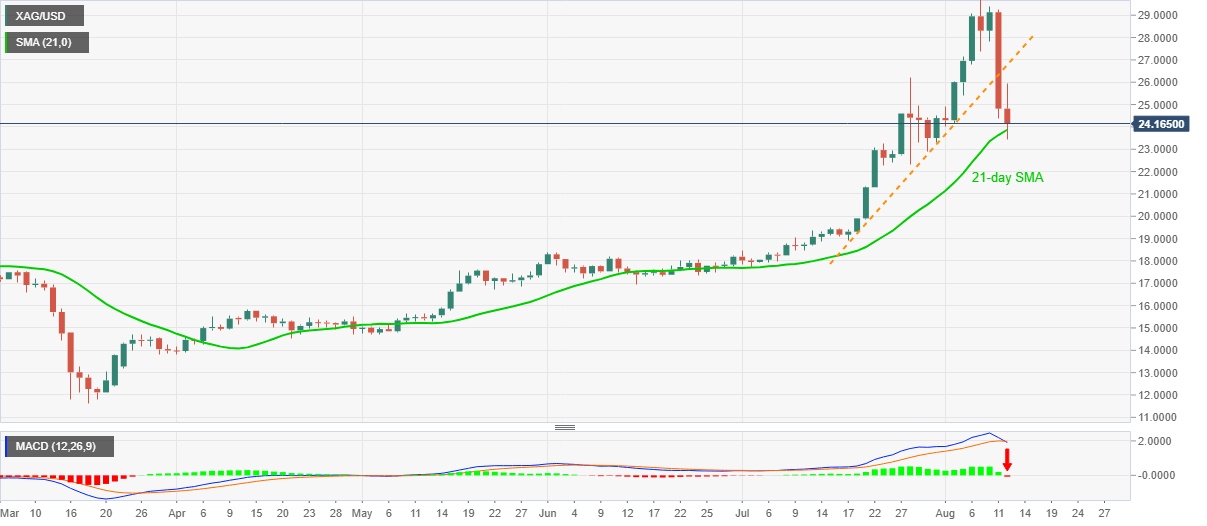

Silver Price Analysis: XAG/USD adds 3.0% to Tuesday’s losses as MACD turns bearish

- Silver prices attempt recovery from $23.43 after breaking one-month-old rising trend line.

- MACD turns bearish for the first time in six weeks.

- 21-day SMA offers immediate support ahead of $23.00.

Silver prices stay pressured despite bouncing off $23.43 to $24.10, down 3.0% on a day, during the pre-European session on Wednesday. The metal broke an ascending trend line from July 17 the previous day whereas its intraday low of $23.43 becomes the monthly bottom.

That said, MACD turns bearish for the first time since the early-July while a sustained break of near-term key support line, now resistance, keeps the bears hopeful.

However, a daily closing below 21-day SMA level of $23.86 becomes necessary for the sellers to target $23.00 and July 28 low near $22.30.

In a case where the metal keeps declining below $22.30, July 2016 top near $21.15 can offer an intermediate halt before highlighting $20.00 psychological benchmark.

On the contrary, fresh buying is less likely to happen unless the quote recovers beyond the support-turned-resistance line, at $26.70 now.

Silver daily chart

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.