Pound Sterling Price News and Forecast: GBP weakens against US Dollar, investors await FOMC minutes

Pound Sterling weakens against US Dollar, investors await FOMC minutes

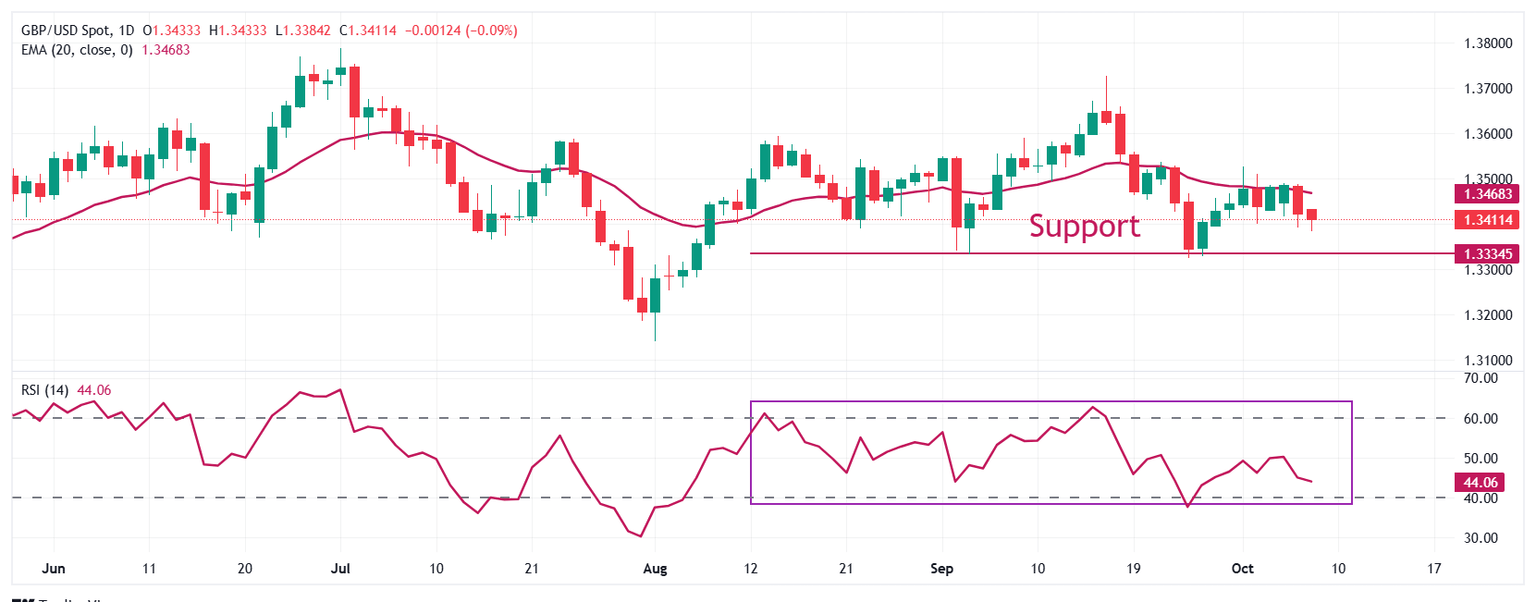

The Pound Sterling (GBP) seems fragile near 1.3400 against the US Dollar (USD) during the late European trading session on Wednesday. The GBP/USD pair faces selling pressure as the US Dollar (USD) outperforms its major currency peers despite the United States (US) government entering its second week of shutdown.

At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.35% higher to near 99.00, the highest level seen in two months. Read more...

