Silver Price Analysis: Bears go head to head with bulls near trend line resistance

- Silver is meeting key support on the daily chart.

- Beazrs need a break of structure while bulls need to get above trendline resistance.

The price of Silver has run into a key area of daily support that leaves the bias bullish for the near term. The following illustrates this along with the market structure and various scenarios for the foreseeable future.,

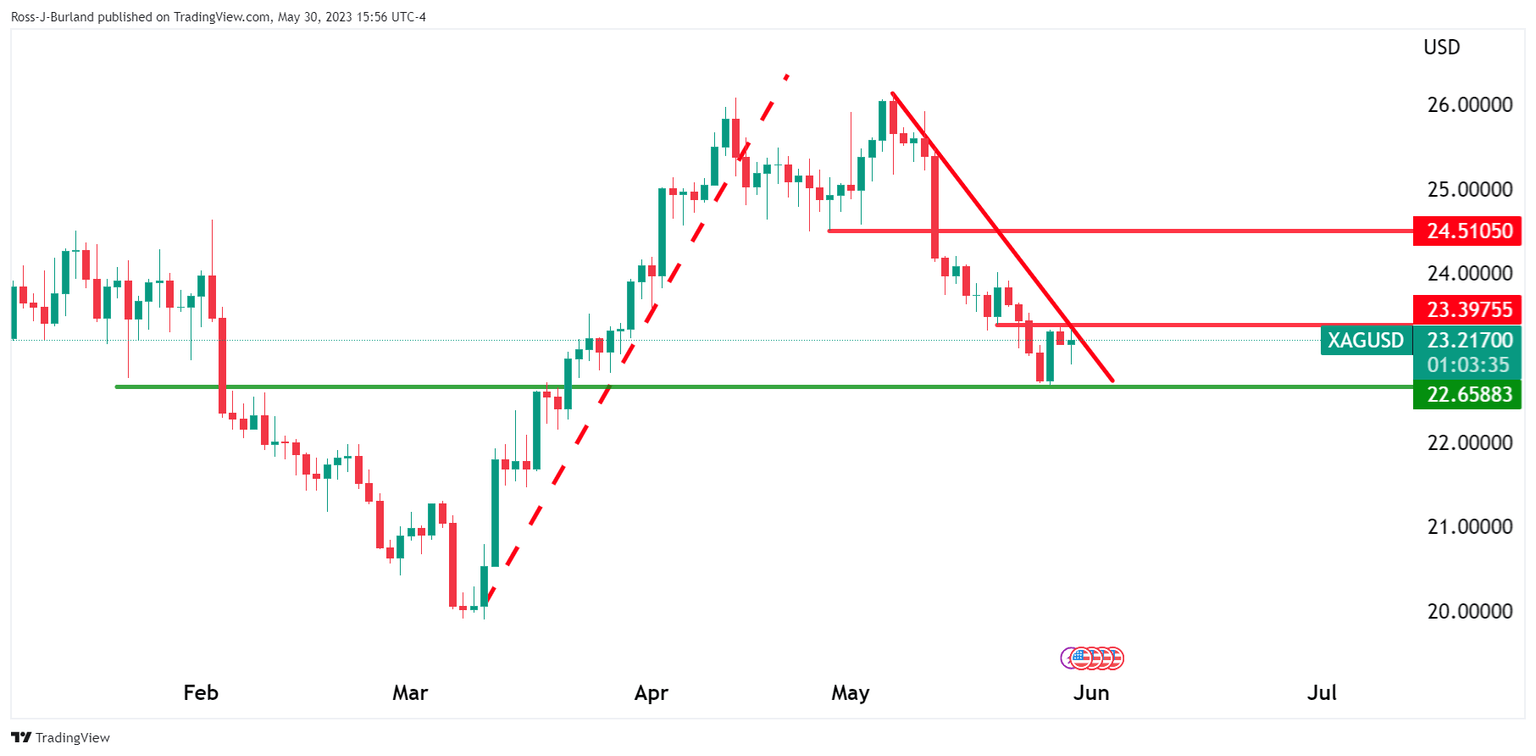

XAG/USD daily charts

Silver is on the front side of the bearish trend but the price has run into a potential demand area that could see the bears throwing in the towel.

