Pound Sterling Price News and Forecast: GBP/USD slips as trader war fears, central bank uncertainty weigh

GBP/USD slips as trader war fears, central bank uncertainty weigh

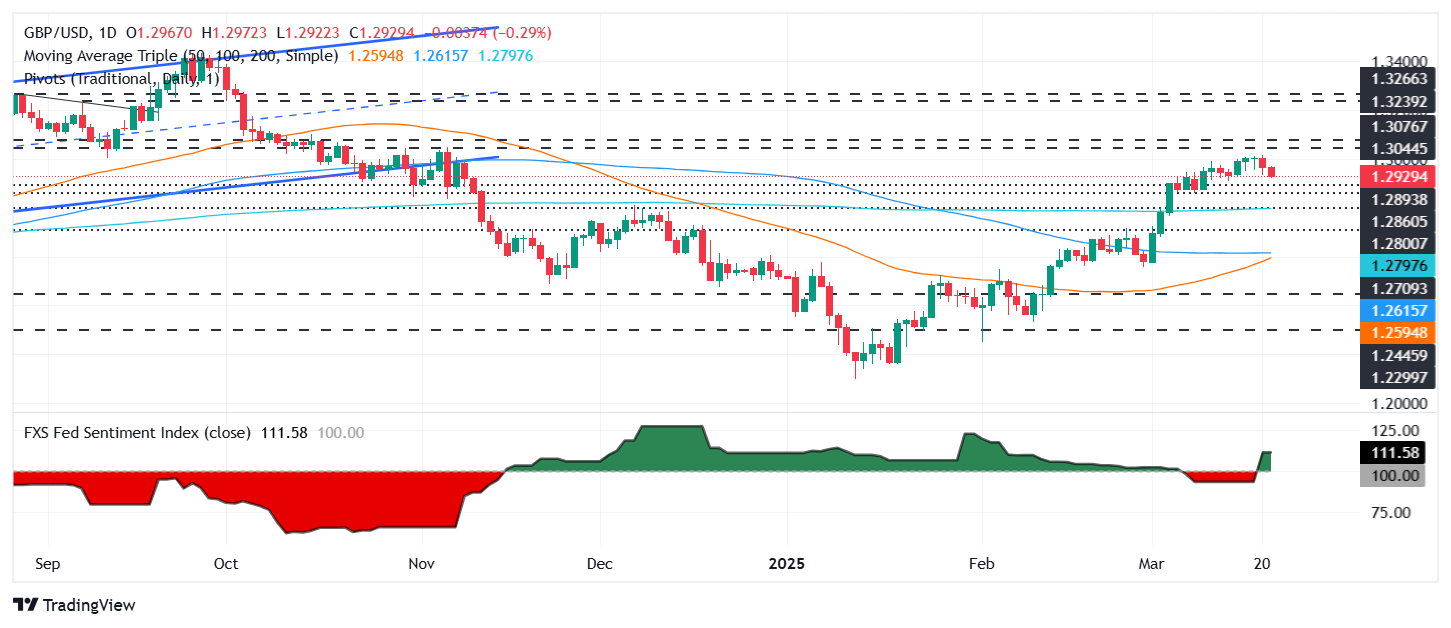

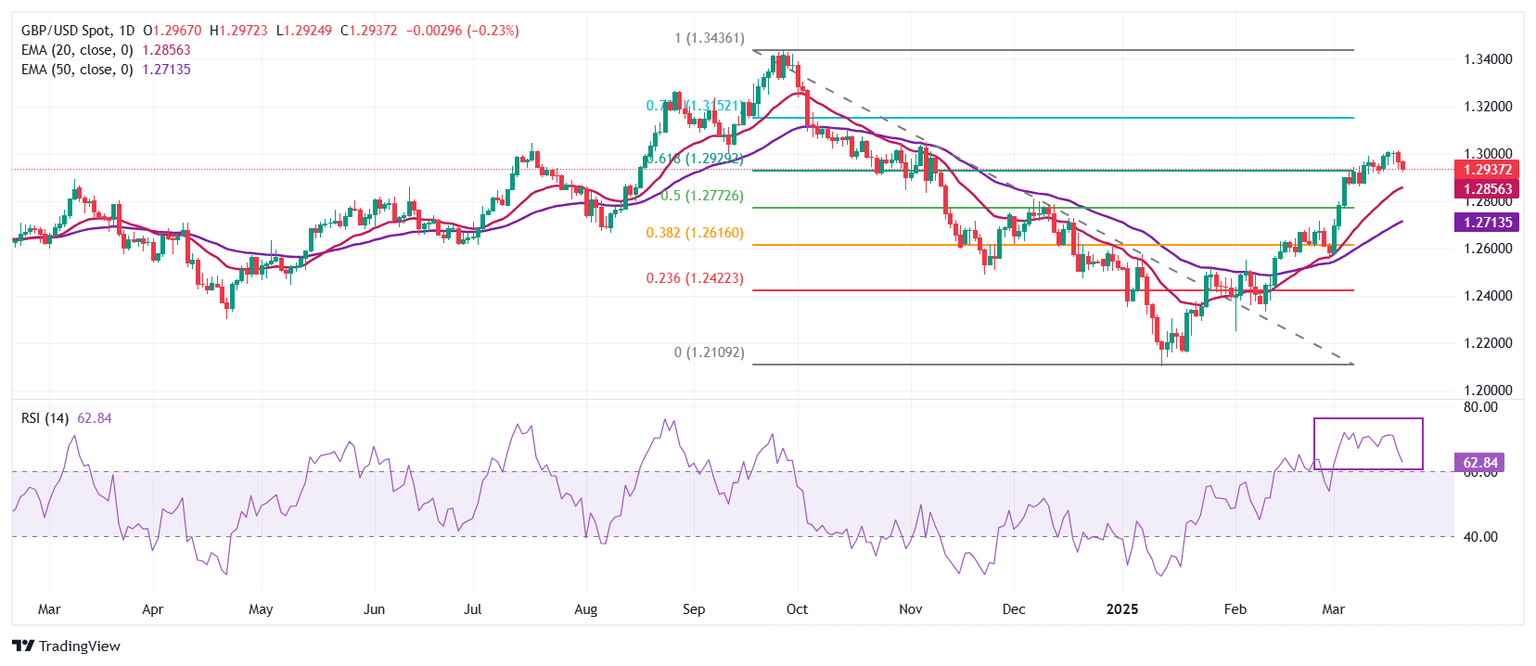

The Pound Sterling (GBP) is dropping some 0.29% against the US Dollar (USD) on Friday, set to end the week unchanged after major central banks featured monetary policy decisions led by the Federal Reserve (Fed) and the Bank of England (BoE). At the time of writing, GBP/USD is trading at 1.2931 after hitting a daily peak of 1.2969. Read More...

Pound Sterling underperforms US Dollar as Fed supports restrictive policy stance

The Pound Sterling (GBP) extends correction to near 1.2920 against the US Dollar (USD) in North American trading hours on Friday. The GBP/USD pair weakens as the US Dollar extends recovery amid growing expectations that the Federal Reserve (Fed) will not cut interest rates soon. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, gathers strength to break above the key resistance of 104.00. Read More...

GBP/USD consolidates above mid-1.2900s; remains close to multi-month peak set on Thursday

The GBP/USD pair lacks any firm intraday direction on Friday and oscillates in a narrow trading band, around the 1.2960 area during the Asian session. Spot prices, however, remain close to the highest since early November – levels beyond the 1.3000 psychological mark touched on Thursday – and remain at the mercy of the US Dollar (USD) price dynamics. Read More...

Author

FXStreet Team

FXStreet