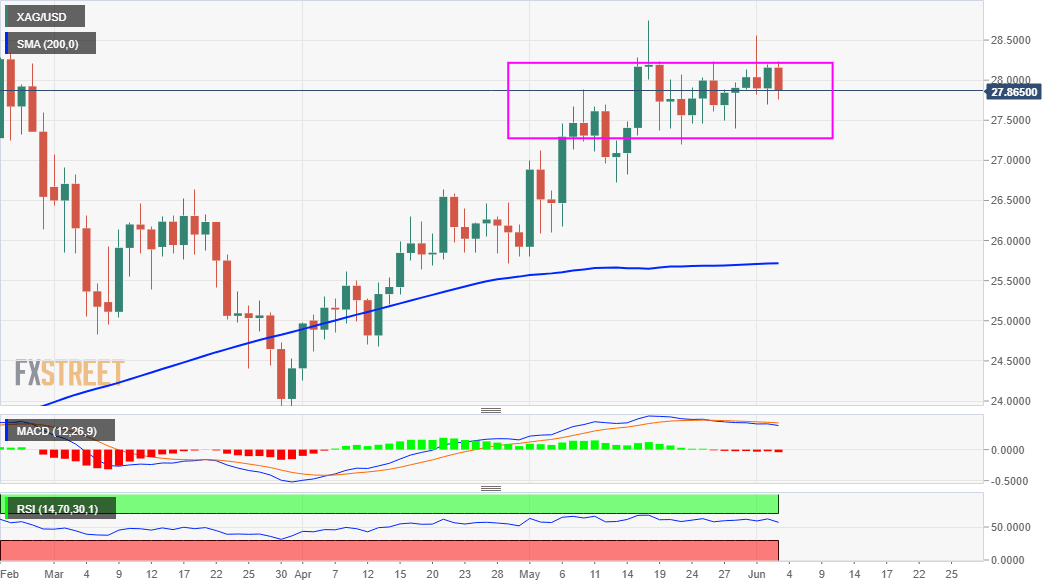

- The range-bound price action constitutes the formation of a rectangle on short-term charts.

- Mixed technical indicators on hourly/daily charts warrant some caution for aggressive traders.

Silver failed to capitalize on the previous day's positive move, instead came under some renewed selling pressure on Thursday. The downfall dragged the commodity to the $27.75 area, back closer to weekly lows during the first half of the European session.

From a technical perspective, the XAG/USD – barring few knee-jerk spikes – has been oscillating in a familiar trading band over the past three weeks or so. The range-bound price action constitutes the formation of a rectangle, pointing to indecision amid traders.

Meanwhile, technical indicators on hourly charts have been gaining some negative momentum. That said, bullish oscillators on the daily chart support prospects for the emergence of some dip-buying at lower levels and warrant caution for aggressive bearish traders.

Hence, any subsequent fall might still be seen as a buying opportunity near the $27.60-55 region. This should help limit the downside near the trading range support, around the $27.35-30 region, which if broken decisively might turn the XAG/USD vulnerable to slide further.

The next relevant support is pegged near the $27.00 mark, below which the XAG/USD might accelerate the fall to the $26.45 horizontal level. The downward trajectory could get extended towards the $26.00 mark en-route the very important 200-day SMA, around the $25.70 zone.

On the flip side, the $28.00 round figure now seems to act as an immediate resistance ahead of the $28.25-30 strong barrier. This is followed by resistance near the $28.55 region, or weekly swing highs and May monthly tops, around the $28.75 region.

Bulls might wait for a sustained move beyond the mentioned hurdles before positioning for any further appreciating move. The XAG/USD might then surpass the $29.00 mark, and the $29.40-50 intermediate resistance and aim to reclaim the key $30.00 psychological mark.

XAG/USD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.