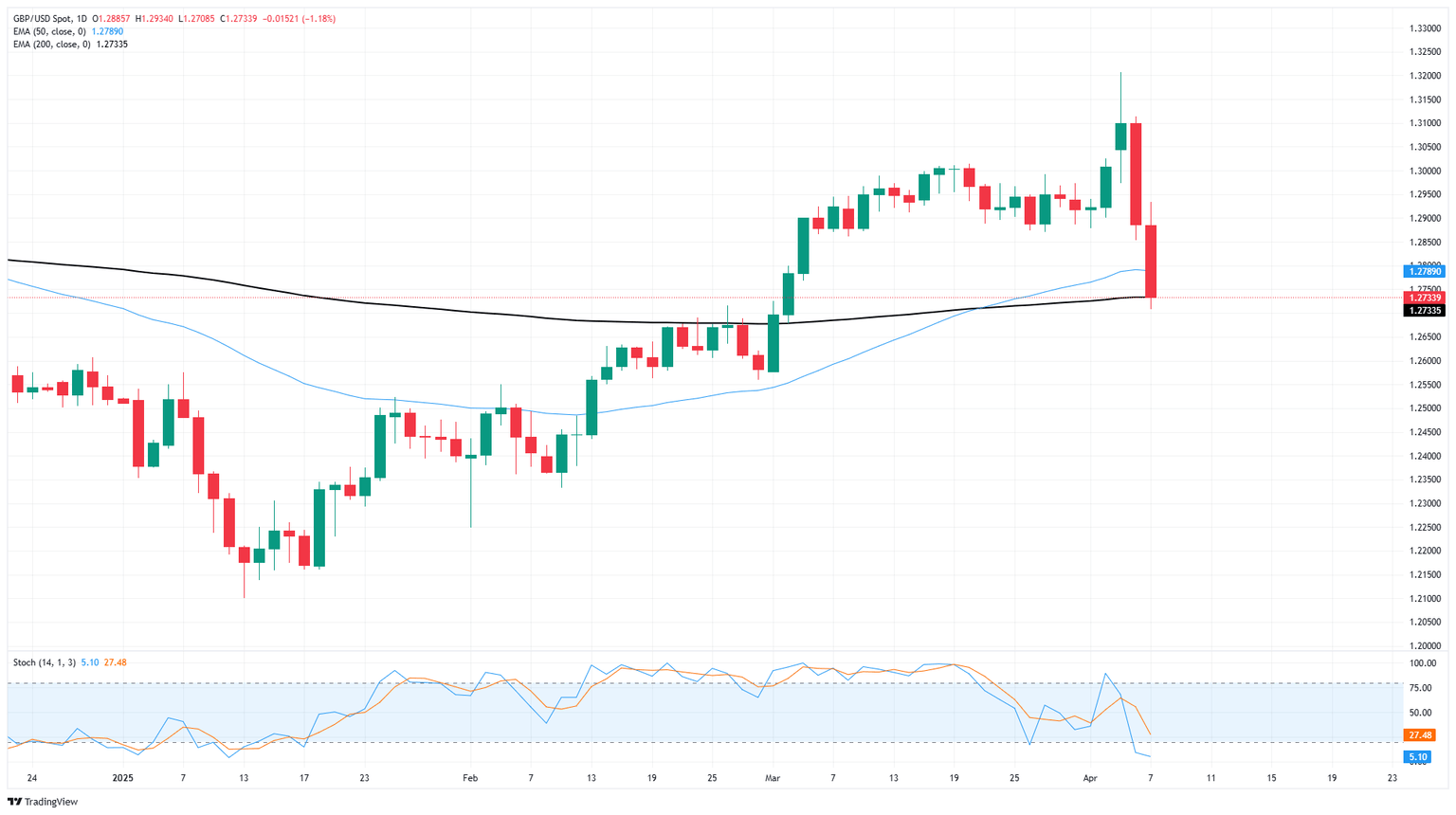

Pound Sterling Price News and Forecast: GBP/USD tumbled 1.2% on Monday, falling below 1.2750

GBP/USD extends backslide as safe haven trade resumes

GBP/USD sank again on Monday, extending Cable into a second straight trading day of declines and pushing bids back down to the 200-day Exponential Moving Average (EMA) just north of 1.2700. After a brief reprieve, The US Dollar has resumed dominating risk-off flows, with deflating investor sentiment bolstering the Greenback across the board.

After a tense week that saw the US pivot fully into a protectionist trade stance (but without the industry infrastructure to back it up), widespread import tariffs are on the books, with the US charging a flat 10% import tax on all goods from all countries, as well as widely-varied “reciprocal” tariffs that were derived by dividing US imports by US exports. After imposing an additional 34% tariff on Chinese goods, China clapped back with a retaliatory 34% tariff of its own on all goods bound from the US. Lacking any other means of problem-solving, the Trump administration has threatened to impose an additional 50% tariff on all Chinese goods, set to take effect on April 8. Read more...

GBP/USD crashes over 100 pips below 1.28 as trade war escalates

The Pound Sterling (GBP) plunges over 100 pips or 0.90% against the Greenback at the beginning of the week, driven by recession fears and hopes cut short that the White House could reconsider their position in trade policies over the weekend. The GBP/USD pair trades at 1.2763 after hitting a daily high of 1.2933.

Risk aversion keeps the Greenback bid on Monday. News that the White House is mulling a 90-day pause in tariffs for all nations except China, revealed by CNBC, triggered a recovery in GBP/USD, which was short-lived as Trump stated that he “did not say this.” Additionally, CNBC revealed that it was “fake news.” Read more...

Author

FXStreet Team

FXStreet