Run into key earnings

S&P 500 consolidated post-CPI push, and continued higher – what a week for clients after Wednesday‘s flush and less than optimal market breadth that I knew better not to rely on (this time). Tech had been doing great, and names such as LRCX and SMCI, even AMD on company chip usage news, did great – check also IBM, DELL.

And I like it when tech does great – sectorally, some defensive bias is there as neither communications nor discretionaries are pulling up much on a weekly basis (the former after a long great run consolidating, the latter somewhat stalling). Not everything with the consumer is picture perfect, but a week ago, the main worry became regional banks, and how soothing information we got there since. Healthcare among the defensives deserves more attention than real estate, still true – and I wrote weeks ago about MAHA not hurting Big Pharma all that much.

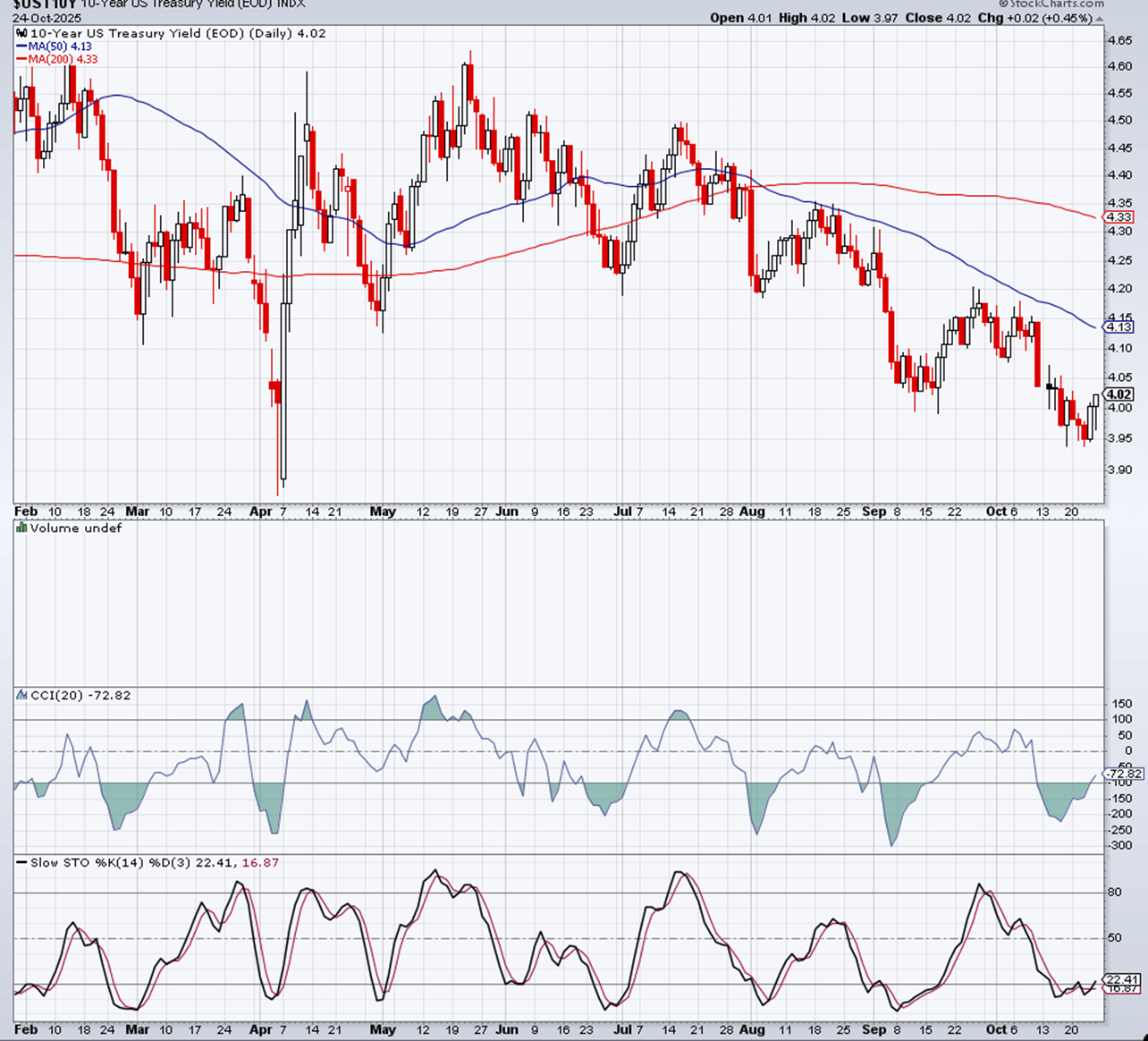

The tame CPI effect gave way to reasonably fine manufacturing and services PMI, hence we saw the below move in yields (ticking higher).

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.