GBP/USD slips as trader war fears, central bank uncertainty weigh

- GBP/USD falls from a daily high of 1.2969 amid a risk-off mood and persistent US Dollar strength.

- BoE and Fed flag uncertainty, both citing Trump’s tariffs as a risk to global growth and inflation outlook.

- Traders will be eyeing key inflation data next week, with UK CPI and US Core PCE likely to shape rate cut expectations.

The Pound Sterling (GBP) is dropping some 0.29% against the US Dollar (USD) on Friday, set to end the week unchanged after major central banks featured monetary policy decisions led by the Federal Reserve (Fed) and the Bank of England (BoE). At the time of writing, GBP/USD is trading at 1.2931 after hitting a daily peak of 1.2969.

Sterling drops 0.29%, set to end the week flat after dovish Fed and BoE tone

The market mood remains downbeat, as depicted by United States (US) equities posting losses, while the Greenback remains bid. On Thursday, the BoE kept rates unchanged and said there is uncertainty about the future, echoing Fed Chair Jerome Powell's words. Both policymakers mentioned US President Donald Trump’s tariffs against its partners as a cause.

Kenneth Broux, the head of corporate research at Societe Generale, said, “There's just a general sense of caution. We don't really know what are the implications of the trade war on growth and inflation.”

Traders had circled April 2 as a crucial date for the enactment of US reciprocal tariffs. Most analysts estimate that the trade war might spur a slowdown in the global economy.

The lack of economic data releases and the beginning of the Fed parade leaves traders leaning on policymakers. New York Fed John Williams said the Fed’s 2% inflation target is not up for debate, adding that the current modestly restrictive monetary policy is “entirely appropriate,” and it is hard to know how the economy will perform.

Chicago’s Fed, Austan Goolsbee, said that when there is a lot of uncertainty, you have to wait for things to clear up.

Next week, the UK economic docket will feature the Consumer Price Index (CPI) and the Spring Budget Statement. Across the pond, the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index, will also be eyed.

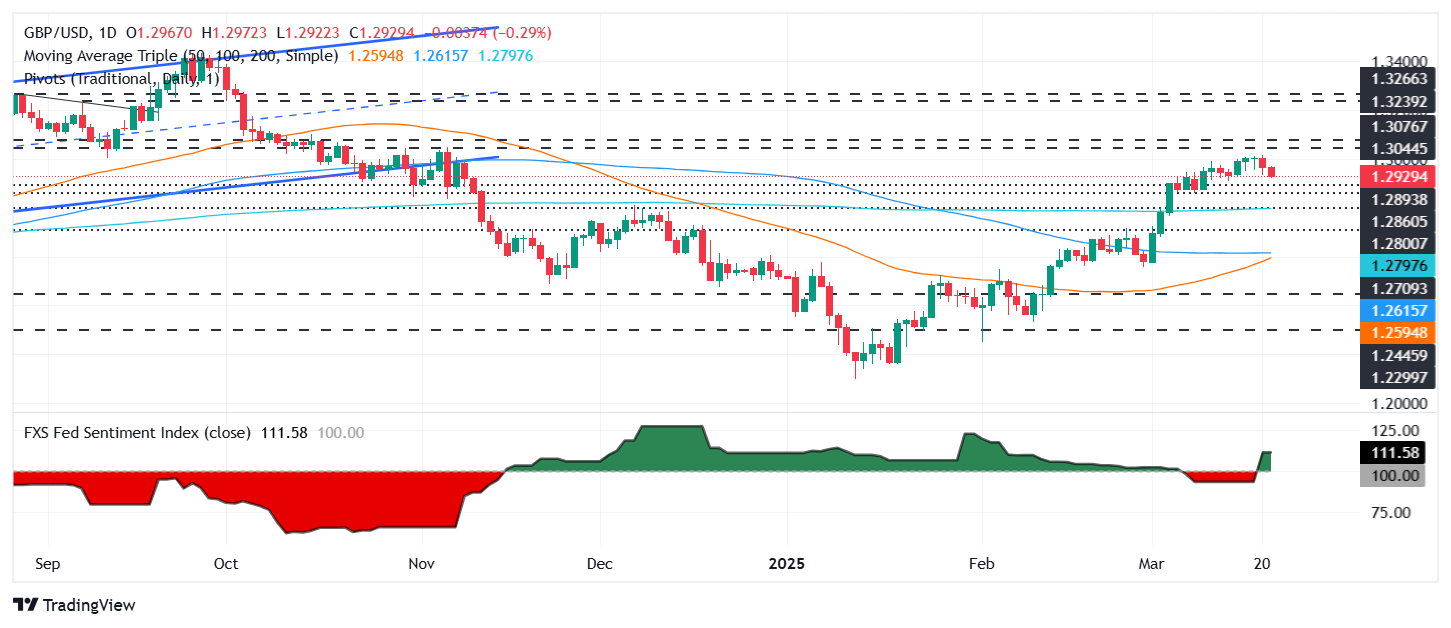

GBP/USD Price Forecast: Technical outlook

The GBP/USD pair is set to finish the week almost flat, yet it has advanced steadily since climbing above the 1.2900 handle. Nevertheless, the pair printed two bearish days, hitting a four-day low of 1.2927.

In the short term, momentum favors sellers, as depicted by the Relative Strength Index (RSI), which aims lower despite being in bullish territory. This opens the door for a pullback, and traders could pull GBP/USD to challenge the March 10 low of 1.2861. If surpassed, the next stop is the 200-day SMA at 1.2797. On the other hand, if buyers drive the exchange rate past 1.3000, the next resistance would be the November 6 peak at 1.3047.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.48% | 0.06% | 0.03% | -0.23% | 0.95% | 0.14% | -0.25% | |

| EUR | -0.48% | -0.53% | -0.85% | -0.70% | 0.32% | -0.35% | -0.75% | |

| GBP | -0.06% | 0.53% | 0.02% | -0.38% | 0.85% | 0.17% | -0.28% | |

| JPY | -0.03% | 0.85% | -0.02% | -0.25% | 0.71% | 0.16% | -0.40% | |

| CAD | 0.23% | 0.70% | 0.38% | 0.25% | 0.97% | 0.37% | -0.56% | |

| AUD | -0.95% | -0.32% | -0.85% | -0.71% | -0.97% | -0.65% | -1.06% | |

| NZD | -0.14% | 0.35% | -0.17% | -0.16% | -0.37% | 0.65% | -0.40% | |

| CHF | 0.25% | 0.75% | 0.28% | 0.40% | 0.56% | 1.06% | 0.40% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.