Pound Sterling recovers strongly as monthly US core PCE Inflation declines

The Pound Sterling (GBP) recovers intraday losses and jumps to 1.2750 in Friday’s American session. The GBP/USD rises as monthly United States core Personal Consumption Expenditure

Price Index (PCE) data for April misses estimates. The underlying inflation grew at a slower pace of 0.2% from the estimates and the prior release of 0.3%.

Read More...

GBP/USD trades with mild gains above 1.2700, focus on US PCE data

The GBP/USD pair edges higher near 1.2730 during the early Asian session on Friday. The USD Index (DXY) faces some selling pressure, and this provides some support to the major pair. Investors will closely monitor the US Core Personal Consumption Expenditures

Price Index (Core PCE) for April, which is due later on Friday.

Read More...

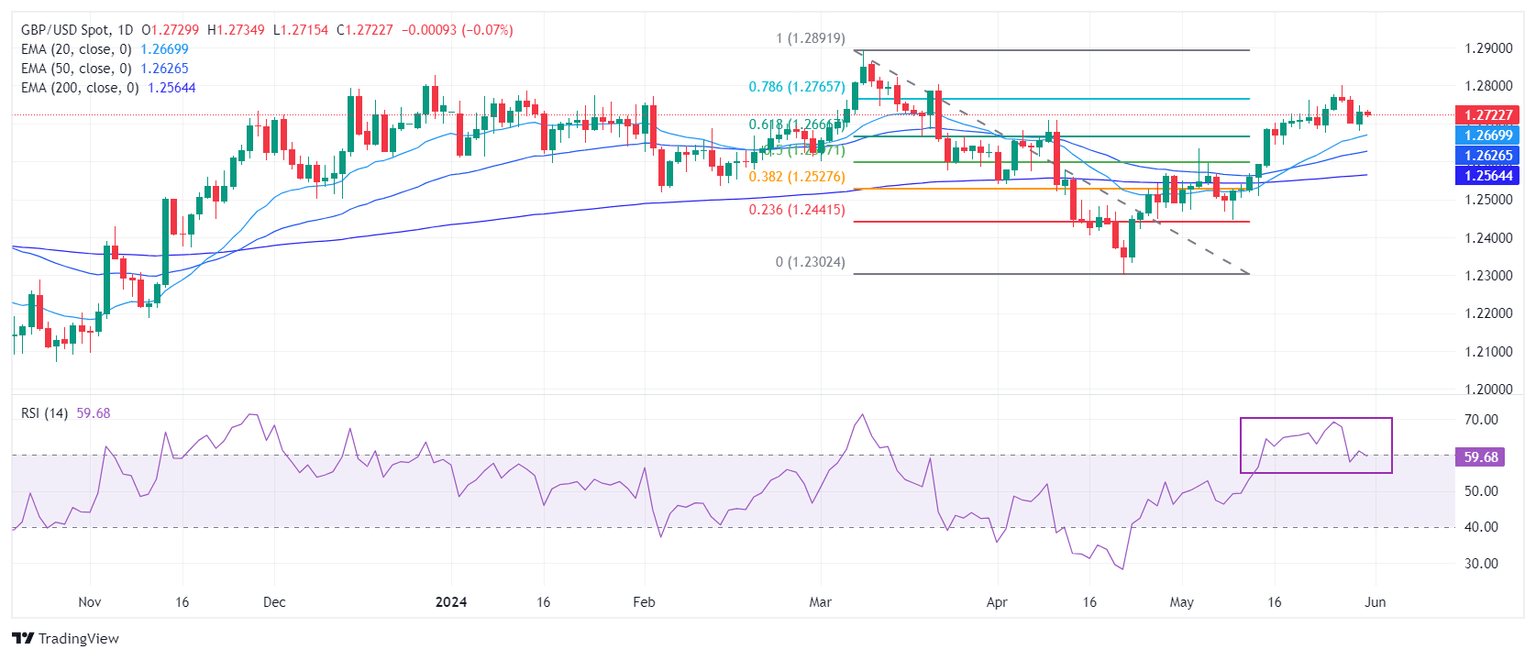

GBP/USD Price Analysis: Recovers above 1.2700 amid soft US Dollar

The

Pound Sterling recovered some ground against the US Dollar on Thursday, as US Treasury yields are sliding, undermining the Greenback. Consequently, the GBP/USD bounced off weekly lows, reached 1.2680, and traded at 1.2728, gaining 0.20%.

Read More...