Riot Platforms, Inc. (RIOT) Elliott Wave technical analysis [Video]

![Riot Platforms, Inc. (RIOT) Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/supermicro-02_XtraLarge.jpg)

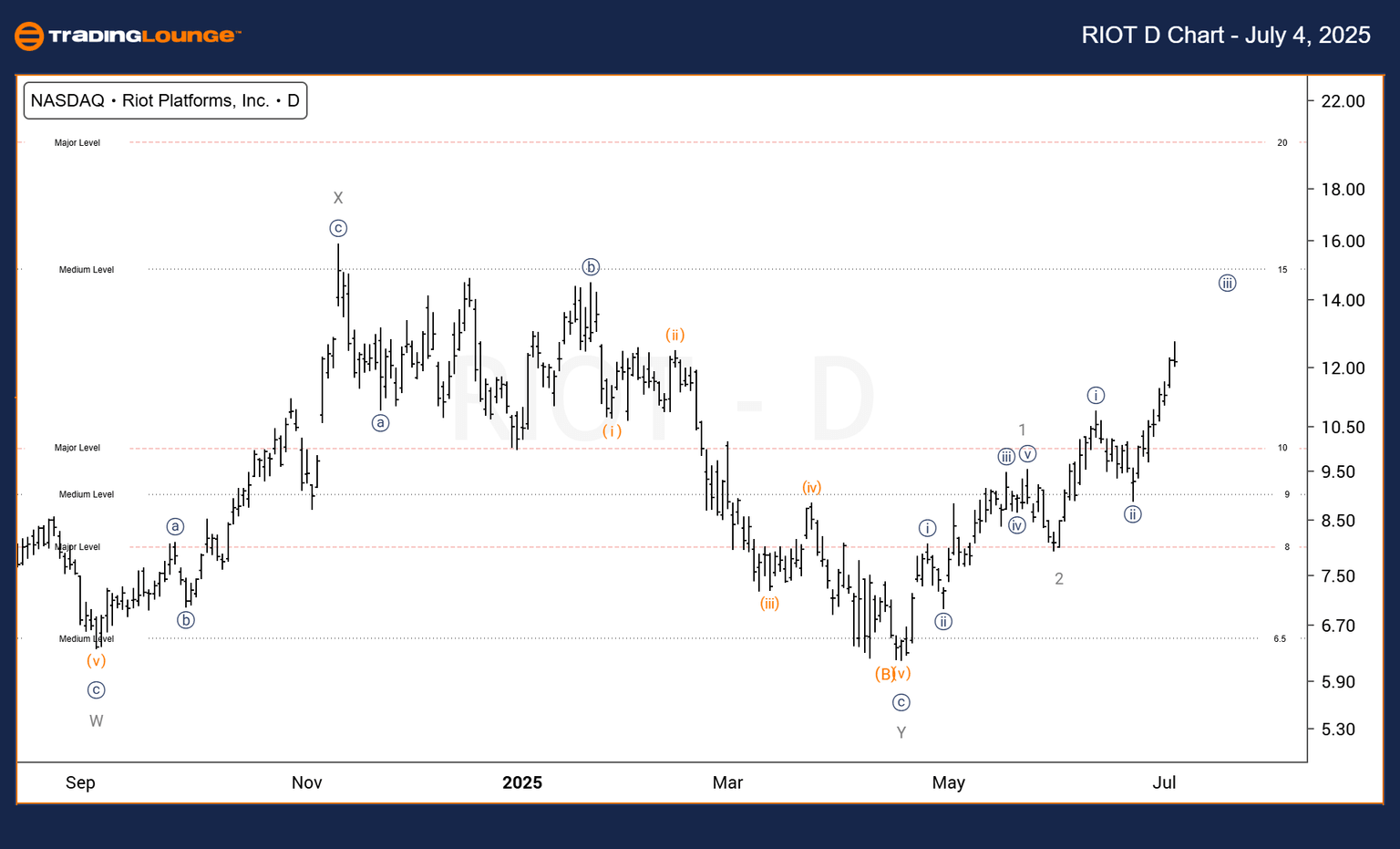

Riot Platforms, Inc. (RIOT) – Elliott Wave analysis – Daily chart

Technical analysis overview – Trading lounge

-

Function: Trend.

-

Mode: Impulsive.

-

Structure: Impulsive.

-

Position: Wave {iii} of 3.

-

Direction: Upward movement toward Wave {iii}.

-

Details: Expecting a strong rally as Wave {iii} of 3 advances.

On the daily chart, Riot Platforms, Inc. (RIOT) is maintaining an upward trajectory, advancing in Wave {iii} of the third wave. A sharp rally is anticipated, potentially breaching prior resistance levels. Given that Wave {iii} is often the most extended in an impulsive sequence, a target near 161.8% of Wave {i} is likely. This setup presents a favorable short-term bullish opportunity within the current trend structure.

