Pullback coming? This axis line could be the launching pad [Video]

![Pullback coming? This axis line could be the launching pad [Video]](https://editorial.fxsstatic.com/images/i/supermicro-01_XtraLarge.jpg)

Watch the video from the WLGC session on 6 May 2025 to find out the following:

-

The 2 key levels to watch for pullbacks.

-

The bullish scenario and the key level that's likely to attract the buyers.

-

The long-term and short-term outlook for the S&P 500 (Don't stay overly bullish).

-

The 3rd price target for the S&P 500 that could attract the short-sellers.

-

And a lot more…

Market environment

The bullish vs. bearish setup is 491 to 64 from the screenshot of my stock screener below.

Three stocks ready to soar

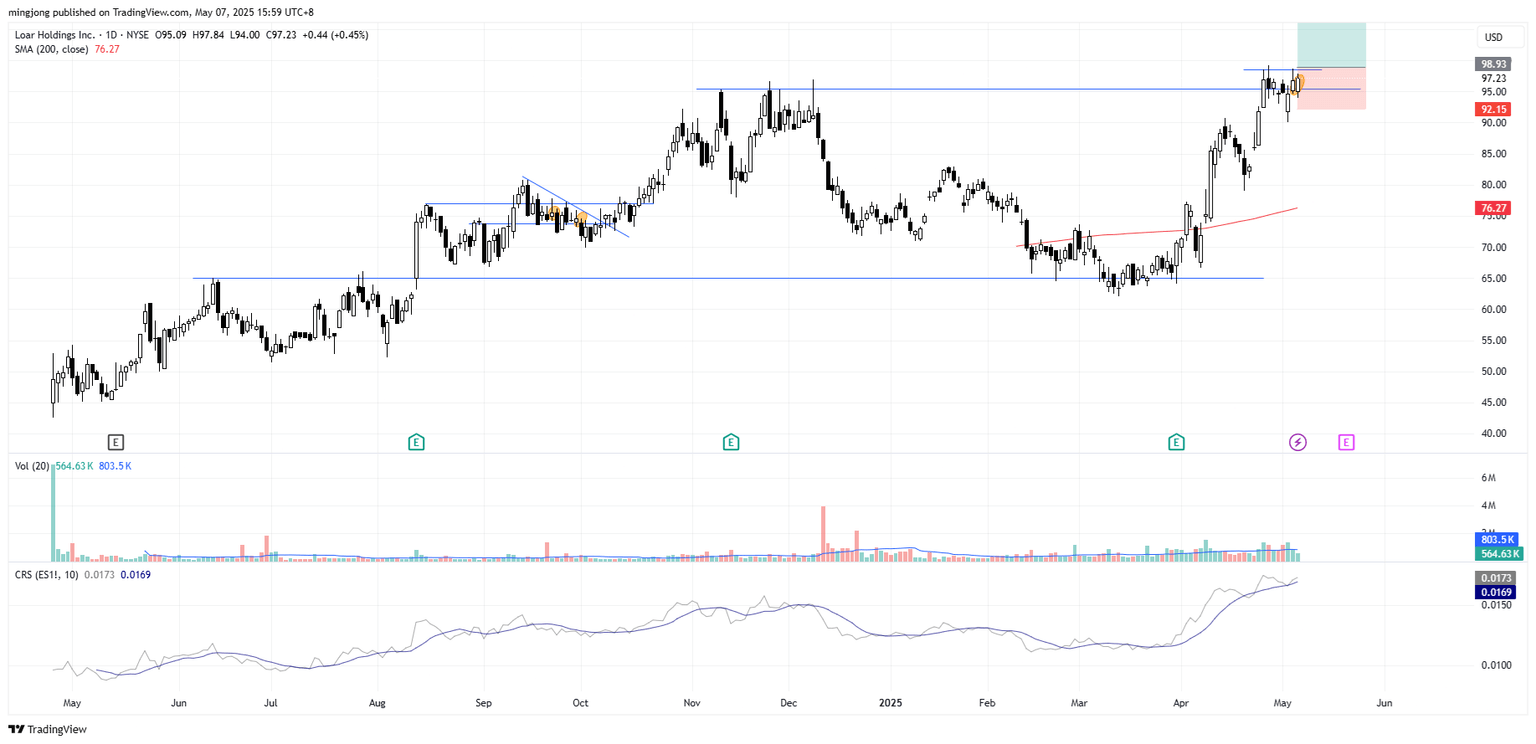

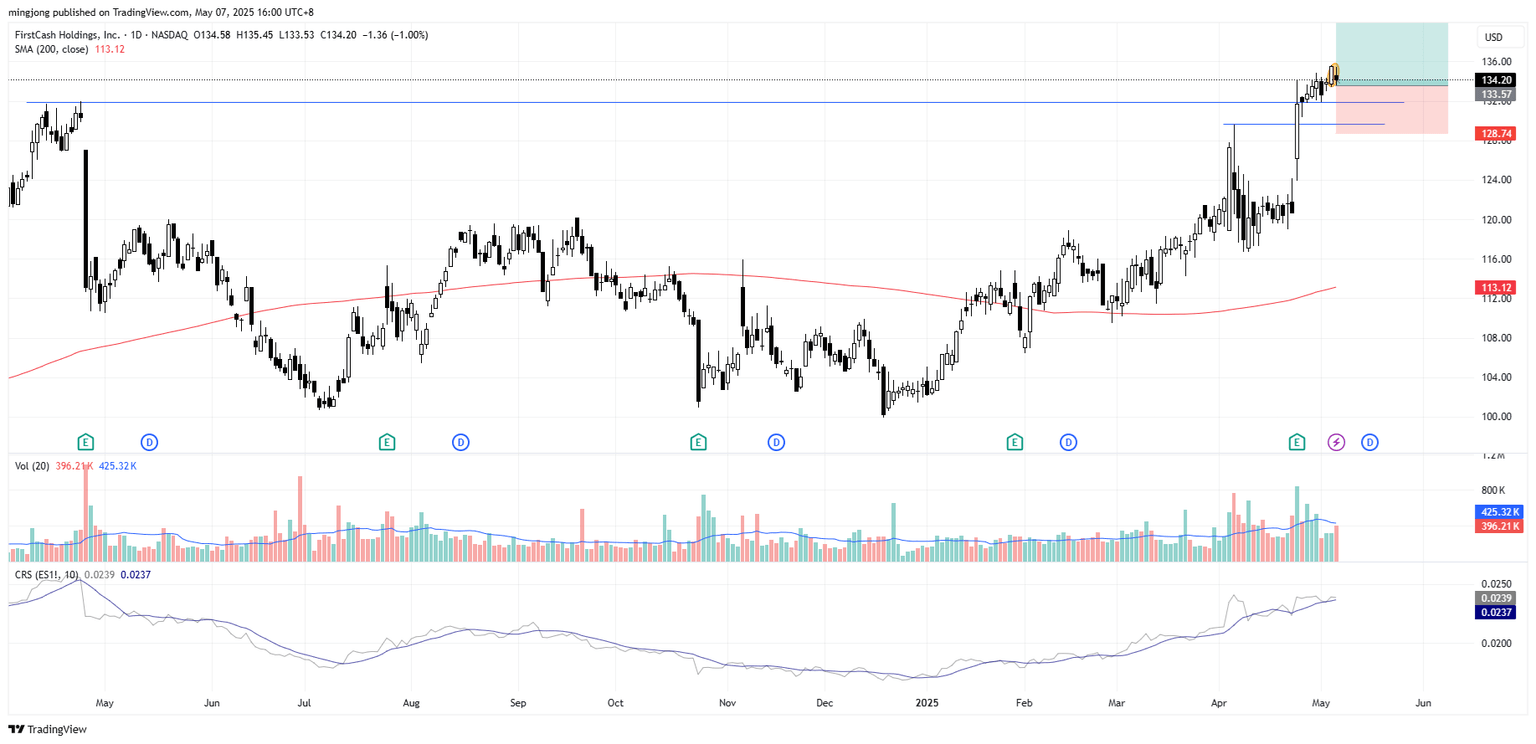

20 actionable setups such as TTAN, LOAR, FCFS were discussed during the live session before the market open (BMO).

ServiceTitan (TTAN)

Loar Holdings (LOAR)

FirstCash Holdings

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.