Silver Price Analysis: XAG/USD climbs more than 0.50%, eyes $30.00

- Silver trades and gains 0.60% after touching a daily low of $29.35.

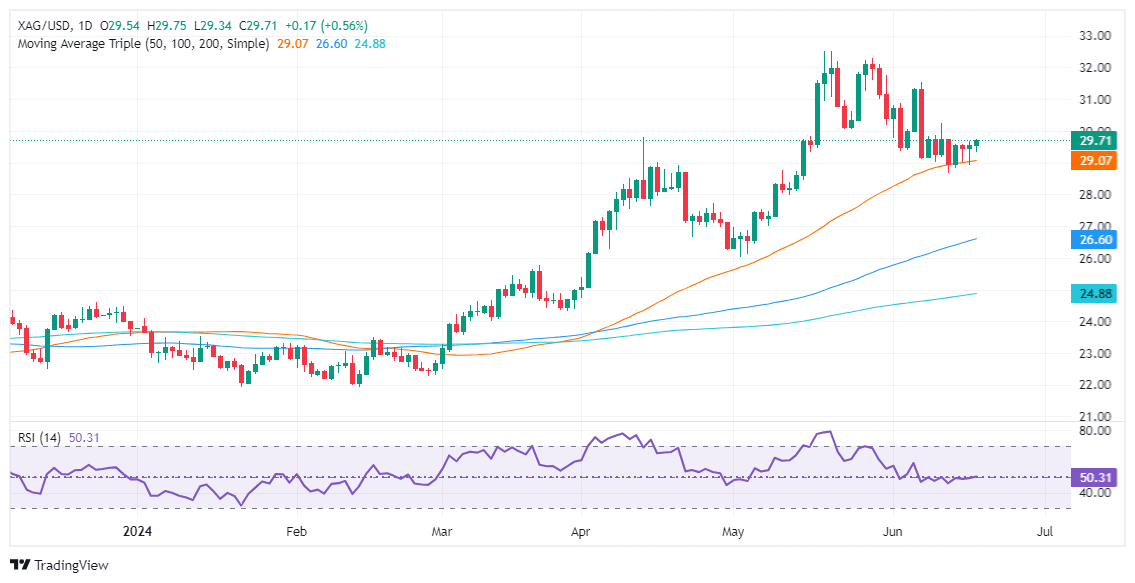

- Momentum is neutral, with RSI around the 50-neutral line, suggesting buyers and sellers are balanced.

- Key resistance at $30.25 and $31.54, with support levels at $29.05 and $28.66.

Silver climbed during the North American session, gaining more than 0.60% amid thin trading liquidity conditions. Wall Street remained closed in observance of the Juneteenth holiday. The XAG/USD trades at $29.71 after hitting a daily low of $29.35.

XAG/USD Price Analysis: Technical analysis

The grey metal remains neutral to upward bias, despite diving from year-to-date (YTD) highs reached at $32.51, below the $30.00 figure. Silver seems to have bottomed after hitting a monthly low of $28.66; since then, XAG/USD edged higher, and it’s shy of challenging the $30.00 mark.

Momentum shows that neither buyers nor sellers are in charge, as the Relative Strength Index (RSI) hovers around the 50-neutral line.

The most likely scenario would be a bullish continuation if XAG/USD buyers reclaim $30.00, which could reignite Silver’s rally and pave the way for further upside. The next resistance level would be the June 12 high at $30.25, followed by the month-to-date (MTD) high of $31.54, the June 7 peak. A breach of the latter will expose the YTD high of $32.51.

On the other hand, if XAG/USD sellers drag spot prices below the 50-day moving average (DMA) at $29.05, it will expose $29.00. Once cleared, that could expose the MTD low of $28.66, ahead of plunging toward the 100-DMA at $26.60.

XAG/USD Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.