Pound Sterling Price News and Forecast: GBP/USD trades on a weaker note around 1.2450

GBP/USD Price Forecast: The initial support level emerges near 1.2350

The GBP/USD pair remains under selling pressure near 1.2450 during the early European session on Monday. The renewed US Dollar (USD) demand amid the safe-have flows drags the major pair lower.

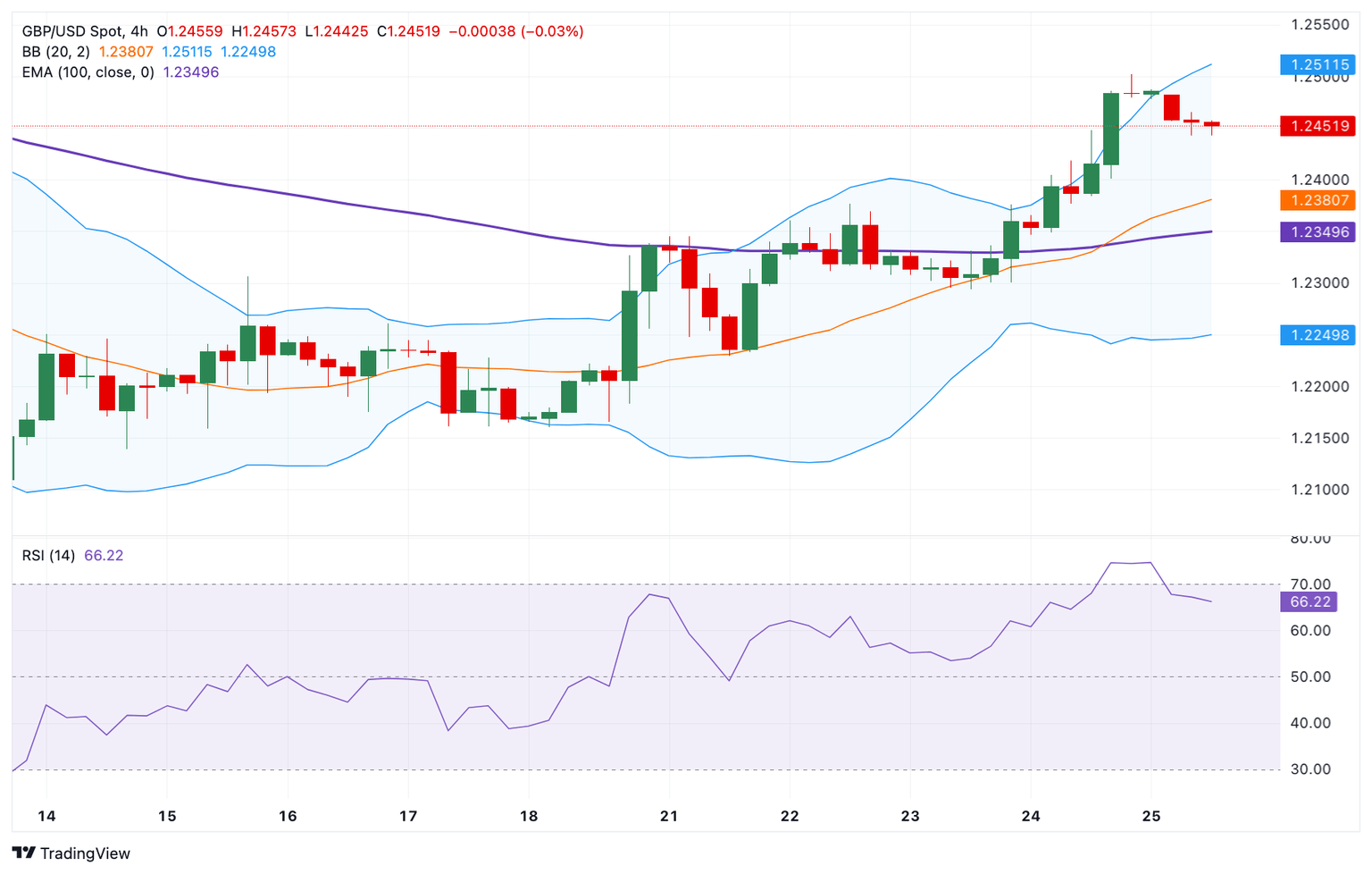

According to the 4-hour chart, the bullish outlook of GBP/USD prevails as the major pair is above the key 100-period Exponential Moving Average (EMA). The upward momentum is reinforced by the Relative Strength Index (RSI), which stands above the midline around 64.70, indicating that further upside looks favorable. Read more...

