Silver Price Analysis: XAG/USD drops towards $23.00 on breaking key supports

- Silver Price remains pressured after falling the most in six weeks.

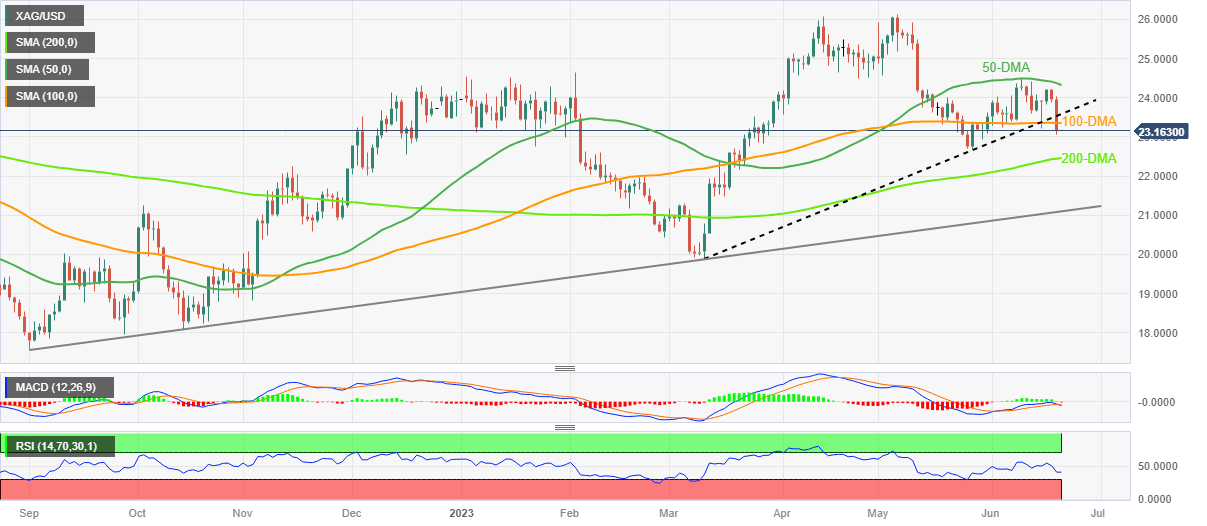

- Downside break of three-month-old support line, 100-DMA favor XAG/USD sellers.

- Bear cross on MACD signals further downside of the Silver Price but the below-50.0 RSI prods sellers.

- Previous monthly low, 200-DMA lures XAG/USD bears during further downside.

Silver Price (XAG/USD) seesaws around the monthly low marked the previous day, sidelined near $23.15 amid early Wednesday in Asia after falling the most in 1.5 months the previous day.

That said, the bright metal dropped heavily on Tuesday after breaking the key support line stretched from March, as well as the 100-DMA. The downside break of the previously important supports also took clues from the looming bear cross on the MACD, which in turn suggests further downside of the XAG/USD.

Hence, the XAG/USD’s further fall towards the $23.00 round figure appears imminent ahead of challenging the previous monthly low of around $22.70.

It’s worth noting, however, that the RSI (14) is below 50.0 and hence suggests limited downside room.

As a result, the Silver price may refrain from breaking the previous monthly low, if not then the 200-DMA level of around $22.45 can act as an extra filter towards the south.

Above all, the XAG/USD buyers remain hopeful unless witnessing a clear downside break of an ascending support line from September 2022, close to $21.10 by the press time.

On the flip side, the 100-DMA and the three-month-old previous support line, respectively around $23.35 and $23.55, guard immediate recovery of the Silver Price.

Following that, the 50-DMA hurdle of $24.35 gains the market’s attention as it holds the key to further advances of the XAG/USD.

Silver Price: Daily chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.