Silver Price Analysis: XAG/USD battles short-term key resistances above $24.00

- Silver keeps recovery moves from intraday low of $24.09.

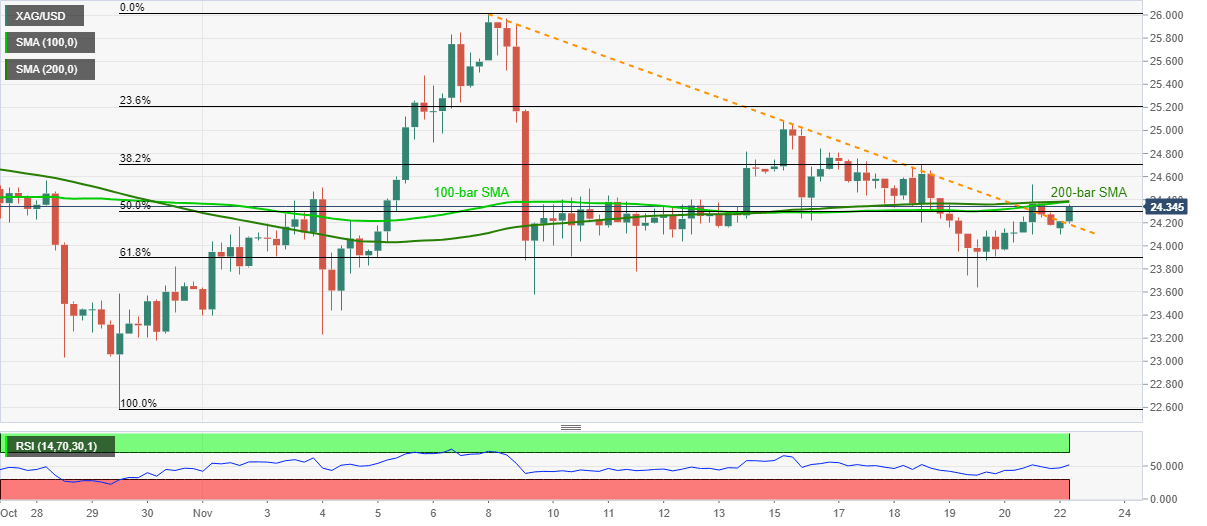

- A two-week-old resistance line, the confluence of 100 and 200-bar SMAs probe the bulls.

- Sellers can look for entries below 61.8% Fibonacci retracement.

Silver prices rise to $24.25, up 0.32% intraday, amid Monday’s Asian session. In doing so, the white metal battles around a downward sloping trend line from November 08 while targeting to cross a joint of 100-bar and 200-bar SMAs

Considering the commodity’s ability to stay past-61.8% Fibonacci retracement of October 29 to November 08 upside, coupled with the normal RSI conditions, as favoring the silver buyers.

However, a clear above the immediate SMA confluence near $24.40 becomes necessary for the silver bulls to probe the mid-month peak surrounding $25.10.

Meanwhile, a downside break of the previous resistance line, at $24.18 now, can drag the quote back to the 61.8% Fibonacci retracement level of $23.89 whereas the $23.60 and $23.30 can entertain silver sellers afterward.

In a case where the bullion remains weak past-$23.30, the 23.00 round-figure and the monthly low near $22.60 should return to the charts.

Silver four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.