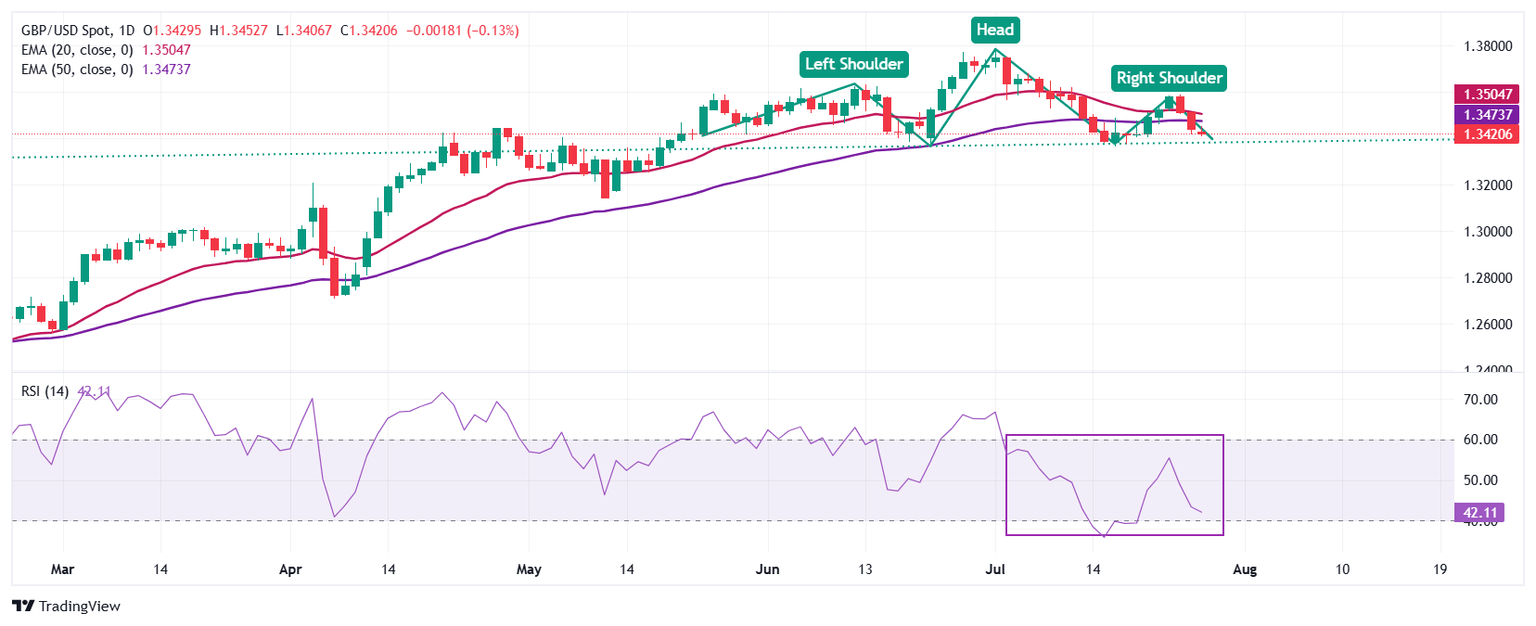

Pound Sterling Price News and Forecast: GBP/USD slips to 1.3401

GBP/USD slips to 1.3401 as US–EU trade deal lifts Dollar ahead of Fed meeting

The GBP/USD drops 0.25% during the North American session after the United States (US) and the European Union (EU) reached a trade agreement before the August 1 deadline set by President Donald Trump. At the time of writing, the pair trades at 1.3401, near two-week lows. Read More...

Pound Sterling slides as US-EU deal approval strengthens US Dollar

The Pound Sterling (GBP) drops to near 1.3400 against the US Dollar (USD) during the European trading session on Monday. The GBP/USD pair falls as the US Dollar attracts bids after the announcement of a trade framework between the United States (US) and the European Union (EU). Read More...

GBP/USD Price Forecast: Retains bullish bias above 1.3550 above the 100-day EMA

The GBP/USD pair posts modest gains near 1.3440 during the Asian trading hours on Monday. The latest optimism fueled by a trade deal between the United States (US) and the European Union (EU) triggers a fresh wave of the global risk-on sentiment, which boosts the Pound Sterling (GBP). All eyes will be on the US Federal Reserve (Fed) interest rate decision later on Wednesday, with no change in rate expected. Read More...

Author

FXStreet Team

FXStreet