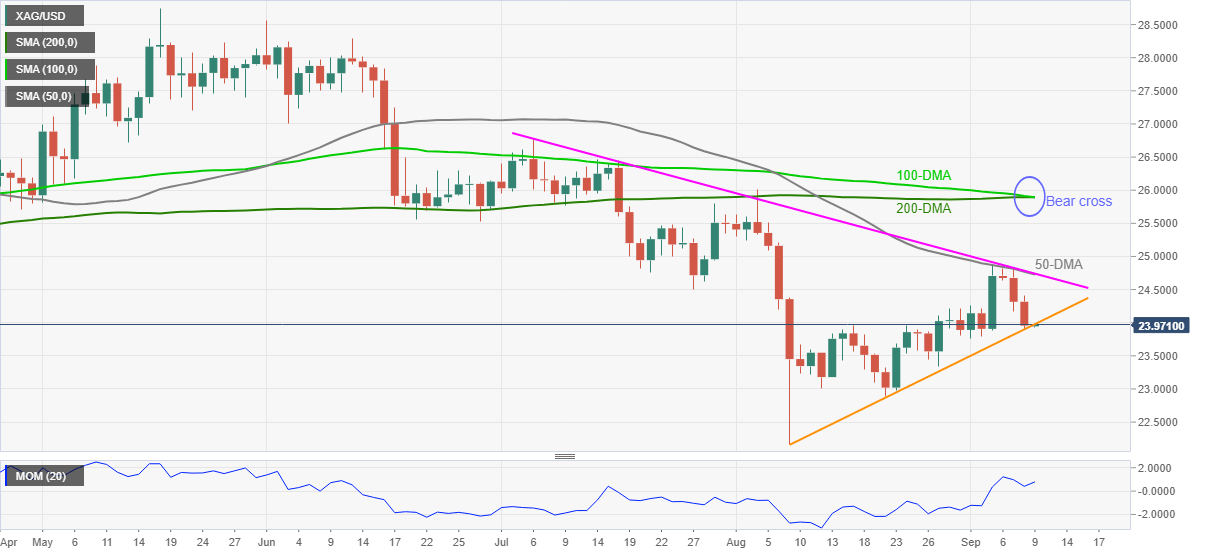

Silver Price Analysis: Impending bear cross highlights XAG/USD support near $24.00

- Silver pauses around one-week low after three-day downtrend.

- Firmer Momentum line backs recent weakness as the key DMA brace for bearish signal.

- Late August low can offer an intermediate halt during the fall to yearly low.

- 50-DMA, two-month-old trend line acts as strong nearby resistance.

Silver (XAG/USD) bears take a breather around $24.00 after a three-day fall during Thursday’s Asian session. In doing so, the bright metal seesaws around an upward sloping trend line from early August.

It’s worth noting that the 100-DMA is posing for a downside break below the 200-DMA and back the commodity sellers with a bearish cross.

Also keeping the case interesting is the metal’s pullback moves from a convergence of 50-DMA and a two-month-long resistance line that gains support from a firmer Momentum line.

Hence, bears are at a critical juncture and need to conquer the $24.00 support to confirm the bearish trajectory towards the yearly low near $22.15. However, August 20 low near $22.90 can offer an intermediate halt during the slump.

Meanwhile, corrective pullback remains less important until staying below the $24.75 comprising 50-DMA and a descending trend line from early July.

Even so, the $25.00 and a confluence of the 200 and 100-DMA near $25.90 will be tough nuts to crack for the XAG/USD bulls.

Silver: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.