Pound Sterling Price News and Forecast: GBP/USD trades higher even as UK Retail Sales decline sharply

Pound Sterling trades higher even as UK Retail Sales decline sharply in May

The Pound Sterling (GBP) trades firmly against its major peers on Friday despite United Kingdom (UK) Retail Sales data declined sharply in May.

The Office for National Statistics (ONS) reported that Retail Sales, a key measure of consumer spending, declined by 2.7% on month, the sharpest drop seen since December 2023. Economists expected the consumer spending measure to have contracted at a moderate pace of 0.5% after expanding by 1.3% in April, upwardly revised from 1.2%. Read more...

GBP/USD Forecast: Pound Sterling holds ground as markets assess BoE outlook, geopolitics

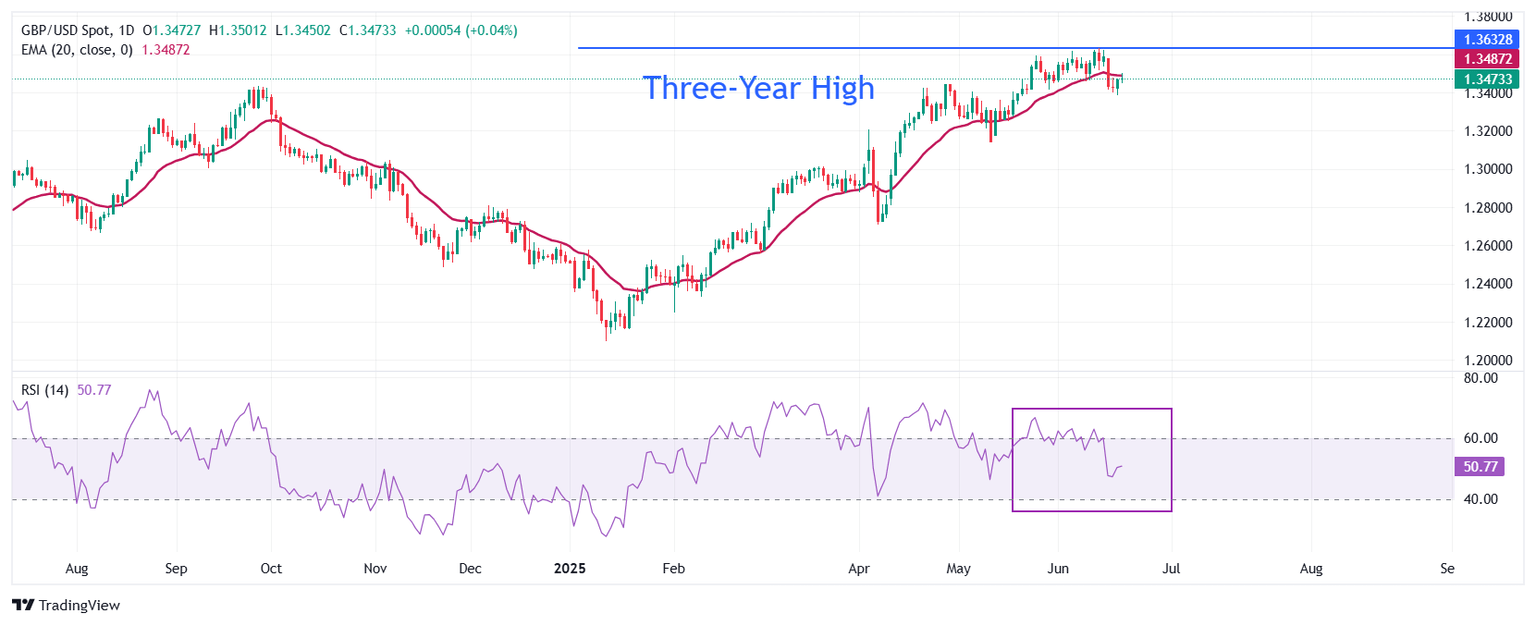

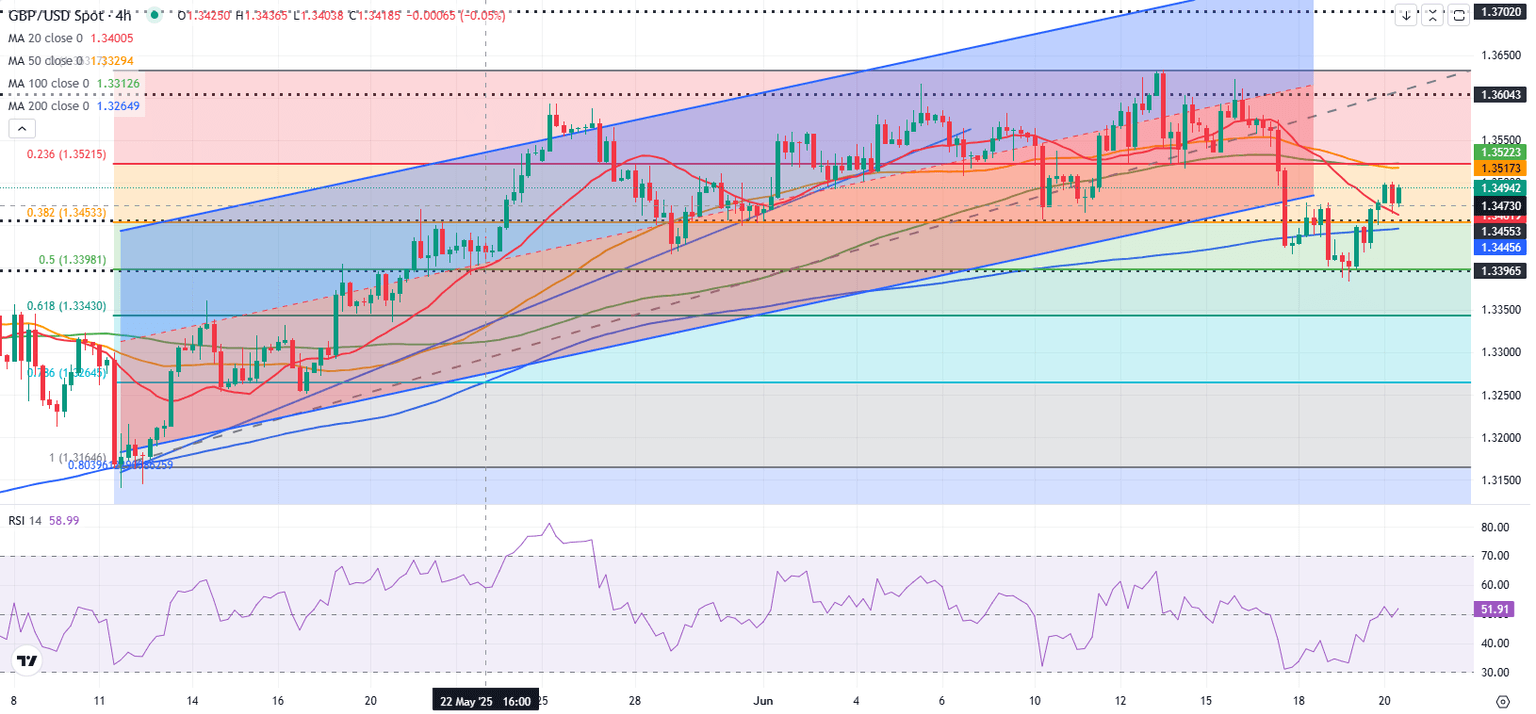

GBP/USD trades modestly higher on the day at around 1.3500 after closing in positive territory on Thursday. The pair, however, could have a difficult time gathering bullish momentum in the near term.

The Bank of England (BoE) announced on Thursday that it maintained the bank rate at 4.25%, as expected. Three members of the Monetary Policy Committee (MPC), however, voted in favor of a 25 basis points (bps) rate cut, citing material further loosening in the labour market, subdued consumer demand and pay deals near sustainable rates. In the policy statement, the BoE reiterated that a gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate. Read more...

Author

FXStreet Team

FXStreet