Rivian Automotive Inc (RIVN) Stock News and Forecast: Rivian forms a triangle pattern

- Rivian (RIVN) stock rises over 4% on Thursday.

- Rivian (RIVN) closed at $103.42 just retaking the short-term moving average.

- Rivian (RIVN) is still under pressure as earnings and delivery delays weigh on sentiment.

Rivian (RIVN) shares did catch a bounce on Thursday, perhaps some contra flow from the Tesla recall story. However, Rivian is far from out of the woods in terms of bearish sentiment and the stock is still struggling for momentum. $100 is just about holding for now but a break below could spell trouble and signal a move to the IPO level of $78.

Rivian (RIVN) stock news

Yesterday saw news break of a large Tesla recall due to issues over the rear cameras. Reuters reports the total recall is 475,000 which is nearly last year's total delivery number. Rivian may have benefitted indirectly from this despite Rivian not delivering large numbers of vehicles yet. Lucid Group (LCID) also rose on Thursday giving the Tesla alternative argument some credence. Both Rivian and Lucid are obvious Tesla competitors so any problems for Tesla could be taken as an indirect positive for other electric vehicle manufacturers. Gores Guggenheim (GGPI) a SPAC taking EV maker Polestar public also rose yesterday. Polestar is seen as a serious Tesla competitor and is backed by Volvo.

Rivian (RIVN) stock forecast

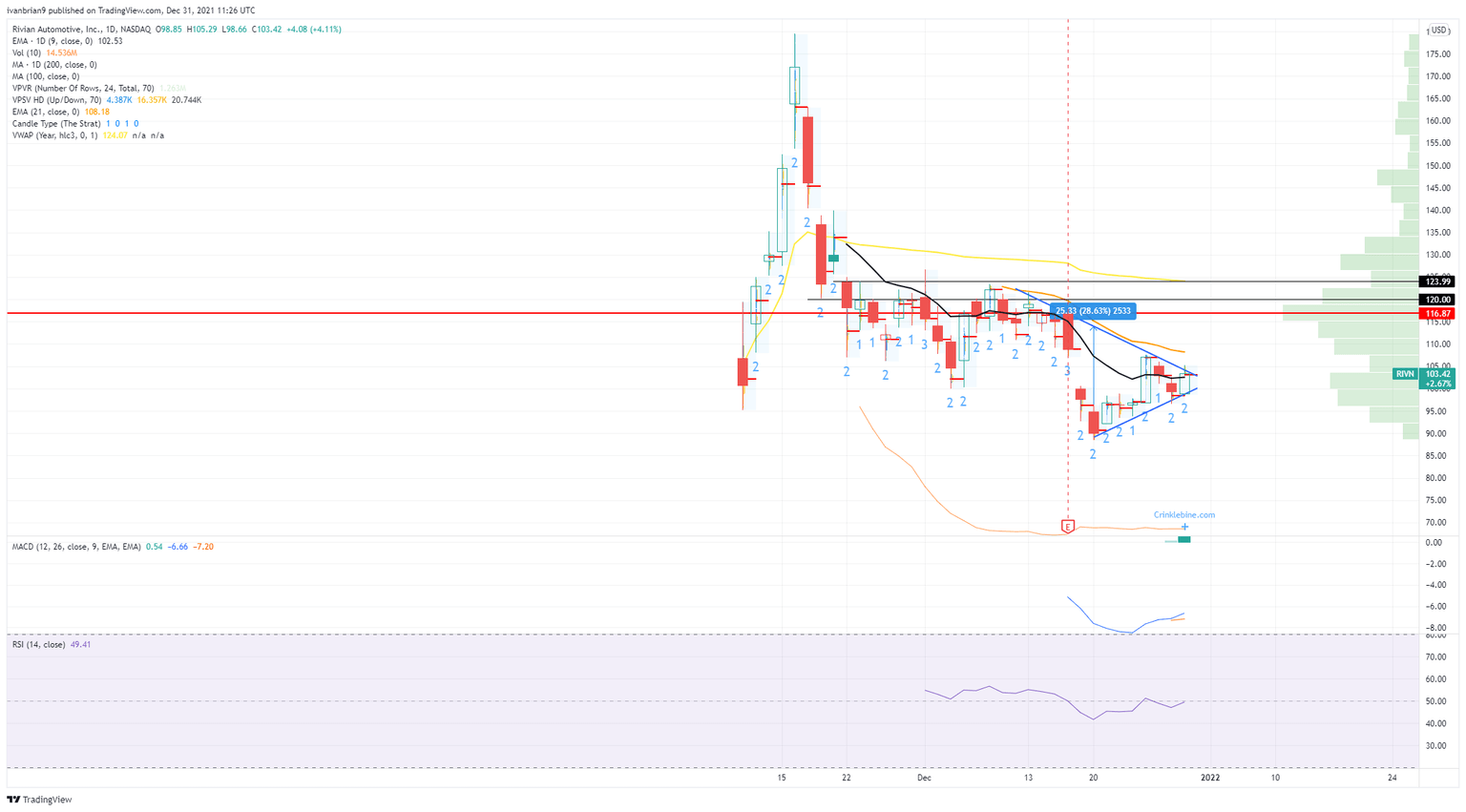

We notice the development of a triangle pattern in Rivian shares. For the most part triangle patterns are continuation patterns. Especially this type which is symmetrical, ie both top and bottom lines are sloped equally. This would see Rivian break out to the downside to continue the slide from the post IPO high of $179.47. The target is the size of the entry width of the triangle. In this case just over $25 giving Rivian a downside target of $75. This sits neatly with the IPO target of $78. Breaking the high of $107 from Dec 27 would end this theory in our view and see $117 then tested.

Rivian (RIVN) chart, daily

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.