Silver extending its search for $24 ahead of Wednesday Fed rate call

- XAG/USD going higher as the metal turns bullish from the floor near $$22.40.

- Precious metals, commodities recovering ahead of Fed rate call.

- The Federal Reserve is set to stand pat on rate hikes, bolstering risk assets.

The price of Silver has recovered from the recent backslide into the $22.30 region, reclaiming $23.20 in Monday trading. Commodities are broadly turning higher ahead of the Federal Reserve (Fed) rate call on Wednesday, where the Federal Open Market Committee (FOMC) is expected to hold rates at 5.5%.

Silver's bullish turnaround to get support from a Fed holding pattern

The Fed’s recent rate hike cycle has left Silver to tumble to the floor as the United States (US) central bank lifts rates to combat an intense inflationary environment. As interest rates and the US Dollar (USD) have soared, the XAG/USD has struggled, slumping from recent highs of $26.00 set earlier in the year.

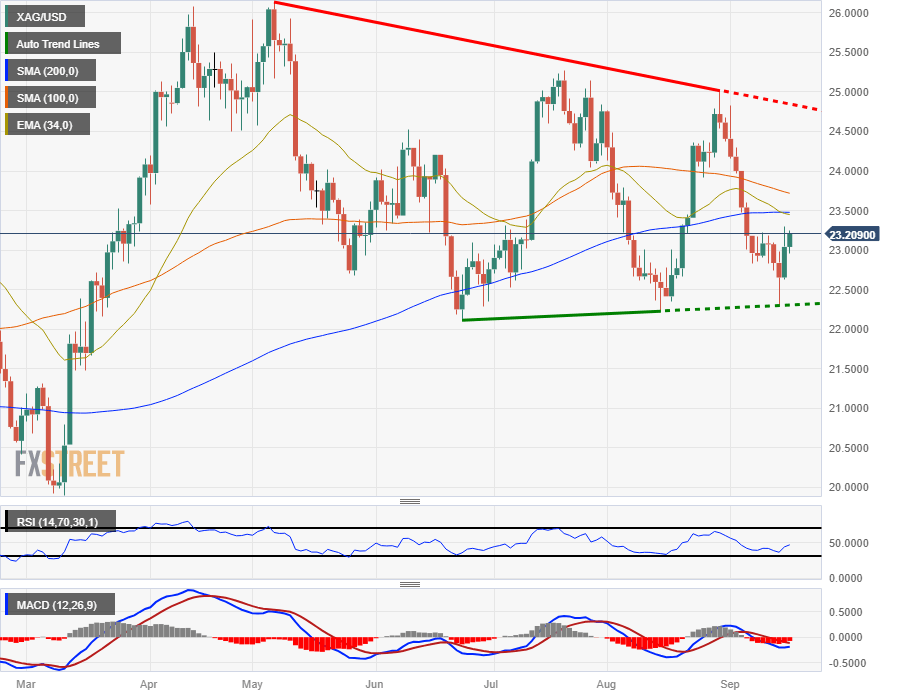

Silver has steadily rebounded against the USD from $22.50 in recent months, but lower highs continue to push the precious metal, and XAG bulls will be looking to snap the losing streak by breaking out of the descending trendline marked in by the last swing high at the $25.00 major handle.

XAG/USD technical outlook

Silver has turned bullish and is looking to claim further ground, with the Relative Strength Index (RSI) and Moving Average Convergence-Divergence (MACD) indicators both flashing upside momentum and showing some room for prices to run.

Any nasty surprises from the economic calendar this week could see the XAG/USD stumble, but overall market momentum is leaning firmly bullish with Silver set to make a hard run at the 200-day Simple Moving Average (SMA) currently treading water near $23.50.

Renewed selling pressure from here will see prices set to challenge recent lows near $22.30, while extended bidding will see the XAG/USD set to battle the descending trendline marked in from May’s peak of $26.00.

XAG/USD daily chart

XAG/USD technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.