The above scenario, however, shows a bearish bias with the trendline resistance playing its role in the sell-off below the market structure.

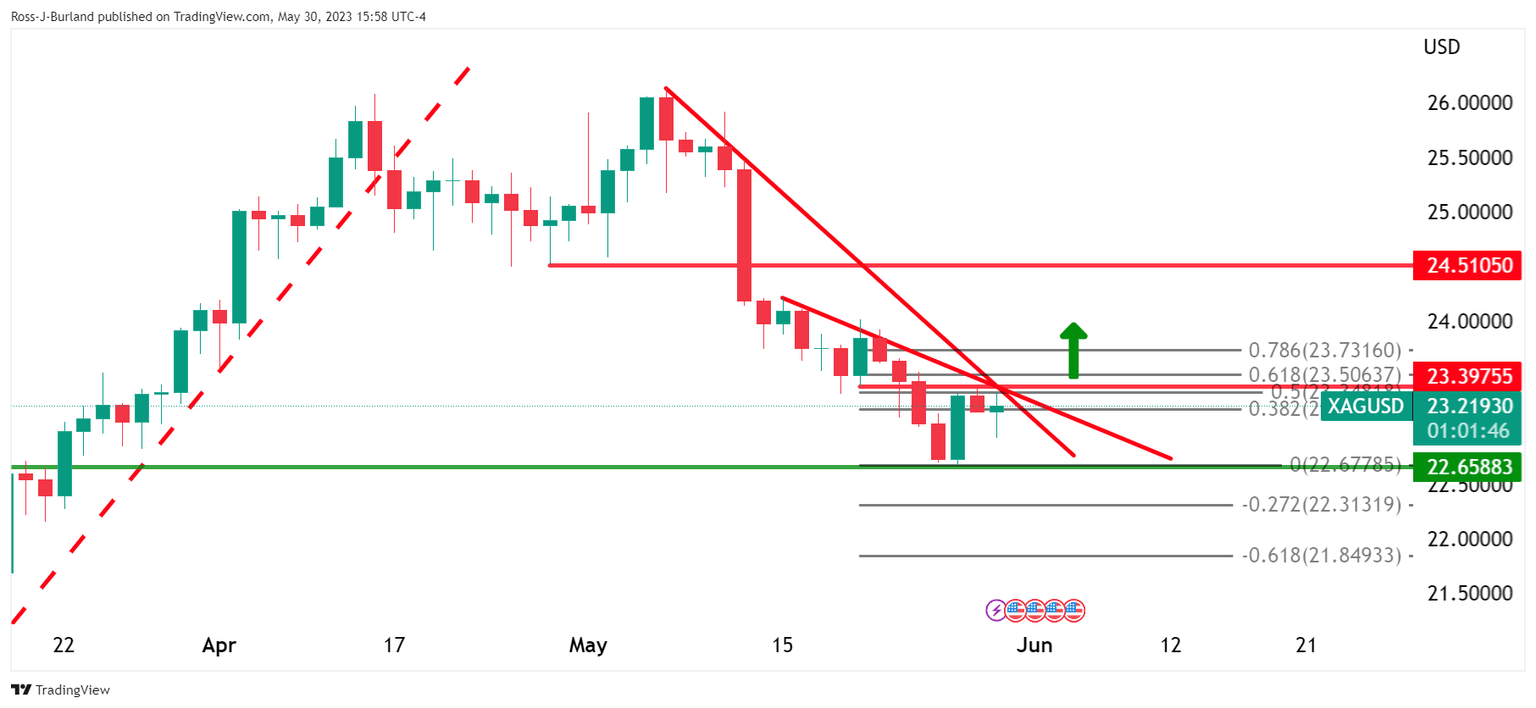

On the other hand, the market has rallied hard into the bearish impulse and is taking out the 50% mean reversion level. A break of the trendline resistance leaves the bullish bias intact. However, that is not to say that the bears will not attempt to sell at a premium which could see the price restest recent lows as its forms structure in a stage of accumulation.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.