Silver Price Analysis: Bullish bias threatened as XAG/USD bears prod $23.00 support

- Silver price remains pressured for the second consecutive day, pressured intraday low of late.

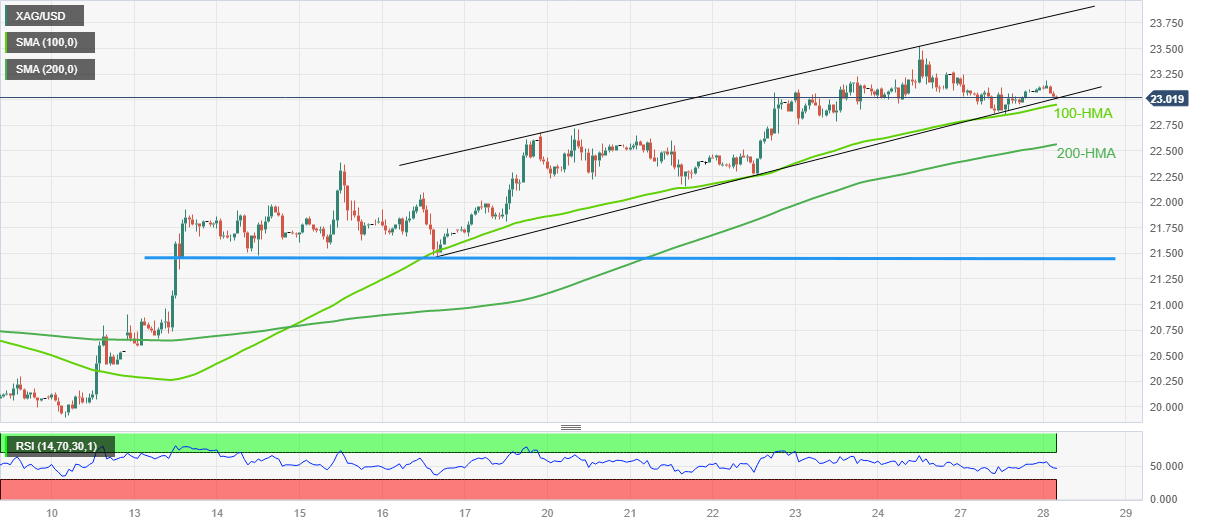

- Eight-day-old bullish channel, 100-HMA challenge XAG/USD bears amid steady RSI.

- 200-SMA adds to the downside filters; two-week-old horizontal support is the key.

Silver price (XAG/USD) takes offers to renew intraday low around $23.00 as bear prod short-term key support heading into Tuesday’s European session. In doing so, the bright metal pokes the lower line of an upward-sloping trend channel from March 16.

It’s worth noting, however, that the steady RSI (14) line joins the 100-Hour Moving Average (HMA) to restrict the short-term Silver price downside.

Should the quote breaks the $23.00 support, also remain comfortably below the 100-HMA support surrounding $22.95, then the XAG/USD bears could challenge the last defense of the buyers, namely the 200-HMA level of $22.55.

In a case where the Silver price remains bearish past $22.55, a fortnight-long horizontal support area near $21.50 will gain the market’s attention.

On the flip side, recovery moves need validation from $23.30 to challenge the monthly high of $23.52.

Following that, the top line of an aforementioned bullish channel, close to $23.85, could restrict the bright metal’s further advances. It should be observed that the Silver price run-up beyond $23.85 enables the bulls to challenge the YTD tops marked in February at around $24.65.

To sum up, the Silver price is likely to decline further even if the road toward the south appears long and bumpy.

Silver price: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.