Pound Sterling Price News and Forecast: GBP/USD [Video]

![Pound Sterling Price News and Forecast: GBP/USD [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/GBPUSD/pound-coin-on-dollar-bills-10626841_XtraLarge.jpg)

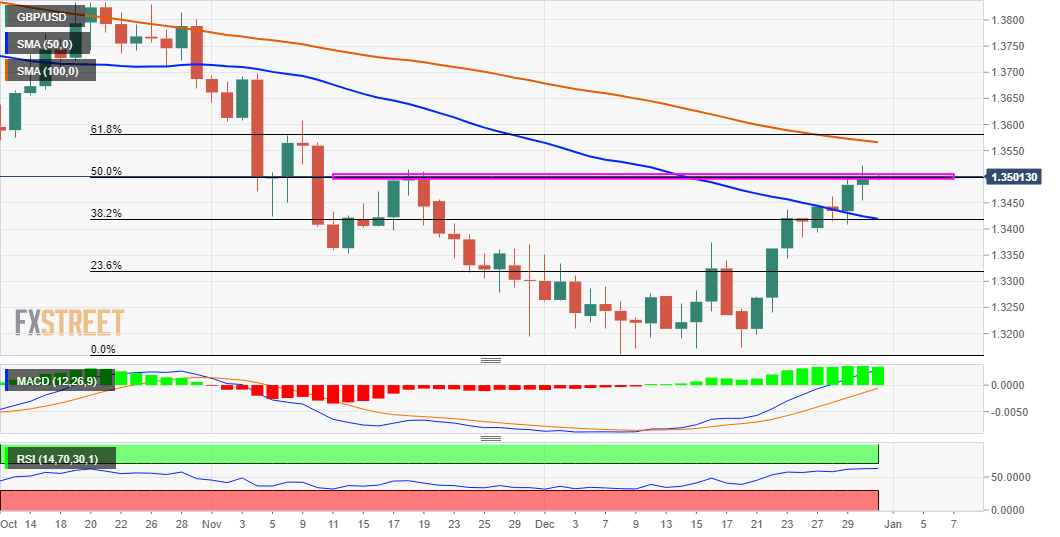

GBP/USD Analysis: Bulls could aim to test 1.3565-70 confluence despite COVID-19 woes

The GBP/USD pair seesawed between tepid gains/minor losses and finally settled nearly unchanged on Thursday amid thin end-of-year trading volumes. The US dollar made a solid comeback and reversed the previous day's losses back closer to the monthly low. This was seen as a key factor that exerted some downward pressure on the major, though the early downtick turned out to be short-lived. Read More...

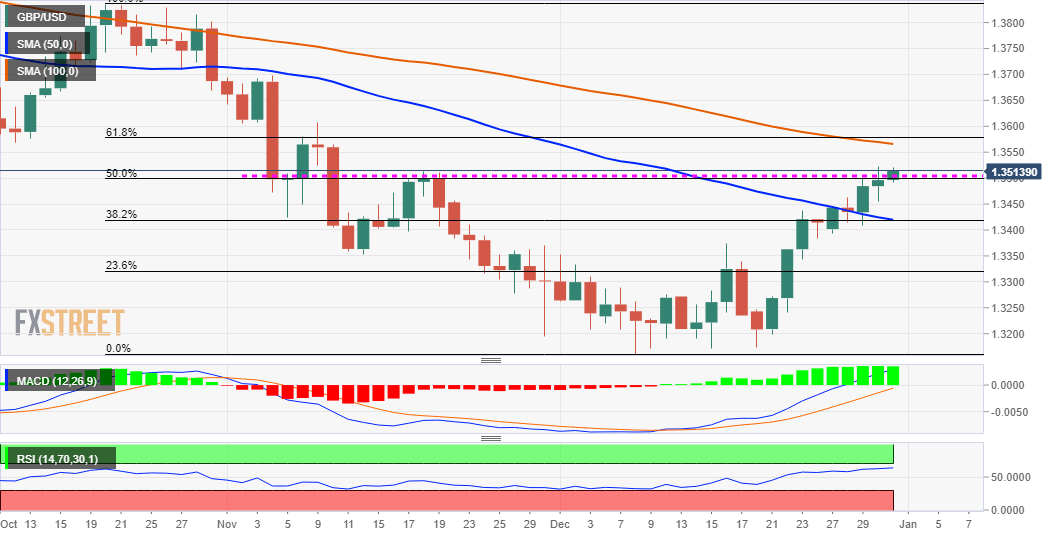

GBP/USD slips back under 1.3500 in holiday-thinned trading conditions, set to end month with decent gains

In thin trading conditions on the final day of 2021, GBP/USD is choppy and recently slipped back under the 1.3500 handle. Trading conditions are subdued with many European markets closed for the day and markets in the UK and France shutting early. Though the pair is down about 0.15% on the day as its trades in the 1.3475 area, it only trades about 0.4% below monthly highs hit earlier this week in the 1.3520s. Read More...

GBP/USD Price Analysis: Bulls retain control near monthly high, above 1.3500 mark

The GBP/USD pair edged during the early part of the European session and shot closer to the highest level since November 10, around the 1.3520 area touched in the previous day. Read More...

Author

FXStreet Team

FXStreet