GBP/USD extends backslide as safe haven trade resumes

- GBP/USD tumbled 1.2% on Monday, falling below 1.2750.

- Greenback safe haven flows have resumed after a brief pause.

- Investor sentiment continues to sour as Donald Trump threatens even more tariffs.

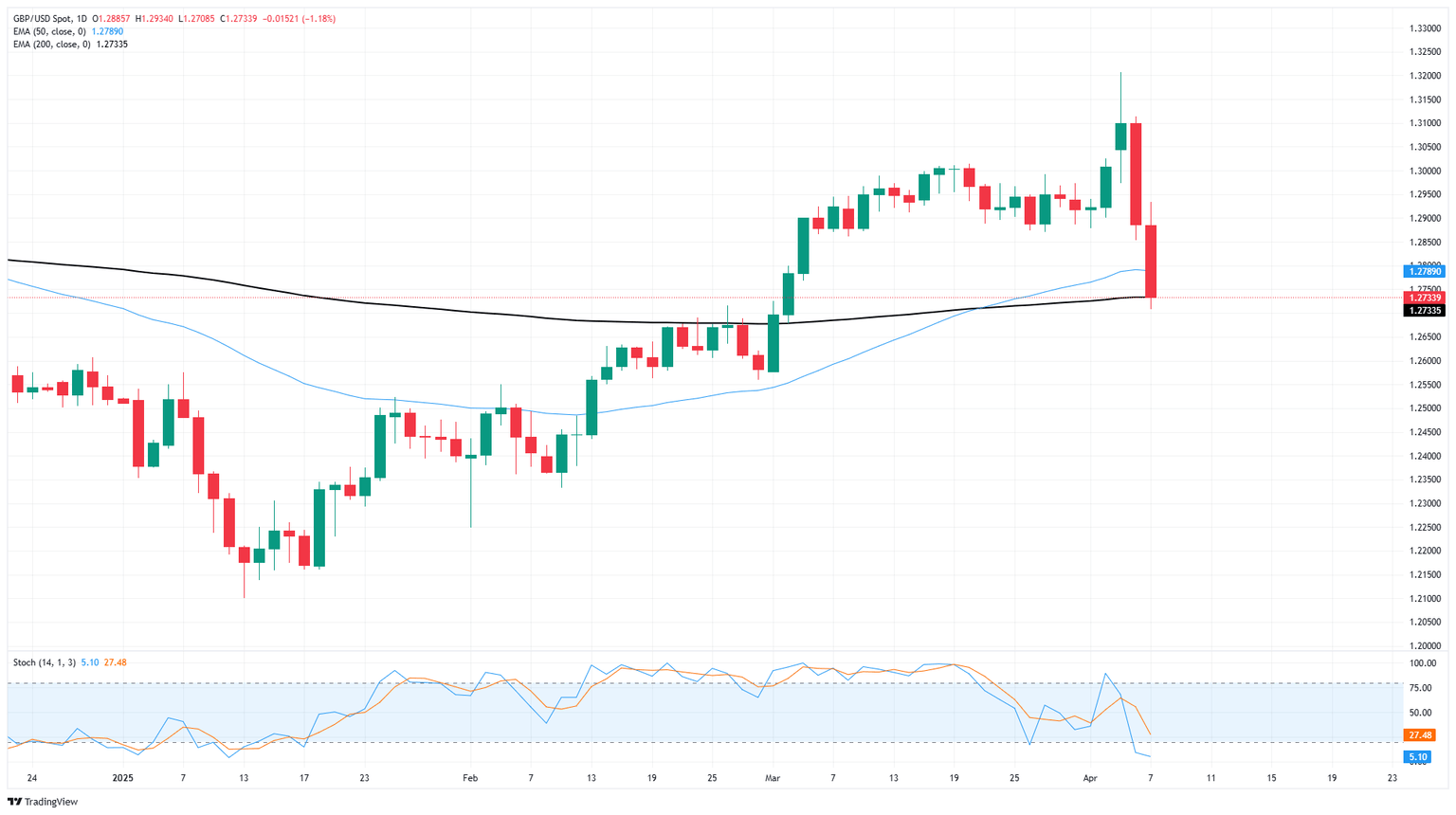

GBP/USD sank again on Monday, extending Cable into a second straight trading day of declines and pushing bids back down to the 200-day Exponential Moving Average (EMA) just north of 1.2700. After a brief reprieve, The US Dollar has resumed dominating risk-off flows, with deflating investor sentiment bolstering the Greenback across the board.

More tariffs? More tariffs.

After a tense week that saw the US pivot fully into a protectionist trade stance (but without the industry infrastructure to back it up), widespread import tariffs are on the books, with the US charging a flat 10% import tax on all goods from all countries, as well as widely-varied “reciprocal” tariffs that were derived by dividing US imports by US exports. After imposing an additional 34% tariff on Chinese goods, China clapped back with a retaliatory 34% tariff of its own on all goods bound from the US. Lacking any other means of problem-solving, the Trump administration has threatened to impose an additional 50% tariff on all Chinese goods, set to take effect on April 8.

Forex Today: Trump’s tariffs remain in centre stage ahead of US CPI

US data once again comes front and center this week; US Consumer Price Index (CPI) inflation figures are slated for Thursday, with US Producer Price Index (PPI) inflation and University of Michigan (UoM) Consumer Sentiment Index survey results are both set to publish on Friday. This will be the last blast of key US inflation and sentiment figures from the ‘pre-tariff’ phase of 2025, marking a key measurement metric for the remainder of the calendar year.

According to the CME’s FedWatch Tool, investors are piling back into bets that the Federal Reserve (Fed) will begin cutting interest rates to head off a recession. Rate markets are pricing in nearly 200 bps in interest rate cuts through the remainder of 2025, despite the Fed’s ongoing middling policy speeches warning that trade uncertainty makes it harder, not easier, for the Fed to trim rates.

GBP/USD price forecast

GBP/USD has declined nearly 4% peak-to-trough from last week’s peak bids just above the 1.3200 handle. A sharp rebalancing of market flows has dragged Cable back into the 200-day EMA, forcing bids back into a midrange that has plagued the pair for over two years.

Volatility is on the rise across the board, making technical levels difficult to identify. A rough resistance zone is priced in between 1.2900 and 1.3000, while the immediate technical floor is priced in from 1.2600.

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.