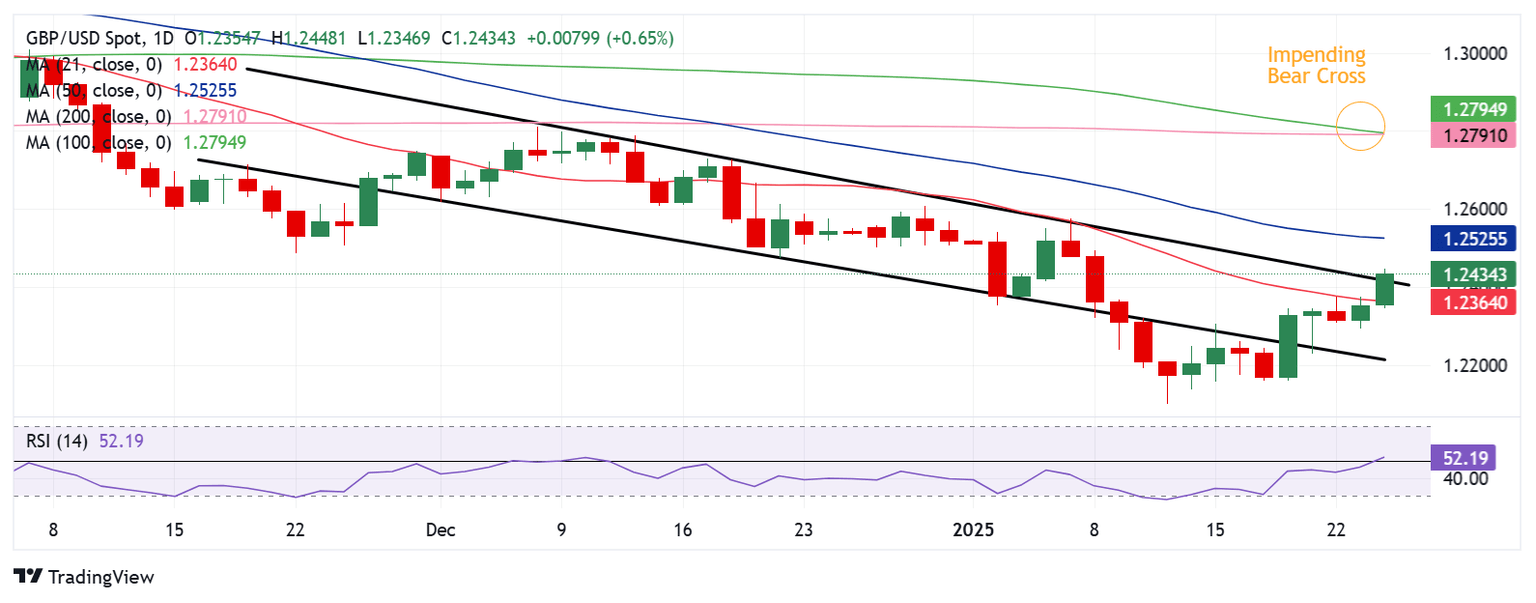

GBP/USD Weekly Outlook: Bearish risks loom amid recovery from 14-month lows

The Pound Sterling (GBP) extended its recovery from 14-month lows of 1.2100 against the US Dollar (USD), with GBP/USD testing offers above 1.2400.

US President Donald Trump returned to the White House for the second term, and his tariff talks remained the primary market driver, influencing risk sentiment, the US Dollar, and eventually the high-beta currency pair - GBP/USD. The Greenback languished in monthly lows against its major rivals amid uncertainty over Trump’s tariff policy and his calls to lower interest rates and the USD. Read more...

GBP/USD trades with negative bias around 1.2460 amid modest USD bounce

The GBP/USD pair kicks off the new week on a softer note and erodes a part of Friday's strong gains to the 1.2500 psychological mark, or a near three-week peak. Spot prices currently trade around the 1.2460 region, down 0.20% for the day amid a modest US Dollar (USD) strength, though the downtick lacks any follow-through selling or bearish conviction.

The USD Index (DXY), which tracks the Greenback against a basket of currencies, rebounds from over a one-month low amid the flight to safety, triggered by US President Donald Trump's decision to impose import duties on Colombia. Trump imposed a 25% tariff on all imports from Colombia after the latter refused to allow two US military planes carrying deported migrants to land in the country. Trump also warned that the tariffs will increase to 50% by next week on further noncompliance, fueling concerns about global trade wars and tempering investors’ appetite for riskier assets. Read more...

Author

FXStreet Team

FXStreet