Silver Price Analysis: XAG/USD flirts with $26.00 as 50-DMA prods metal bears

- Silver price licks its wounds at the lowest levels in six weeks.

- Downbeat RSI (14) allows 50-DMA to challenge XAG/USD bears.

- Horizontal hurdle from early 2023, 21-DMA guard recovery moves.

Silver price (XAG/USD) struggles to defend the latest corrective from a 1.5-month low near $26.00 amid early Monday morning in Europe.

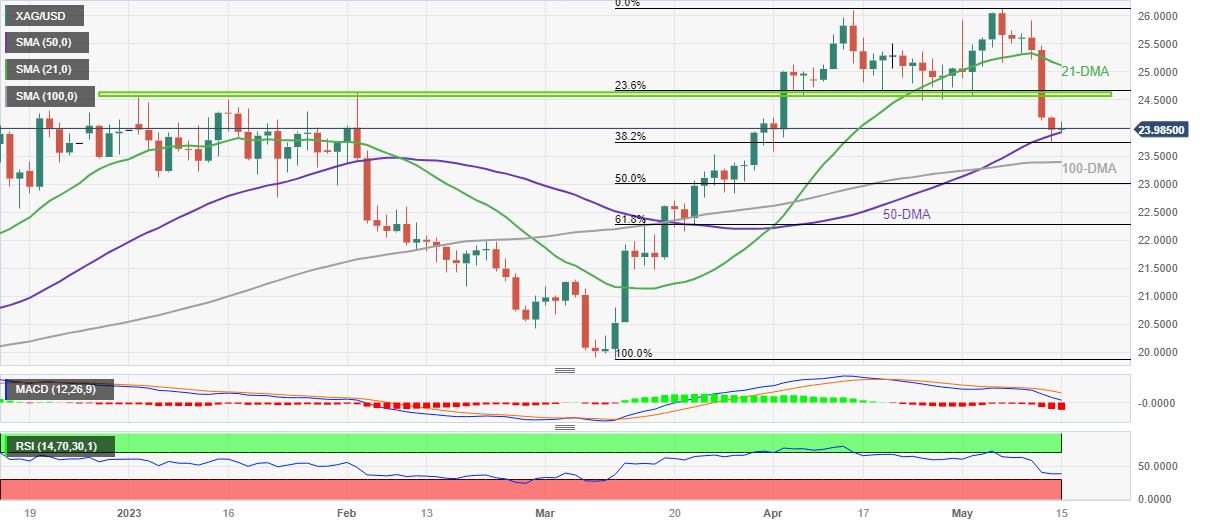

That said, the bright metal dropped to the lowest levels since early April the previous day but failed to offer a daily close beneath the 50-DMA, around $23.90 by the press time.

In addition to the failure to provide a daily close below the short-term key DMA, the downbeat conditions of the RSI (14) line also favored the Silver price’s corrective bounce on early Monday.

However, the bearish MACD signals and sustained trading below the previous key supports keep the XAG/USD bears hopeful.

That said, the corrective bounce remains elusive unless the quote stays below a horizontal area comprising multiple levels marked since early January 2023, close to $24.60.

Even if the XAG/USD rises past $24.60, the 21-DMA hurdle of around $25.10 can prod the bulls before giving them control.

On the contrary, a daily close below the 50-DMA level of near $23.90 can quickly direct the Silver price toward the 100-DMA support surrounding $23.40.

Following that, the 61.8% Fibonacci retracement level of the precious metal’s March-May upside, near $22.30, can act as the last defense of the Silver buyers.

Silver price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.