Pound Sterling Price News and Forecast: GBP/USD slides below 1.29 on soft UK CPI, budget presentation

GBP/USD slides below 1.29 on soft UK CPI, budget presentation

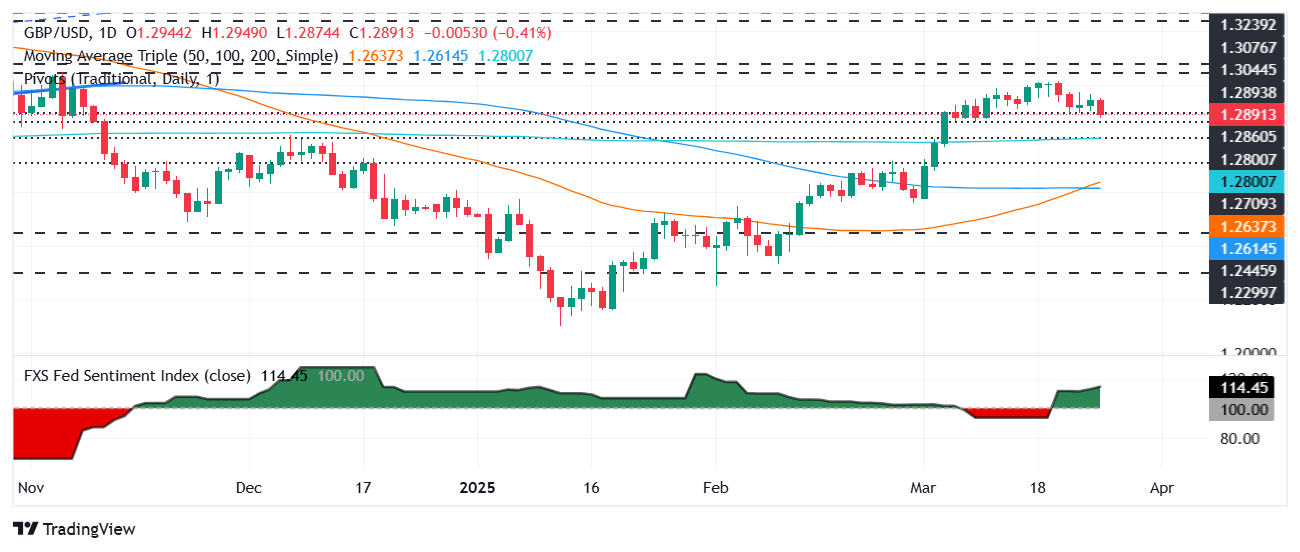

The Pound Sterling (GBP) depreciates against the US Dollar (USD) on Wednesday as United Kingdom (UK) inflation came in softer than expected, while investors scrutinized the Spring Budget. Across the pond, mixed US economic data lent a lifeline to the Greenback, which pared losses versus the British pound. GBP/USD is trading at 1.2895, down 0.36%. Read More...

Pound Sterling slumps after UK budget update

The Pound Sterling (GBP) faces selling pressure against its major peers in North American trading hours on Wednesday after United Kingdom (UK) Chancellor of the Exchequer Rachel Reeves unveils the Spring Statement. Reeves was expected to cut fiscal spending as she promised not to raise taxes again after increasing employers' contribution to social security schemes in the Autumn Statement. She announced that amendments in welfare spending will save £4.8 billion. Read More...

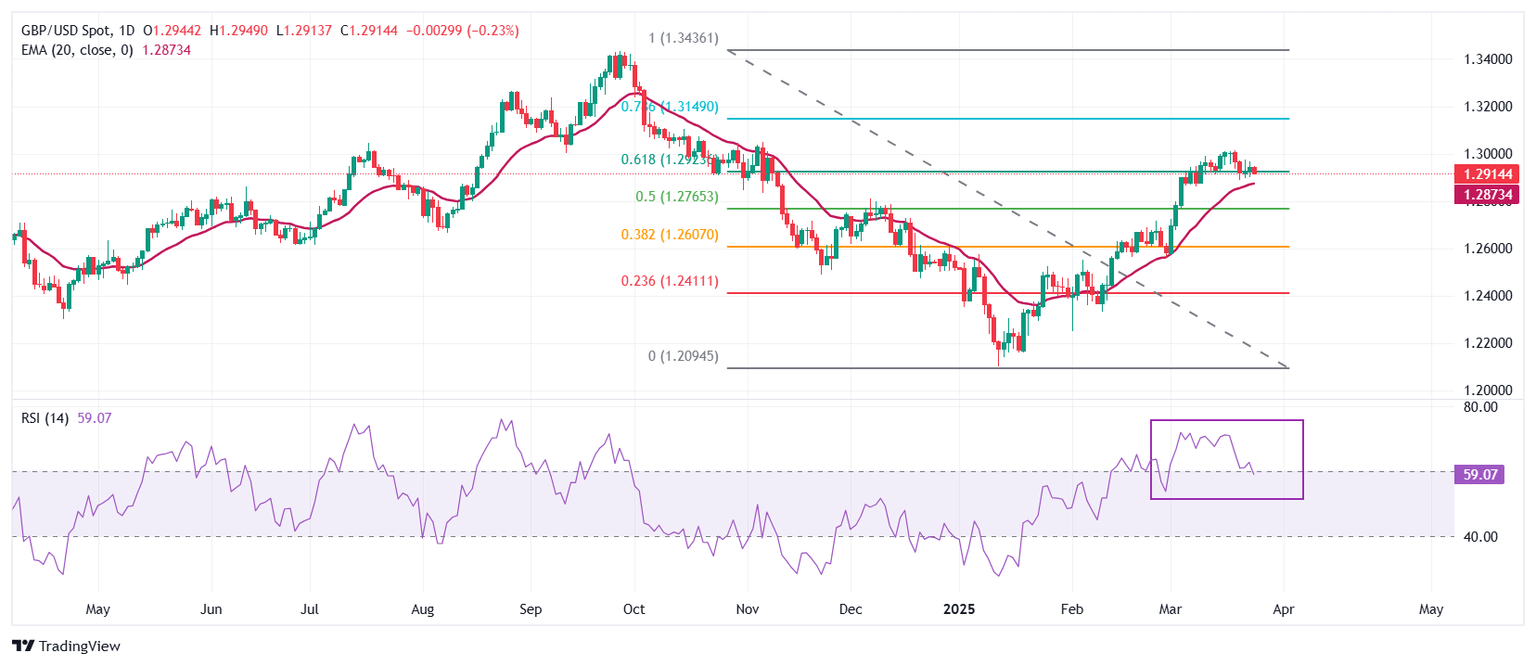

GBP/USD Price Forecast: Tests nine-day EMA barrier near 1.2950 amid a bullish bias

The GBP/USD pair loses ground after registering gains in the previous two sessions, trading around 1.2930 during the Asian hours on Wednesday. The technical analysis of the daily chart indicates a continued bullish bias, with the pair consolidating within an ascending channel pattern. Read More...

Author

FXStreet Team

FXStreet