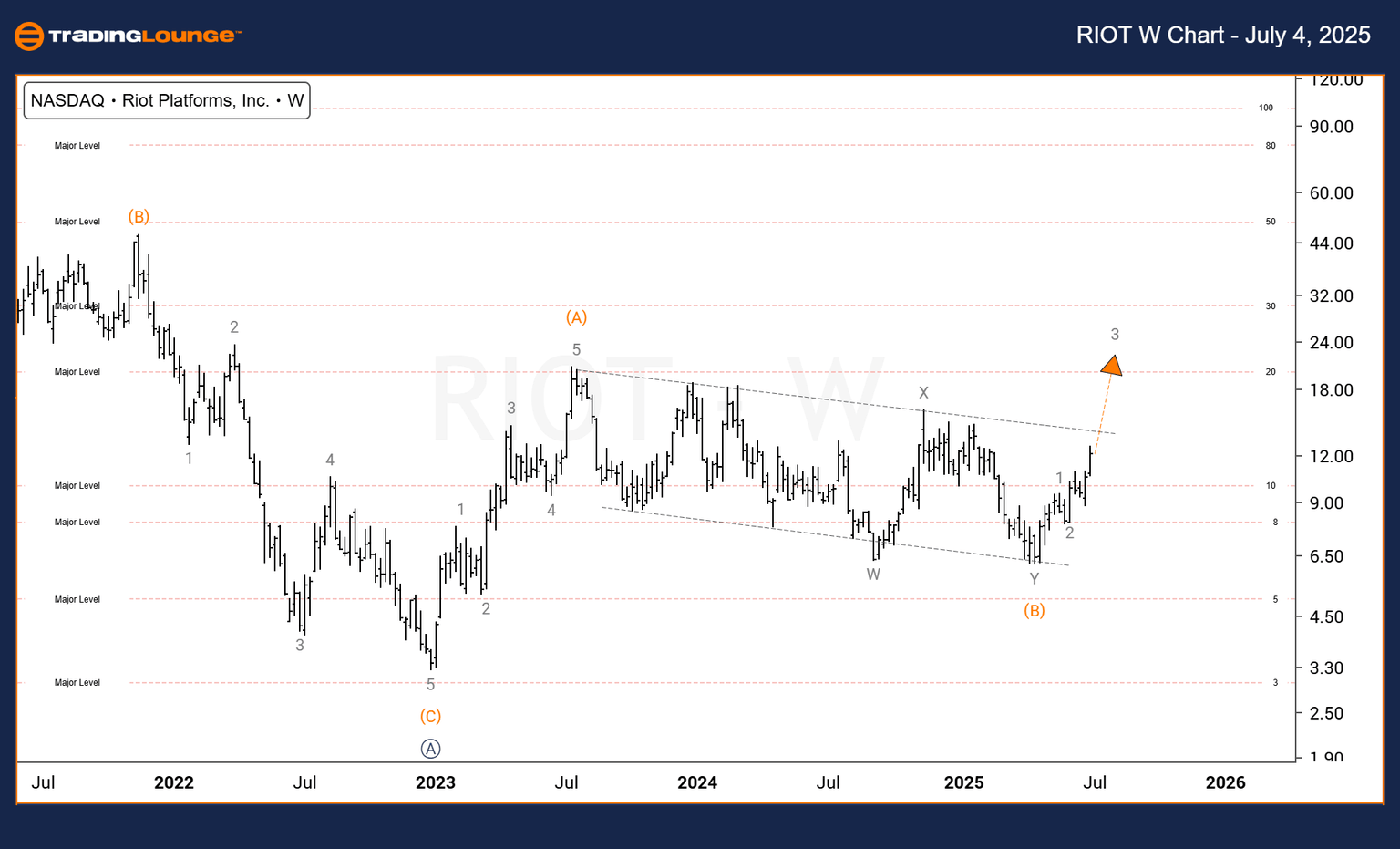

Riot Platforms, Inc. (RIOT) – Elliott Wave analysis – Weekly chart

-

Function: Trend.

-

Mode: Corrective.

-

Structure: Impulsive.

-

Position: Wave 3 of (C).

-

Direction: Upward move toward Wave 3.

-

Details: Following a breakout from the parallel channel, the stock targets Wave 3 of (C).

On the weekly timeframe, Riot Platforms, Inc. (RIOT) is developing within a broader corrective pattern. The current move is progressing toward Wave 3 of (C). After breaking above the parallel channel, the price has reached the 100% projection of Wave (A), a significant resistance area. This level may trigger a temporary top or consolidation. While the larger trend remains upward, traders should monitor key resistance zones for possible pullbacks before the next impulsive move.

Riot Platforms, Inc. (RIOT) Elliott Wave technical analysis [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.