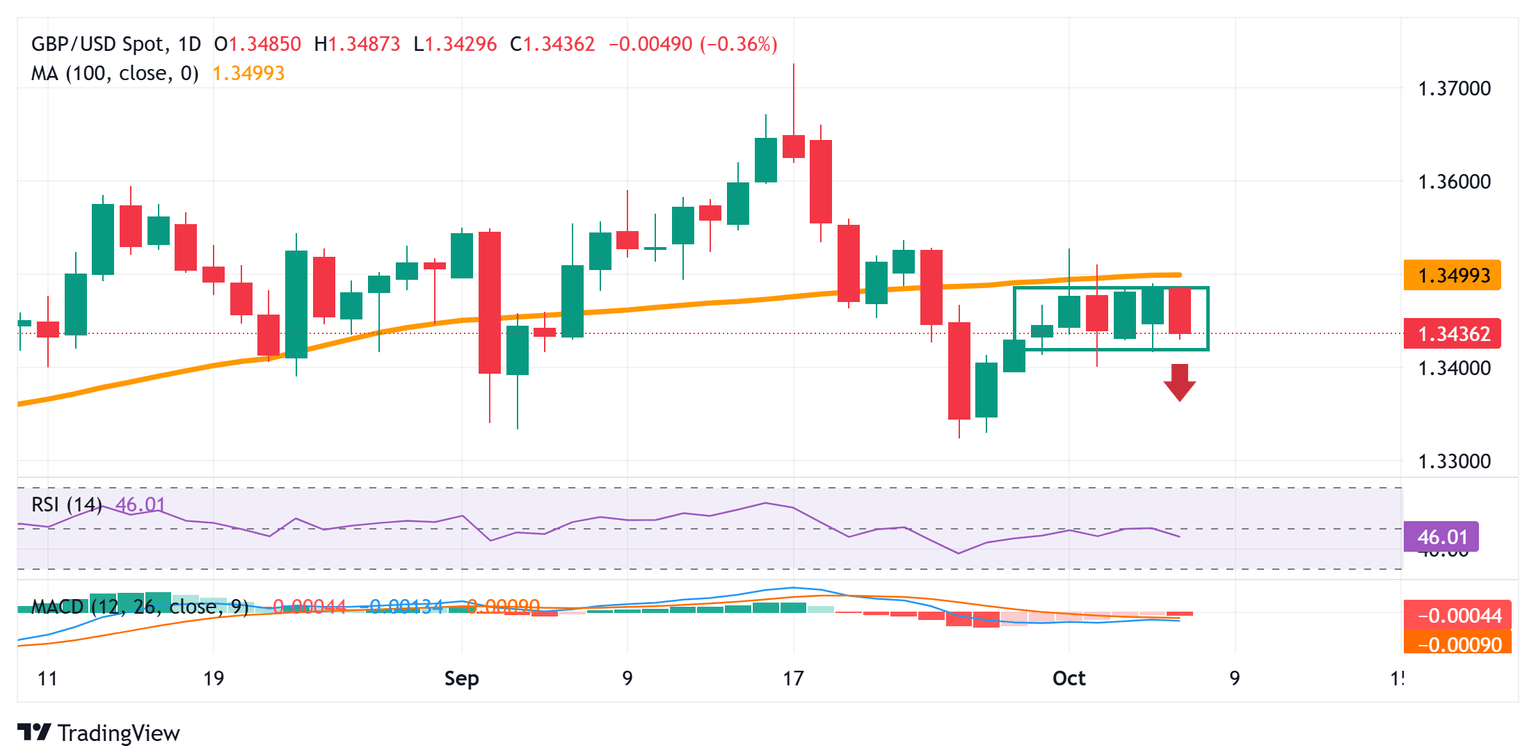

GBP/USD Price Forecast: Seems vulnerable below 100-day SMA amid firmer USD

The GBP/USD pair meets with a fresh supply and slides below mid-1.3400s, back closer to the overnight swing low during the early part of the European session on Tuesday. The US Dollar (USD) attracts fresh buyers following the previous day's pullback from the vicinity of the late September high and turns out to be a key factor exerting downward pressure on the currency pair. The USD strength could be attributed to a broadly weaker Japanese Yen (JPY) and the Euro, which continue to be weighed down by domestic political uncertainties.

An unexpected result from Japan’s leadership contest sets the country on course for more expansionary fiscal policies. The expectations forced investors to temper their bets for an immediate interest rate hike by the Bank of Japan (BoJ), and turned out to be a key factor undermining demand for the JPY. Meanwhile, the surprise resignation of France’s new Prime Minister Sebastien Lecornu, amid a backlash from allies and adversaries over his freshly-appointed cabinet, dents sentiment surrounding the shared currency and benefits the Greenback. Read more...

Author

FXStreet Team

FXStreet