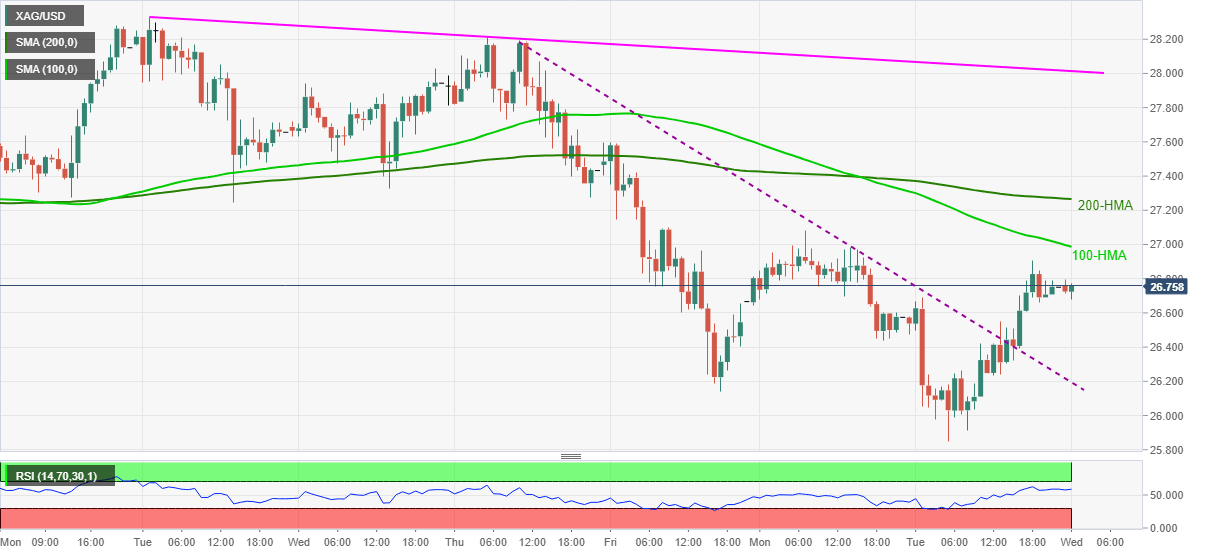

Silver Price Analysis: XAG/USD fades recovery moves from five-week low below $27.00

- Silver fails to extend weekly resistance breakout, eases below key moving averages.

- Strong RSI needs the seller to drop back below previous resistance.

- Descending the trend line from February 23 adds to the upside barriers.

Silver refreshes intraday low to $26.67, currently around $26.72, in a pullback move during Wednesday’s Asian session. In doing so, the quote fizzles the previous day’s notable recovery moves from late-January lows.

It should, however, be noted that the commodity keeps upside break of one-week-old trend line resistance, now support, amid strong RSI conditions.

Hence, the latest pullback needs to decline below the stated resistance line, at $26.20 now, before recalling the silver sellers.

Following that, the recent low, also the lowest since January 28, near $25.85, will be the key as a downside break of which will derail Tuesday’s recovery and direct silver bears to sub-$24.00 area.

Alternatively, 100-HMA and 200-HMA guard the quote’s immediate upside around $27.00 and $27.30 respectively.

Also acting as an upside barrier is the short-term descending trend line, at $28.00 now.

Overall, silver faces an uphill task and hence sellers should remain hopeful.

Silver hourly chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.