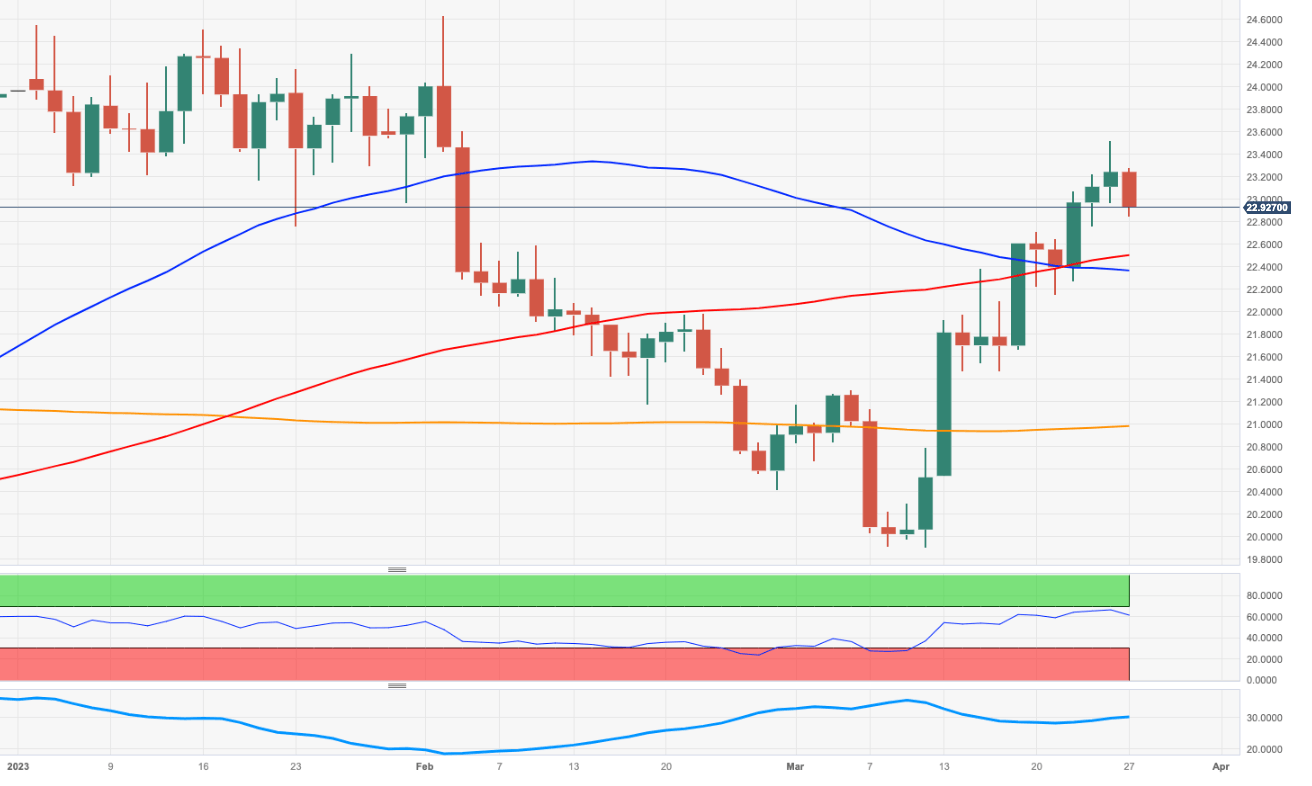

Silver Price Analysis: XAG/USD drops to 2-day lows in the sub-$23.00 area

- The grey metal trades on the defensive below $23.00.

- Recent tops near $23.50 caps the upside so far.

- There is an interim support at the 100-day SMA ($23.48).

Prices of the ounce of silver starts the new trading week on the defensive and retreat for the first time after three consecutive daily advances on Monday, probing at the same time the sub-$23.00 region.

In fact, silver comes under renewed selling pressure despite the so far bearish performance in the greenback and soon after hitting fresh multi-week peaks just beyond $23.50 on March 24.

In case the bullish mood returns to the market, the industrial metal is expected to meet the next up barrier at the March top at $23.52 (March 24). The surpass of this level should put silver en route to a potential visit to the 2023 peak at $24.62 (February 2) ahead of the April 2022 high at $26.21 (April 18). If losses accelerate, then there are provisional contention at the 100- and 55-day SMAs at $22.48 and $22.35, respectively, prior to the minor support level at $21.47 (low March 16). Further down comes the key 200-day SMA at $20.96, which precedes the 2023 low at $19.90 (March 10).

XAG/USD daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.