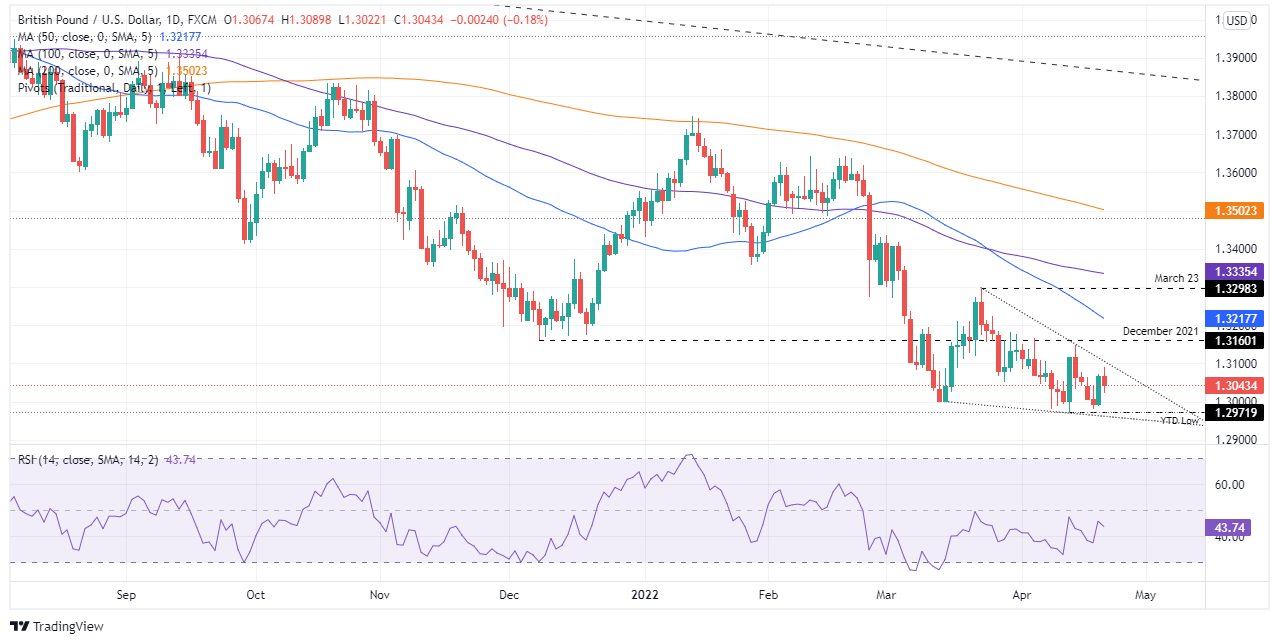

Pound Sterling Price News and Forecast: GBP/USD slides after failing to reclaim 1.3100

GBP/USD slides after failing to reclaim 1.3100 amidst Fed-BoE speaking

The British pound fell short of testing the 1.3100 mark, which left it vulnerable to selling pressure; consequently, the GBP/USD prices declined to the daily low at 1.3022. At the time of writing, the GBP/USD is trading at 1.3043, down some 0.18%. European and US equities are trading with gains, while US Treasury yields rise. The greenback remains underpinned by the latter, as shown by the US Dollar Index, up some 0.22%, sitting at 100.571. Some central bank speaking is dominating newswires. Read more...

GBP/USD Forecast: Pound on track to challenge 1.3100

Although GBP/USD has been struggling to build on Wednesday's gains, the bullish bias stays intact in the near term with the pair holding above the key 1.3050 level. The next recovery target for the pound aligns at 1.3100. The heavy selling pressure surrounding the greenback triggered a decisive rebound in GBP/USD on Wednesday. The dollar remains on the back foot early Thursday but the sharp upsurge witnessed in EUR/GBP suggests that the euro is the main beneficiary of the capital outflows out of the dollar. Read more...

GBP/USD bullish reversal awaits confirmation [Video]

The GBP/USD pair rallies in the short term as the Dollar Index seems determined to resume its correction. It’s traded at 1.3078 level at the time of writing below 1.3082 today’s high which represents an upside obstacle. Fundamentally, the US data and the Fed Chair Powell Speaks could be decisive today. The Unemployment Claims could drop from 185K to 177K in the last week, while the Philly Fed Manufacturing Index is expected at 21.5 points below 27.4 in the previous reporting period. Worse than expected figures could weaken the greenback. Read more...

Author

FXStreet Team

FXStreet