Signs of 2024 SPY topping out

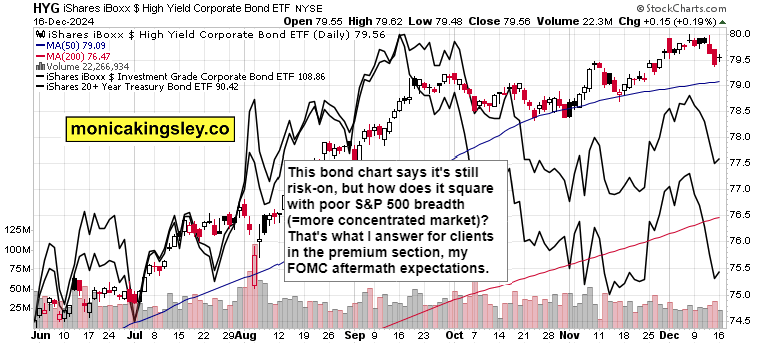

S&P 500 shook off weak Empire State manufacturing, and correctly focused on surging services PMI instead of marginally down manufacturing PMI. But then, the bond market and the dollar made a correct move that I hinted at in the weekend precious metals video while breadth and concentration question marks over SP& 500 remained – nevermind, the setup was good for a fine intraday bullish ride centering on Nasdaq, the strongest index of the three of course.

Premarket, S&P 500 bulls gave up all the gains, so how can the three leading sectors – XLC and XLY being the other two as discussed in depth in yesterday‘s video – keep the S&P 500 up in the run up to (and aftermath of?) FOMC tomorrow…

Have a look at these charts for clues, way more commentary follows in the premium section for clients. I‘ll of course prepare another timely video ahead of FOMC – so do join my lively Youtube channel with notifications turned on – thanks for liking and commenting, it helps greatly!

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.