Silver Price Analysis: XAG/USD corrects from multi-month top, downside seems limited

- Silver retreats from a fresh eight-month high touched earlier this Wednesday.

- The technical setup supports prospects for the emergence of some dip-buying.

- A break below the $23.00 confluence is needed to negate the positive outlook.

Silver extends its steady intraday descent through the early European session and retreats further from an eight-month top, around the $24.30 area touched earlier this Wednesday. The white metal slides below the $24.00 mark in the last hour, eroding a part of the previous day's strong gains.

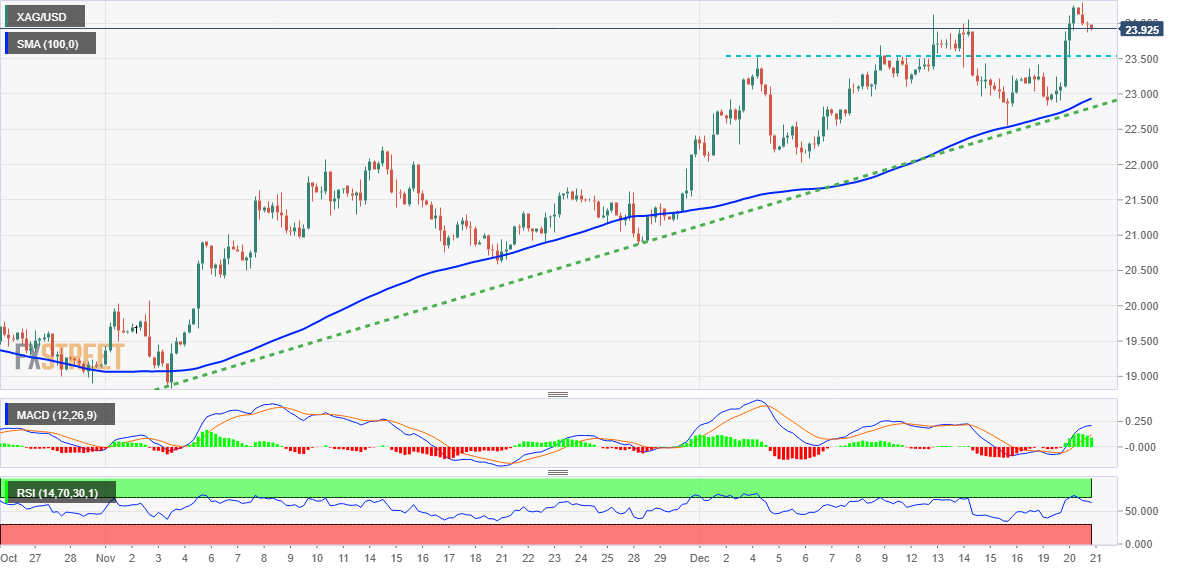

The bias, however, remains tilted in favour of bullish traders and supports prospects for the emergence of some dip-buying around the XAG/USD. The positive outlook is reinforced by bullish oscillators on 4-hour/daily charts, which are still far from being in the overbought territory. Hence, any subsequent fall is more likely to find decent support near the $23.60-$23.50 strong horizontal resistance breakpoint.

That said, some follow-through selling will expose confluence support near the $23.00-$22.90 region, comprising the 100-period SMA on the 4-hour chart and an ascending trend-line extending from November low. A convincing break below the latter will negate the near-term positive outlook and shift the bias in favour of bearish traders. The XAG/USD might then slide towards testing the $22.00 round figure.

On the flip side, the monthly month peak, around the $24.30 region, now seems to act as an immediate barrier. A sustained strength beyond should pave the way for additional near-term gains and allow the XAG/USD to reclaim the $25.00 psychological mark, with some intermediate hurdle near the $24.60-$24.70 zone.

Silver 4-hour chart

Key levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.