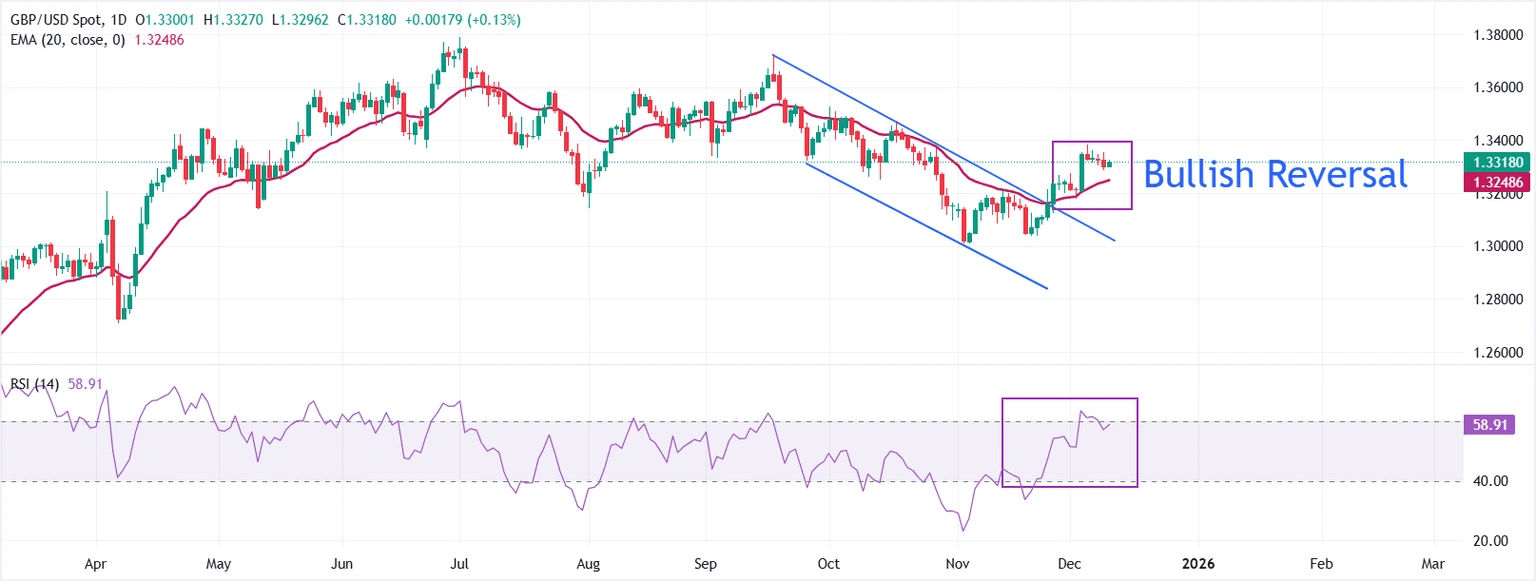

Pound Sterling Price News: GBP/USD firms as dovish repricing for Fed and BoE boosts upside momentum

