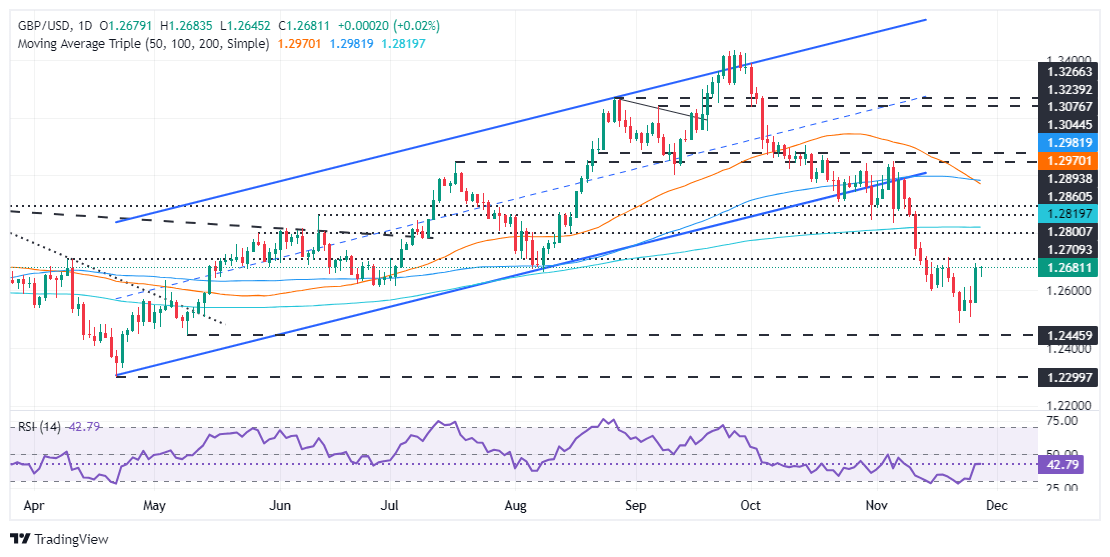

GBP/USD strengthens further beyond 1.2700, over two-week top on weaker USD

The GBP/USD pair gains some follow-through positive traction during the Asian session on Friday and touches a two-week top, around the 1.2715 region in the last hour. Spot prices have now rallied over 200 pips from the weekly trough and look to build on the recent recovery from sub-1.2500 levels, or the lowest since May 2024 touched last Friday amid subdued US Dollar (USD) demand.

Read More...

GBP/USD heads into a thin Friday on a quiet note

GBP/USD saw a quiet Thursday session, trading on the thin side and holding on near the 1.2700 handle. US markets were dark on Thursday for the Thanksgiving holiday, and Friday will also see shortened US trading hours, keeping the back half of the trading week on the low end of volumes overall.

Read More...

GBP/USD Price Forecast: Consolidates near weekly highs on Thanksgiving

The GBP/USD consolidates at around weekly highs, posting modest losses of 0.05% at around 1.2670 due to thin

liquidity conditions as US markets remain closed for Thanksgiving.

Read More...