Rising Natural Gas consumption in the US: A new record with multiple implications

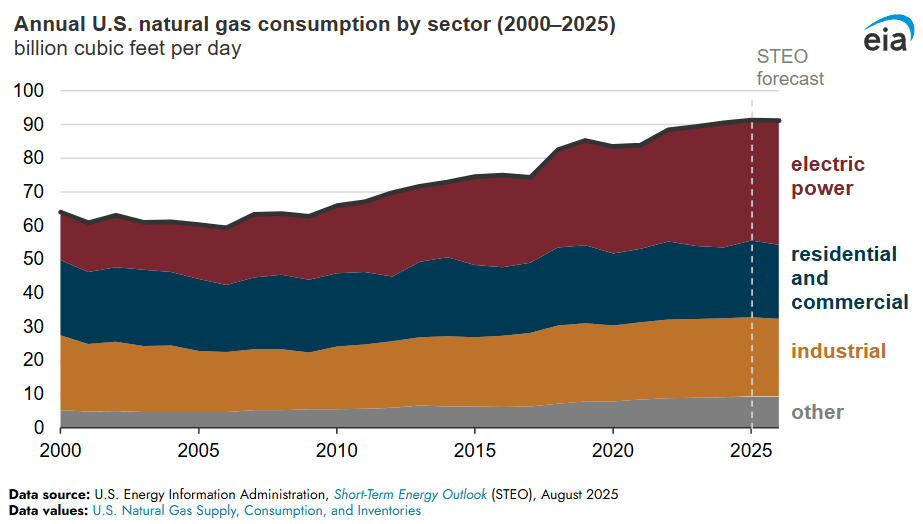

Natural Gas consumption in the United States (US) will reach a new peak in 2025, according to the latest forecasts from the US Energy Information Administration (EIA). Behind this increase lies a complex dynamic that illustrates both the structural dependence of the US economy on Natural Gas and the resulting tensions on energy markets.

An icy winter boosts demand

Natural Gas demand is set to rise by 1% to 91.4 billion cubic feet per day (Bcf/d) in 2025, according to the EIA.

Most of the increase was due to an exceptional start to the year. In January 2025, Gas consumption reached a record 126.8 Bcf/d, 5% higher than the previous record set a year earlier. February followed the same trend, with 115.9 Bcf/d consumed.

These levels are largely explained by a particularly harsh winter marked by a polar vortex. Remember that around 45% of American households use Gas as their main source of heating. A factor that makes demand highly sensitive to weather conditions.

Changing sectors: Less electricity, more heating and industry

Unlike the previous decade, when the electricity sector drove demand, benefiting from the boom in Gas-fired power plants, 2025 marks a turning point.

The share of Gas in electricity production is declining, in favor of Coal and, above all, renewable energies (solar and wind).

On the other hand, consumption remains steady in the residential and commercial sectors, boosted by the harsh winter, and continues to grow in industry, which remains a structural driver of demand.

Natural Gas market under pressure

This rise in consumption comes against a backdrop of heightened volatility in world Gas markets.

US prices, which had surged by nearly 14% in the first quarter, subsequently corrected, reflecting the precarious balance between record production and cyclical demand.

Natural Gas daily chart. Source: TradingView

Gas inventories, meanwhile, are slightly below 2024 levels, according to the EIA report, keeping investors on their toes as winter approaches.

An impact beyond US borders

The United States' position as the world's leading exporter of Liquefied Natural Gas (LNG) lends an international dimension to this rise in domestic consumption.

When US demand intensifies, the availability of cargoes for Europe and Asia can be reduced, fuelling global price volatility.

The winter of 2024-2025 illustrated this phenomenon, with increased competition between Asian and European buyers to secure deliveries.

What's next?

According to the EIA, US Natural Gas consumption is set to decline slightly in 2026, under the expected impact of milder winters and the continued rise of renewable energies.

But the underlying trend remains clear: Gas continues to play a central role in the US energy mix, for heating, industry and exports.

Ultimately, the increase in Natural Gas consumption in the United States underlines a dual reality: the resilience of this energy in the face of the energy transition and its ability to remain a pillar of the global economy, while exposing markets to volatility that is unlikely to abate anytime soon.

Author

Ghiles Guezout

FXStreet

Ghiles Guezout is a Market Analyst with a strong background in stock market investments, trading, and cryptocurrencies. He combines fundamental and technical analysis skills to identify market opportunities.