GBP/USD firms as dovish repricing for Fed and BoE boosts upside momentum

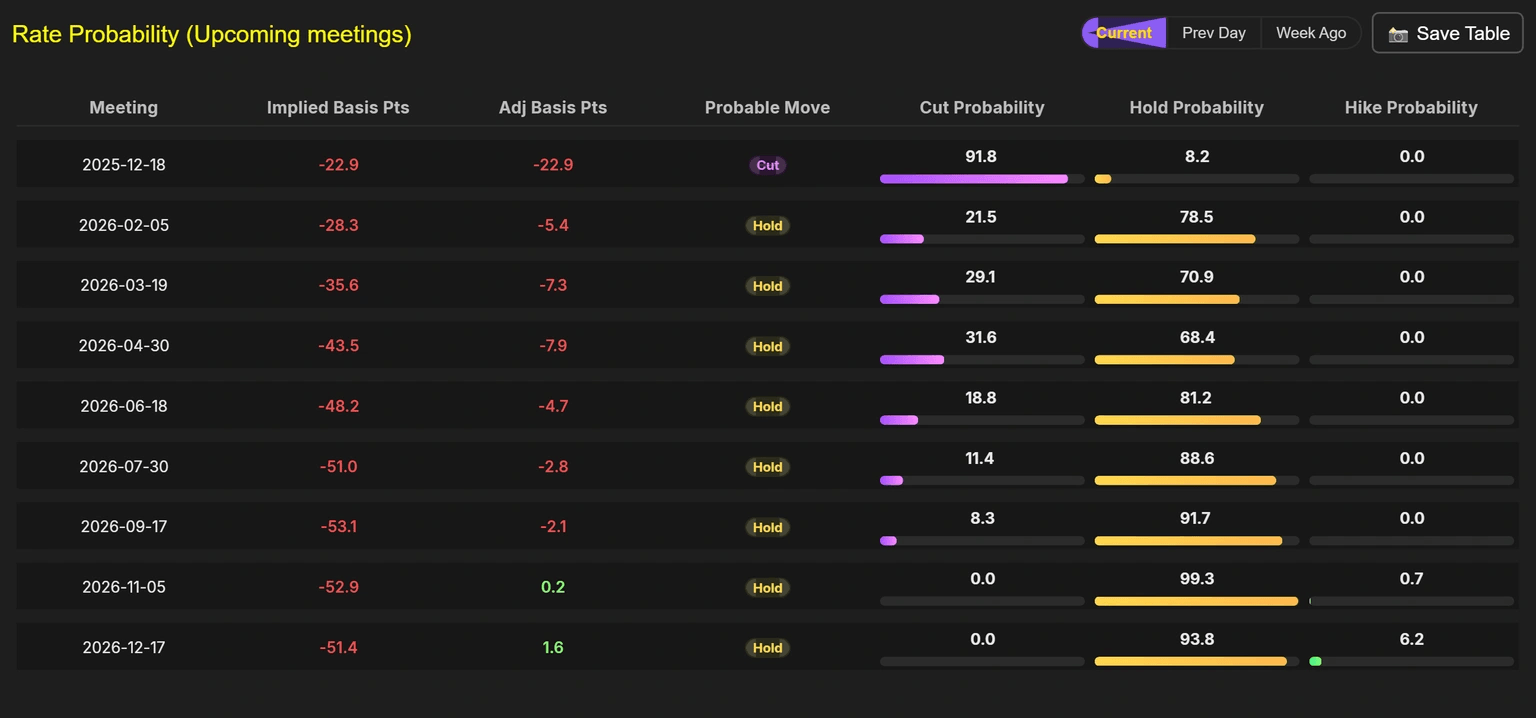

The Pound Sterling (GBP) advances during the North American session on Wednesday as the US Dollar (USD) weakens on the expectation that the Federal Reserve (Fed) will cut rates later in the day. At the time of writing, GBP/USD trades at 1.3336 after bouncing off daily lows of 1.3296. Read More...

Pound Sterling rises against US Dollar, Fed rate cut anticipated

The Pound Sterling (GBP) trades 0.16% higher to near 1.3320 against the US Dollar (USD) during the European trading session on Wednesday. The GBP/USD pair gains as the US Dollar drops slightly amid caution ahead of the Federal Reserve’s (Fed) monetary policy announcement at 19:00 GMT. Read More...

GBP/USD holds positive ground above 1.3300, eyes on Fed rate decision

The GBP/USD pair trades on a firmer note around 1.3305 during the early European session on Wednesday. The Greenback edges lower against the Pound Sterling (GBP) as the US Federal Reserve (Fed) is widely expected to announce another interest rate cut on Wednesday. The UK monthly Gross Domestic Product (GDP) report will be published later on Friday. Read More...

Author

FXStreet Team

FXStreet