Silver Price Analysis: XAG/USD creeps higher as ‘double bottom’ emerges

- Silver advanced 0.20%, after Powell's hawkish comments.

- Technicals: Uptrend within descending channel, potential 'double bottom' pattern.

- Resistance levels: $29.50, $30.84 (June 21 high), $32.29 (May 29 peak), $32.51 (YTD high).

- Support points: $29.00, $28.57 (June 26 low), $27.59 (April 15 low).

Silver prices rose as Tuesday’s North American session finished, trading at $29.51 and registering gains of more than 0.20% at the time of writing. The grey metal advanced as Fed Chair Jerome Powell delivered hawkish remarks in an ECB event in Portugal, where he acknowledged that the Fed’s dual mandate risks are more balanced.

XAG/USD Price Analysis: Technical outlook

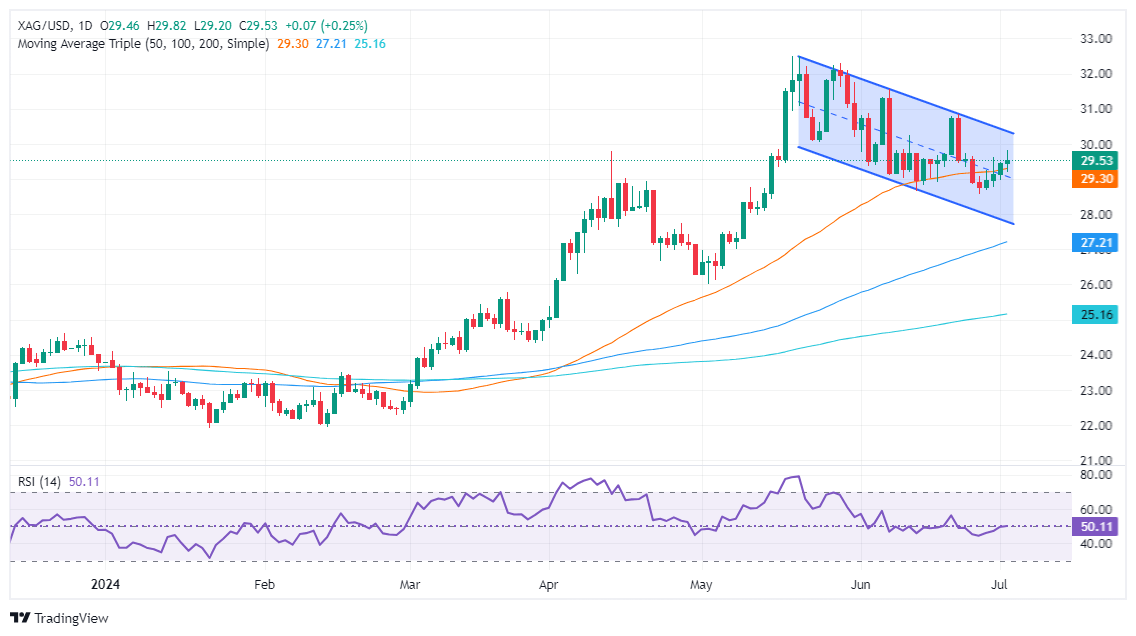

Silver’s uptrend remains intact but is capped to the upside and downside by a descending channel. Although it has formed a ‘double bottom’ chart pattern, buyers lack the momentum to clear the top of the channel, as depicted by the Relative Strength Index (RSI) almost flat at the neutral midline.

To confirm the ‘double bottom’ chart pattern, XAG/USD needs to crack the next resistance level, which is $29.50. Once surpassed the next stop would be the neckline' at $30.84, the June 21 high, followed by the May 29 peak of $32.29. A breach of the latter will expose the year-to-date (YTD) high of $32.51.

Conversely, if XAG/USD falls below $29.00, the next support level would be the June 26 low of $28.57. Clearing this level could lead to a drop to the April 15 swing low of $27.59.

XAG/USD Price Action – Daily Chart

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Last release: Wed Jun 12, 2024 18:00

Frequency: Irregular

Actual: 5.5%

Consensus: 5.5%

Previous: 5.5%

Source: Federal Reserve

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.