GBP/USD Price Forecast: Steadies at around 1.2600

The GBP/USD fluctuates, yet it remains virtually unchanged at the beginning of the week as UK traders await the release of UK inflation figures and

Retail Sales data. In the meantime, aside from Fed speakers, a scarce economic docket in the US might pave the way for some consolidation on the major. The pair trades at 1.2628, flat.

Read More...

Pound Sterling struggles against USD as traders pare back Fed dovish bets

The Pound Sterling (GBP) remains under pressure near 1.2600 against the US Dollar (USD) in Monday’s North American session. The GBP/USD pair struggles to gain ground as the US Dollar clings to gains near a more-than-a-year high, with

the US Dollar Index (DXY) wobbling around 107.00.

Read More...

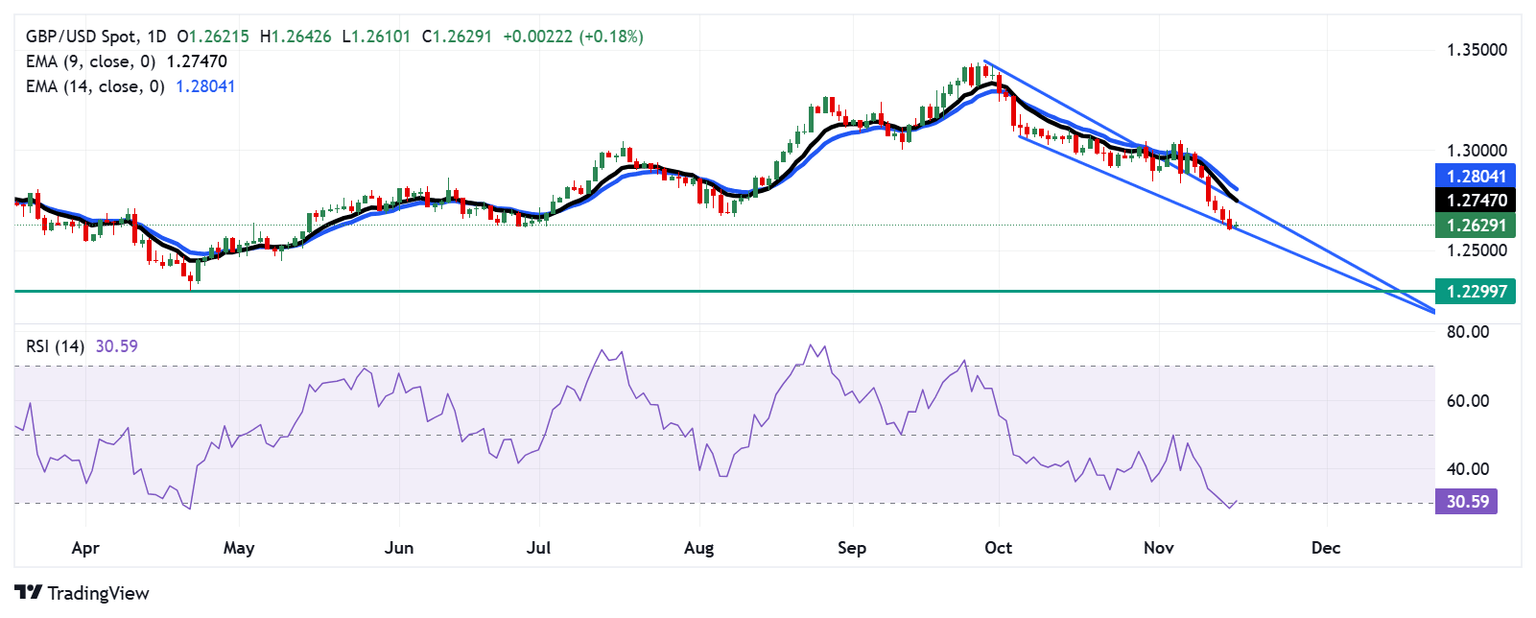

GBP/USD Price Forecast: Attempts to recover from 1.2600 as it enters oversold zone

GBP/USD breaks its six-day losing streak, trading around 1.2630 during the Asian hours on Monday. The daily chart

analysis shows the sellers' control weakens as the pair moves downwards within the descending wedge pattern. This signals a potential bullish reversal for the pair.

Read More...